For the Q2 of 2023, investors put $31.8 billion into US and Canadian startups, which is the lowest quarterly total in over three years. This data alone highlights the growing importance of having a solid startup financial model to attract venture capitalists and raise funding in a competitive market.

On the other hand, we have more than 1.1 million businesses founded in 2022, compared to 839,000 the year before, and this trend keeps rising year after year, so we can expect to see even more startups founded this year.

With all this competition, how can you stand out and attract investors to obtain venture capital? How can you raise venture capital? The answer could be creating a solid financial model for your company.

Whether you're already running several early-stage companies or just starting, we've got you covered. We'll show you how to create a simple startup financial model and a business strategy that help you reach your goals and ensure sustainable recurring revenue growth.

Contents

Startup financial models anticipate your company's financial implications based on current data, business assumptions, business plan and projections. They serve as a guiding roadmap for founders, stakeholders and potential investors.

Fun fact: According to Spendesk, In 2023, 47% of venture capital funding was allocated to SaaS companies with a SaaS business model.

These models (especially for SaaS startups and SaaS businesses), spanning from one to five years, are essential for financial forecasting for startups, as they allow you to anticipate expenses and profitability. That will help you make smarter business decisions and improve your strategic planning and fundraising process.

Here are the key components of a startup financial model:

We'll show you how to create a financial model in only six steps, so you don't have to search for rigid financial model templates to guide you.

First of all, we know that small business financial management can be downright daunting and that building financial models for early-stage startups isn't the founders' favorite thing to do. This isn't because they're concerned about what numbers might indicate, but because building financial models can be tiring and time-consuming.

That's why many founders aren't sure where to start.

Over an extended period, business owners relied on traditional spreadsheets, such as Excel, to build financial models. Spreadsheets offer some basic features for financial planning, but they require a lot of manual work and updating, and that's why many people dread using them.

The good news is that today, there are plenty of financial management solutions that can automate this process for you.

Here are just some of the biggest benefits of using financial modeling software instead of good, old spreadsheets:

One such tool is our Fuelfinance – a cloud-based financial management software that also acts as your outsourced CFO by providing unlimited access to the support of our financial experts, who are here to answer your questions and help you make informed decisions. You'll see its financial modeling features in action in the following sections.

Speaking of software recommendations, you may also want to check out QuickBooks alternatives for small SaaS companies or another article to help you compare Xero and QuickBooks for accounting.

Financial models often require historical data to create reliable forecasts. Now that you've chosen your software, it's time to gather data and generate three financial statements. Collecting data is something you should be doing from day one if you want to understand how your business operates.

Here are the three statements that every business needs:

One of the most effective ways to track historical and current spending is by implementing a procurement system. This ensures accurate financial statements, as businesses can manage transactions with suppliers and employee reimbursements directly within the tool.

Based on this data, you can make underlying assumptions for future performance that will be the basis for your projections, which we’ll discuss soon.

Understanding and tracking your Key Performance Indicators (KPIs) is essential for making informed financial decisions and driving sustainable growth.

However, not all KPIs are created equal. Choosing the right metrics to track depends on many factors, such as your business model, revenue streams and your company's financial situation.

What works for one company may not work for another.

The good news is that you don't have to be a financial expert to choose the metrics to focus on.

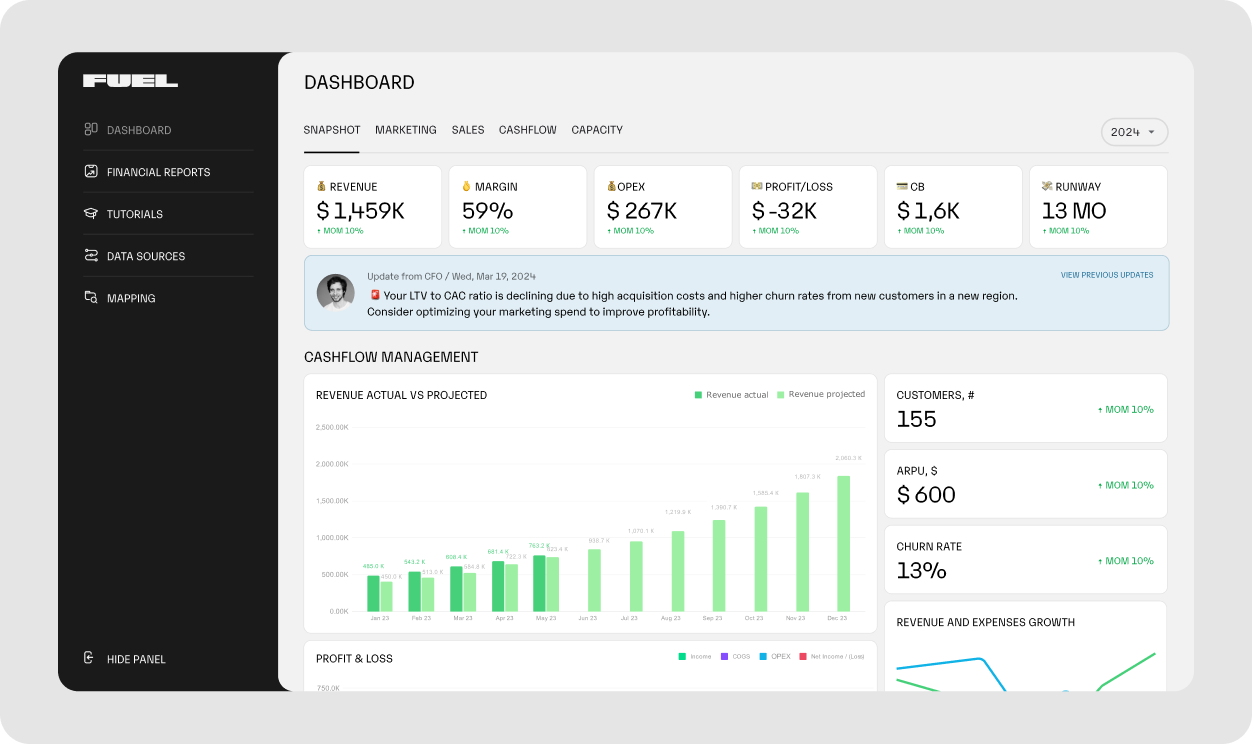

If you're using Fuelfinance, our comprehensive dashboard will recommend the most important KPIs to focus on based on your business model.

Moreover, our experts offer assistance in comprehending the impact of key metrics such as CAC, Churn Rate, LTV and others. Therefore, you can say goodbye to intuitive decision-making and make it data-driven.

See also: Key SaaS metrics & KPIs

To succeed and reach an outstanding business performance, it's not enough to focus on everyday work and financial performance, as so many founders end up doing. You have to think long-term, and that's where financial forecasting software like Fuelfinance can help you.

Our financial planning tool creates two versions of forecasts based on historical data and plans you have in mind:

Fuelfinance updates these projections monthly, based on the latest data, so you'll always be up-to-date.

Considering both pessimistic and optimistic financial forecasts is essential for comprehensive small business financial planning.

While the pessimistic scenario helps a business prepare for challenges and mitigate risks, the optimistic scenario allows for goal-setting, strategic planning and identifying opportunities for growing and scaling your business.

Some founders treat the financial model for a startup as some secretive document, but we actually advise you to share it with relevant stakeholders, especially if you're a new founder who might use the advice of someone more experienced.

Consider sharing some aspects of your startup's financial model with your potential partners, investors, suppliers or advisors. If you don't have a board of advisors, don't worry – our financial experts at Fuelfinance are here to help you.

You should also be fully transparent about your revenue model when engaging with potential customers or the community in general.

Here are a few good reasons to not keep your financial plan to yourself:

Just like a living organism, your startup is evolving and changing, and your startup financial modeling process should reflect that.

Markets are subject to fluctuations, and economic conditions may change due to multiple factors at play. Considering all that, it’s necessary to regularly update your financial model to adapt it to these new dynamics, anticipate challenges and capitalize on opportunities.

The process of updating your financial model is also a great opportunity for continuous learning on how to do financial analysis. As you gather new data and gain a deeper understanding of your business and its financial dynamics, your predictions will become more accurate.

Financial experts say that creating a robust financial model means setting foundations for your business. But what does that actually mean?

Here are some practical reasons to build a financial model:

Beyond automating financial modeling and AI forecasting, Fuelfinance offers a comprehensive suite of tools and services that simplify financial management for startups and SMBs.

Here’s what else Fuelfinance can do for you:

You can work in our modern, web-based interface or stick with Google Sheets and connect it to Fuelfinance if you prefer. Sign up for a short demo to see what our combination of smart AI, propriety software and expert support can do for your business.

Many people believe financial experts are gate-keeping something from them, but creating a financial model doesn’t have to be difficult.

However, I had to learn that the hard way. After doing tons of research and trying out different tools, we decided to combine all aspects of financial management into one app, and that’s how Fuelfinance was born.

It’s made for early-stage startup founders and small business owners who are looking for a user-friendly and reliable tool that doesn’t require having a degree in Finance to figure it out. It doesn’t matter if you’re in e-commerce, construction or SaaS business, we’ve got you covered.

Plus, it also comes with unlimited support from our team of financial experts, acting as your fractional CFO.

Ready to ditch the spreadsheets and complex formulas? Book a free demo and let us simplify your financial planning and model creation journey.

Startup financials are the story of your business in numbers – a full breakdown of your company’s financial performance and future revenue projections. They’re not just for keeping track of your money; they also convince investors you actually know what you’re doing.

They typically include:

If you’re raising funds, pitching investors, or just trying to make sense of your numbers, these reports are non-negotiable.

It may depend on your industry and business model, but here are the most popular financial models for startups, many of which rely on insights from your income statement, balance sheet and cash flows:

Your financial model should contain your current financial statements, including the balance sheet, cost structure, revenue projections, cash flow forecasts and analysis of different future scenarios.

Financial modeling can be challenging because it's based on multiple factors that can change in the future. It requires analyzing large sets of data and a profound understanding of financial concepts, industry dynamics and forecasting methods.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.