Your company is scaling, and you’re looking for a powerful accounting and enterprise resource planning (ERP) system. NetSuite seems like an obvious choice. After all, it’s trusted, comprehensive and feature-packed.

But you decide to dig deeper and fall into a rabbit hole. The pricing, the implementation complexity, the steep learning curve… A few customer reviews burst your bubble. What seemed like the perfect solution begins to feel more like a mismatch for your business operations.

And research shows that 75% of ERP strategies fail to align with the overall business strategies, leading to mediocre results and confusion. This misalignment highlights the importance of assessing whether a new system fits your current needs and future goals.

If you’re uncertain about whether NetSuite is the right fit, we’ve got you covered. The good news is that some alternatives might better suit your needs.

That’s why we’ve compiled a list of ten NetSuite competitors. Keep reading to discover their features, customer reviews and how they support your business.

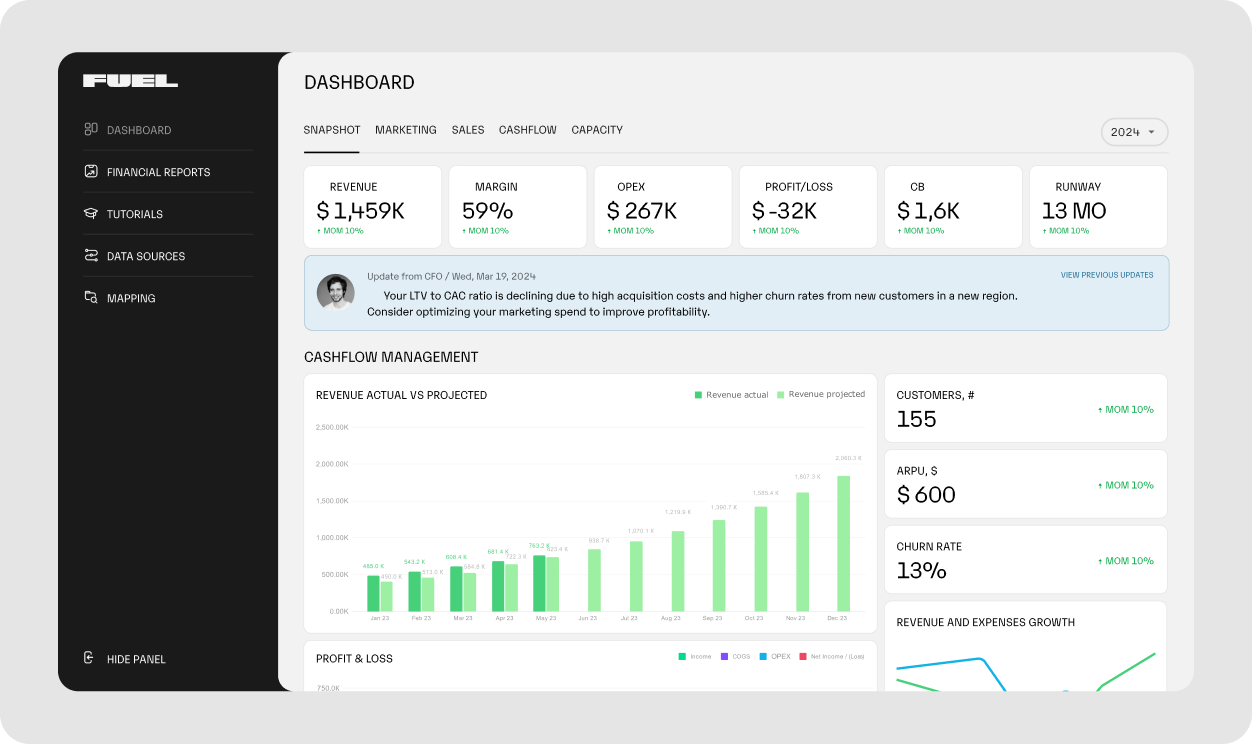

Tired of looking at spreadsheets and manually entering data? We get it! That’s why we developed Fuelfinance.

Fuelfinance is a financial management solution perfect for startups and SMBs. It automates everything from cash flow reports to financial forecasting, giving you real-time insights into your business’s performance.

Forget about digging through messy spreadsheets or searching for data from multiple sources. Fuelfinance automatically pulls financial data from accounting systems and CRMs, syncing everything in real-time.

Read also: Financial Management Solutions: 6 Best Software Options

With unit economics, financial planning and AI forecasting, Fuelfinance helps you make data-driven decisions and prepare for the future. It’s like having the entire finance team just one click away, ready to support your growth and guide you towards wiser decisions.

While NetSuite offers a full suite of ERP tools, including customer relationship management and inventory management, Fuelfinance excels in financial management. It combines AI forecasting, financial planning software features and dedicated support for startups and SMBs that need detailed financial insights. The good news is that NetSuite seamlessly integrates with Fuelfinance, so you get the best of both worlds.

Want to know how Fuelfinance can simplify your financials? Book a free demo!

Capterra: 5

G2: 4.9

Image source: Capterra

Before Fuelfinance, Oceans struggled with scattered data across platforms like QuickBooks, HubSpot and Google Sheets. Financial reporting was manual, inconsistent and unclear.

After integrating Fuelfinance, Oceans consolidated all data into one dashboard. We automated P&L, cash flow and balance sheet reports, ensuring accuracy and consistency. Fuelfinance also implemented churn analytics, helping the team act on data faster.

With accurate forecasting, streamlined accounts receivable and improved business budgeting, Oceans saved time and resources. Plus, our expert guidance helped the company save $20k annually by finding a better financial provider.

Sage Intacct is a cloud-based ERP solution for mid-sized companies that automates financial operations such as accounts payable, receivable and payroll.

Compared to NetSuite, Sage Intacct is more affordable and easier to implement. Its primary focus is accounting and finance, while NetSuite provides tools to run the entire business, including warehouse management, e-commerce and field service management.

Capterra: 4.3

G2: 4.3

Workday Financial Management is suitable for mid-sized businesses and enterprise customers. Its features help businesses automate consolidation tasks, plan resources and manage spending with contextual insights.

Workday Financial Management offers more human capital management tools than NetSuite. It’s a solid choice for businesses looking to integrate human resources and financial management into a single system. Workday Financial Management covers every process from tracking employee absence to managing workforce planning.

Capterra: 4.4

G2: 4.0

QuickBooks Online is next on our list of NetSuite competitors. It is aimed at small businesses and offers core accounting functions like invoicing, expense management and multi-currency support.

Compared to the NetSuite ERP system, QuickBooks is a more affordable solution focusing primarily on accounting. However, it doesn’t support advanced features like procurement, enterprise performance management and omnichannel commerce.

Read also: 5 Best QuickBooks Integrations for Better Financial Management

Capterra: 4.3

G2: 4.0

Read also: Best QuickBooks Alternative for Small Businesses: 6 Top Picks

SAP Business One is an ERP software solution for medium-sized businesses. It allows users to track financial performance, manage supply chains, gain visibility into direct and indirect spending and automate marketing campaigns.

NetSuite vs SAP Business One? The main difference is that NetSuite is for larger enterprises with complex needs, while SAP Business One meets the basic accounting needs of mid-sized businesses.

Capterra: 4.3

G2: 4.3

Certinia offers financial management and professional services automation (PSA) software. It provides tools for revenue recognition, forecasting, billing and accounting. In addition to financial management, Certinia lets users handle orders from different channels.

Certinia is native to Salesforce and is suitable for companies already using this CRM. If you want a more customizable solution, explore NetSuite competitors like Fuelfinance.

Capterra: 4.0

G2: 4.1

Acumatica is suitable for agriculture, construction, transportation, retail and manufacturing companies. It automates processes with AI and machine learning. This technology can also extract real-time dynamic data and detect anomalies.

Like NetSuite, Acumatica is a true ERP system. Their main differences lie in the pricing model and target audience. Acumatica charges based on resource consumption, while NetSuite charges per user. Acumatica is for mid-sized businesses.

Capterra: 4.3

G2: 4.5

Microsoft Dynamics 365 has apps for different business needs. Microsoft Dynamics 365 Business Central is one of them. It’s for finance teams that want to automate processes, create cash-flow projections and generate flexible reports.

Compared to NetSuite, Microsoft Dynamics 365 offers more flexibility to users. Businesses can pick the tools they need, without subscribing to a full ERP system. It’s suitable for companies that already use Microsoft in everyday operations and want to unify data into one ecosystem.

Capterra: 4.0

G2: 4.0

Like other finance cloud solutions, Xero supports invoicing, bank reconciliation and payroll. It has solid integration capabilities with third-party apps, including NetSuite. The tool is suitable for bookkeepers, accountants and small businesses.

Xero is simpler and more affordable, but doesn’t offer all the ERP features that larger NetSuite customers require, such as risk management. That said, it’s a solid choice for everyday financial tasks.

Read also: Xero Vs QuickBooks: Which is the Right One for Your Business?

Capterra: 4.4

G2: 4.3

Zoho Books provides accounting software for SMBs. The system supports invoicing, inventory management and expense tracking. Businesses can also use it to collect digital signatures.

Unlike NetSuite, Zoho Books offers many customization options. While NetSuite requires advanced technical knowledge, users can customize invoices and reports with Zoho Books without a developer.

Capterra: 4.4

G2: 4.4

Consider the following selection criteria to pick the best NetSuite competitor for your needs:

Some criteria will matter more than others based on a company’s size, budget, growth stage and finance team size. For instance, smaller businesses prioritize ease of use and cost efficiency, while larger enterprises may look for advanced features like professional services automation.

Book a call to see how Fuelfinance can simplify your finance and prepare you for the future.

Too many NetSuite competitors? It can be overwhelming to choose the right one. With so many options, focus on what your business needs, whether that’s ease of use, scalability or integration options.

If you want a part-time CFO who helps you learn from financial mistakes and grow with confidence. Fuelfinance is the right tool for you. This AI-driven financial reporting solution generates financial statements, builds accurate forecasts and checks if you’re on track with your KPIs.

Want to reevaluate your financial strategy and unlock growth opportunities? Fuelfinance is here for you every step of the way.

Book a free demo and turn data into actionable insights!

NetSuite has many competitors, including SAP, Sage Intacct, Certinia and Fuelfinance.

The question is: what are your business needs? If you’re an SMB with basic accounting needs, choose SAP. On the other hand, NetSuite is a better choice if you’re a large enterprise wanting features like risk management.

The best ERP system is the one that offers features your business needs. So, NetSuite (and other tools) is the best ERP if it meets the requirements of your company.

Some affordable NetSuite alternatives are tools like Sage Intacct, SAP and Microsoft Dynamics 365. At Fuelfinance, we tailor pricing to your needs, so there’s a good chance it will be a more profitable option for you in the long run.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.