Picture this: You're running a growing business, juggling spreadsheets for inventory, wrestling with separate systems for accounting and CRM and your team keeps asking when they'll finally get one platform that does it all. Enter NetSuite — the Oracle enterprise resource planning solution that promises to be your business's Swiss Army knife.

But here's the thing. Just because something can do everything doesn't mean it's right for everyone.

After diving deep into the NetSuite features, pricing, and real user feedback, we've put together this comprehensive review to help you figure out if NetSuite is worth the investment for your business. We'll also explore one of the leading NetSuite competitors that delivers better value without the complexity.

You'll discover the cost of NetSuite, the features it offers and when you might be better off with a specialized solution that grows with you instead of overwhelming you.

NetSuite emerged in 1998 as a pioneering cloud-based enterprise resource planning platform. In 2016, Oracle Corporation bought the company for $9.3 billion, making it one of the largest cloud software acquisitions in history.

Today, Oracle NetSuite is a comprehensive business management solution. It combines financial management, customer relationship management, inventory management and other business functions into a single cloud-based platform.

The NetSuite ERP has customers from different industries, from healthcare and manufacturing to professional services and retail. The ERP system is an all-in-one solution for companies that want to consolidate their business systems under one roof.

But here's where it gets interesting. While NetSuite markets itself as suitable for businesses of all sizes, the reality is quite different. Most successful NetSuite implementations happen at companies with $5 million+ in annual revenue and dedicated IT resources. For small business owners, the platform often becomes more of a burden than a benefit.

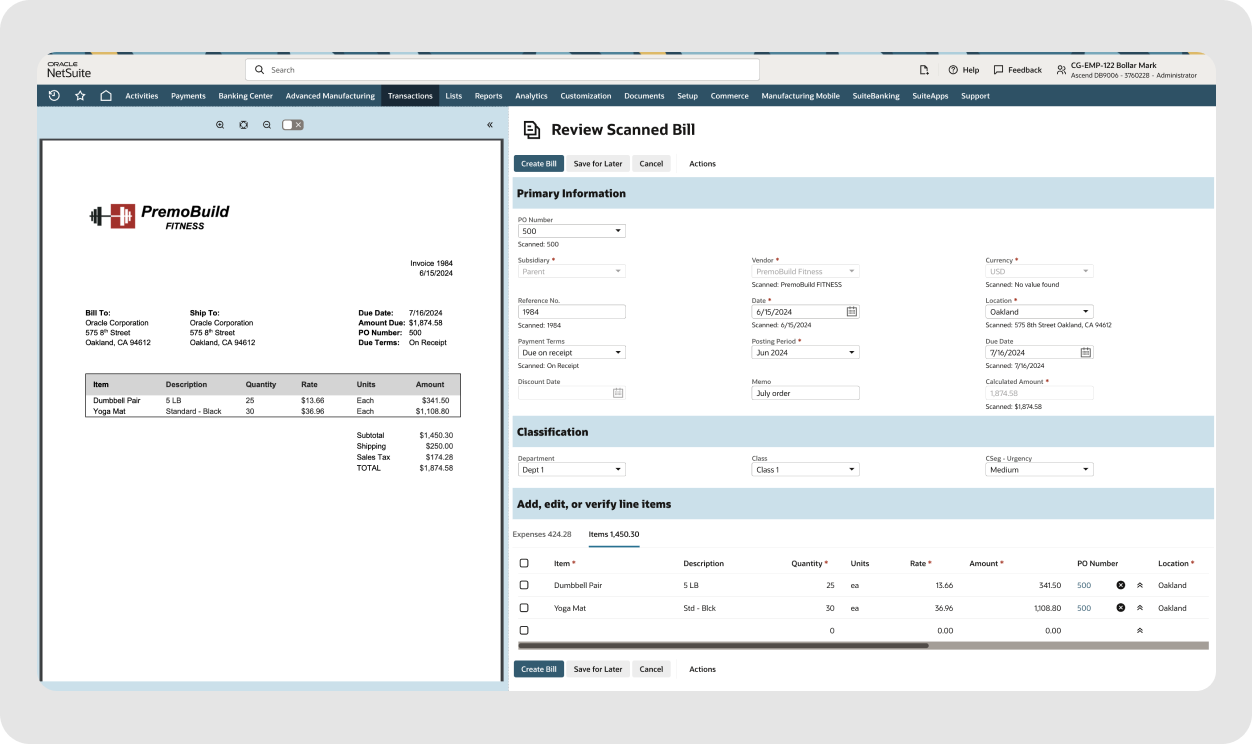

At its core, it offers comprehensive financial management, including general ledger functionality, accounts payable and accounts receivable automation and multi-currency support for global operations.

The platform handles financial reporting and consolidation, especially for businesses managing multiple subsidiaries or locations. You can generate financial statements, track cash management across entities and improve audit trails.

Beyond accounting software basics, NetSuite includes inventory management capabilities and supply chain management. You can track stock levels, manage warehouse operations and coordinate supply chain activities across multiple locations. The order management system handles everything from quote to cash, making it appealing for companies with complex sales processes.

The customer relationship management features integrate directly with the financial data, giving sales teams visibility into customer profitability and payment history. Professional services automation tools help project-based businesses track time, manage resources and bill clients accurately.

NetSuite connects these modules quite well. When a sales order gets approved, it automatically updates inventory, triggers accounting entries and flows through to financial reporting. This eliminates much of the manual work that happens when systems don't talk to each other.

However, this comprehensiveness comes with drawbacks. The extensive features create complexity that many users find overwhelming, especially those transitioning from simpler financial management tools.

Based on user reports and industry analysis, the estimated costs are $99 per user per month, plus sometimes even thousands for implementation. But that's just the starting point. Most implementations include other modules, customizations and professional services that can double or triple the initial estimate.

Review sites report total costs ranging from $2,000 to $10,000+ monthly for mid-sized businesses. The exact price depends on factors like:

Many Reddit users comment that this tool is for large companies and enterprises needing complex business management. For smaller teams, it can be very pricey compared with some small business financial management tools, with features you may never use.

Real user feedback tells a more complete story than marketing materials ever could. On G2, NetSuite has a 4.1-star rating.

We've analyzed comments from G2, Capterra and industry forums to understand what works (and what doesn't) with this cloud-based ERP.

For this NetSuite review, we'll look at the main advantages:

NetSuite has also received some negative reviews. They mention:

Can this platform fit your business processes? Our NetSuite review will now explain who should be using it.

While NetSuite tries to be everything to everyone, Fuelfinance takes a different approach. Instead of replacing your entire tech stack, Fuelfinance integrates with your existing accounting system and transforms it into a powerful financial command center.

See also: Financial Reporting Software for QuickBooks: Top 7 Tools 📊

Think of it this way: NetSuite aims to be a comprehensive, all-in-one operating system for your business, consolidating every function into a single platform. Meaning you have to move all your existing data and processes into Oracle. Fuelfinance, on the other hand, has seamless integrations with the systems you already rely on, pulling in that data automatically. It adds powerful financial planning and automation that make your operations more precise, your insights clearer and your decisions faster.

Plus, it only takes about two weeks to implement, and expert help is included in each pricing plan, while NetSuite implementations can drag on for six months or more.

This lightweight approach means you keep using QuickBooks, Xero or whatever accounting platform already works for your team. Fuelfinance layers on top with AI-powered forecasting, automated financial reports and real-time insights that help you make decisions.

See also: Best QuickBooks Alternative for Small Businesses: 6 Top Picks

The result? You get enterprise-level financial intelligence without the enterprise-level headaches or costs. No lengthy implementations, no steep learning curves, and no need to retrain your entire team on a new system.

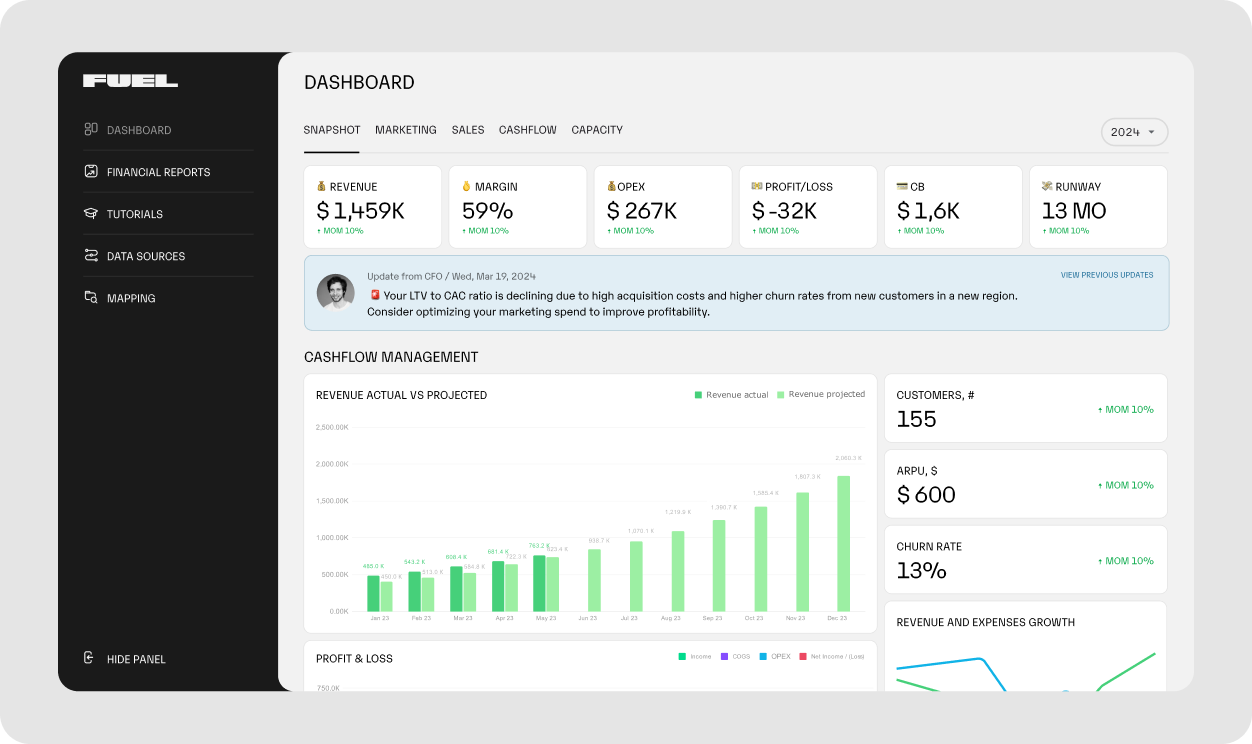

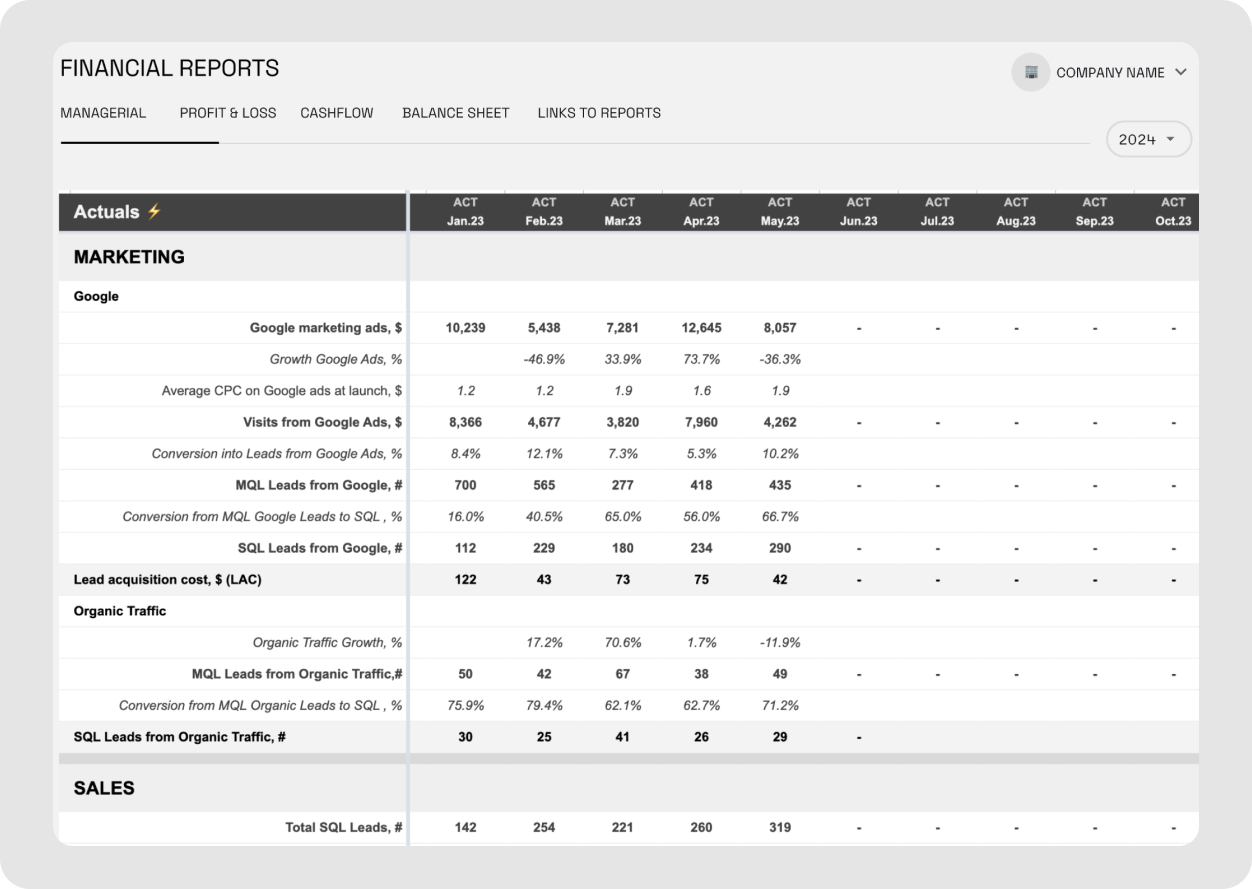

Fuelfinance focuses on what growing businesses actually need: better visibility, smarter forecasting and actionable insights from their financial data.

The platform's AI CFO capabilities analyze your financial patterns and highlight trends you might miss. Instead of just showing you what happened last month, it helps you understand what's likely to happen next quarter and what you should do about it.

Automated financial reports eliminate the monthly scramble to pull together board decks and investor updates. Your CFO dashboard updates in real time, pulling data from across your tech stack to give you a complete picture of financial health.

The forecasting tools go beyond basic projections. You can model different scenarios, track key SaaS metrics if you're a software company or monitor agency metrics if you're service-based. The AI learns your business patterns and helps you spot opportunities or risks early.

With over 350 connections, including QuickBooks integrations, Salesforce integrations and HubSpot integrations, your data flows automatically without manual uploads, exports or tool switching.

The real win with Fuelfinance isn't just the technology — it's the combination of smart tools and expert support. Every plan includes access to a dedicated finance manager who knows your business and helps you interpret your data.

This matters more than you might think. Having sophisticated financial forecasting software is great, but knowing how to use those forecasts to make better decisions? That's where the finance manager becomes invaluable.

The learning curve is minimal because the interface builds on familiar concepts. If you understand basic financial statements, you can navigate Fuelfinance effectively.

Cost efficiency becomes obvious quickly. Instead of paying for modules you don't need, you get focused functionality directly impacting your business performance. Many clients find that the Fuelfinance insights help them optimize spending and improve unit economics enough to pay for itself within the first quarter.

ColdIQ’s experience illustrates what's possible when you match the right tool to your business needs. This GTM agency was struggling with scattered financial data across multiple platforms.

After implementing Fuelfinance, they built a custom dashboard that consolidated everything from revenue tracking to expense management. The improved forecasting accuracy and real-time visibility into their financial metrics helped them make smarter decisions about hiring, client acquisition and resource allocation.

The results speak for themselves: a 236% increase in revenue over eight months. More importantly, they gained full visibility into their business's financial health.

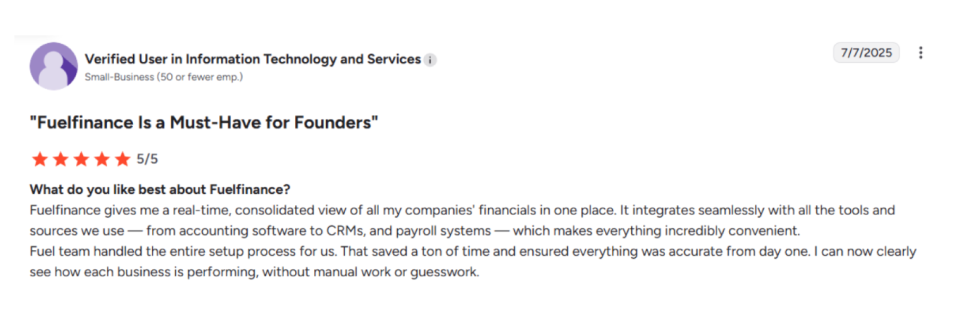

On G2, Fuelfinance has a 4.9 rating. Users appreciate the consolidated view of their finances and support from the Fuelfinance expert team.

Here's how these two platforms stack up.

NetSuite is suitable for specific customers: established companies with complex operations, substantial revenue and dedicated IT resources. If you're managing multiple entities, require extensive customization or need deep warehouse management capabilities, NetSuite's comprehensive approach makes sense.

But for most growing businesses, NetSuite is just too much. The high costs, lengthy implementation and steep learning curve outweigh the benefits for companies that need focused financial planning software tools rather than enterprise-grade complexity.

The smarter path for most SMBs is choosing specialized tools that get them from point A to point B. Instead of trying to force your growing business into an enterprise mold, consider solutions that adapt to your current needs while providing room to scale.

Ready to see what your financial data could tell you with the right tools? Book a 30-minute call with us for expert advice.

NetSuite generally isn't the right fit for small businesses. The platform's enterprise focus, high costs and complex implementation process create barriers that smaller companies struggle to overcome.

While Oracle doesn't publish official pricing, user reports consistently indicate costs starting around $999 monthly for licensing plus $99+ per user. Total implementation costs, including setup, training and customization, can reach $15,000-$50,000+ for mid-sized businesses.

The best alternative depends on your specific needs. For comprehensive financial reporting software, platforms like Fuelfinance offer enterprise-level insights with startup-friendly implementation.

The main disadvantages of this business solution include high implementation and ongoing costs, complex setup requiring consultant support, a steep learning curve for new users and functionality that often exceeds what smaller businesses actually need.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.