You set next quarter’s budget, plan a new marketing campaign and maybe even hire a few people. Everything looks solid – until reality hits. Sales don’t grow as fast as expected, expenses pile up and cash flow tightens. Now, you're scrambling to figure out what went wrong, tweaking spreadsheets and hoping next time will be different.

The thing is that traditional forecasting methods rely on rigid assumptions and outdated spreadsheets. They don’t adapt to sudden shifts in external data like changing market trends, competitor moves or fluctuations in customer demand.

That's why you get inaccurate demand forecasts that force you to react instead of planning ahead.

If financial planning has ever felt like a mix of best guesses and crossed fingers, this is your chance to change that.

After reading this article, you’ll know how to overcome that. We’ll cover:

Traditional financial planning usually means spending hours tweaking spreadsheets, updating formulas and hoping a single mistyped cell doesn’t throw everything off. It’s slow, static and prone to human error.

Enter artificial intelligence (AI) forecasting models. These models eliminate guesswork by automating the data preparation and prediction process. This technology uses machine learning techniques to process both structured and unstructured data, pulling in cloud resources and market trends to refine predictions in real time.

Data scientists design financial forecasting software to continuously learn from new information, ensuring forecasts remain relevant and reliable. Using deep learning and ML forecasting, AI models analyze historical data collection, identify patterns and update projections based on your synced bookkeeping records.

No more outdated reports or last-minute adjustments – AI refines its predictions continuously. Instead of static reports, you get dynamic demand planning that adjusts to your situation instantly, providing the forecast accuracy needed for better business decisions.

What makes AI forecasting better?

Let us introduce you to a tool that combines this modern approach with comprehensive financial planning and analysis (FP&A) software and expert support. Fuelfinance takes AI forecasting a step further, offering predictive analytics across revenue, sales, marketing, customer success and more. As a cloud-based financial department, it automates everything from spreadsheets to real-time dashboards – integrating with over 300 data sources to keep your numbers fresh.

Fuelfinance puts this AI precision in the hands of startups and small businesses. With automated, AI-powered insights across revenue, expenses, cash flow and more, you can optimize inventory, plan budgets and track financial performance without getting lost in spreadsheets.

Gone are the days of juggling spreadsheets and hoping for the best. AI forecasting offers a faster, more reliable solution. Fuelfinance turns financial forecasting into an automated, data-driven planning process.

Here’s how it works:

Book a Fuelfinance demo today to stop guessing and start planning your business decisions.

At this point, you might be thinking, “Okay, AI forecasting sounds great, but what do I actually do with it?” Fair question. The good news? You don’t have to do much – Fuelfinance does the work for you. Here’s how to put it to use.

Everything starts here. Your financial data is already in place, and if there’s historical data available, AI forecasting is up and running without you lifting a finger.

But what if you don’t have historical data yet? Fuelfinance can help you generate projections based on industry trends and market research, helping you build realistic forecasts even if you’re just starting out. It considers factors like total addressable market (TAM), expected sales pipeline, expense forecasts and cash flow projections, giving you a solid financial plan from day one.

New here? Sign up for Fuelfinance to get started.

Revenue, expenses, MRR, customer retention – Fuelfinance pulls past data and predicts future numbers automatically. These forecasts appear right in your financial reports, so there’s no need for manual setup.

Decide how far ahead you want to look:

You won’t be staring at endless rows of numbers – everything lives in one dashboard with tables, graphs and up-to-date financial data. Track cash flow fluctuations, monitor spending trends, forecast balance sheet and identify unexpected cost spikes or revenue slowdowns before they affect your financial stability.

Numbers don’t always play out as expected, which is why Fuelfinance updates your forecasts based on real data. This helps you:

And that’s it. AI forecasting runs in the background, giving you accurate, current insights so you can stay ahead instead of playing catch-up.

By now, you get the idea – AI forecasting is a game-changer. But what does that actually mean in practice? Let’s examine real businesses that have used Fuelfinance to make smarter financial decisions, optimize spending and fuel their growth (pun intended).

Scaling a business isn’t just about having a great product – it’s about knowing when to hire, expand or invest in new opportunities. That’s exactly what ColdIQ, a GTM agency, needed help with.

Before Fuelfinance, they had no clear visibility into which products were driving revenue. After implementing AI forecasting, they could track performance across different revenue streams and regions.

The result? A 236% revenue increase in just 8 months, growing from $67K MRR to $250K MRR.

By using accurate forecasting to pinpoint its most profitable products, ColdIQ focused on high-margin revenue streams and made better strategic decisions.

Throwing money at ads without knowing what’s working is a fast way to burn cash. Testimonial Hero, a video production company, wanted to optimize their marketing budget – but lacked the financial clarity to do so.

With Fuelfinance, they automated their Customer Acquisition Cost (CAC) and Lifetime Value (LTV) tracking, gaining real insights into marketing efficiency. Instead of blindly increasing ad spend, they identified the best-performing channels and reallocated their budget accordingly.

This smarter approach cut their finance and accounting costs by 50% while tripling the value they got from their financial system.

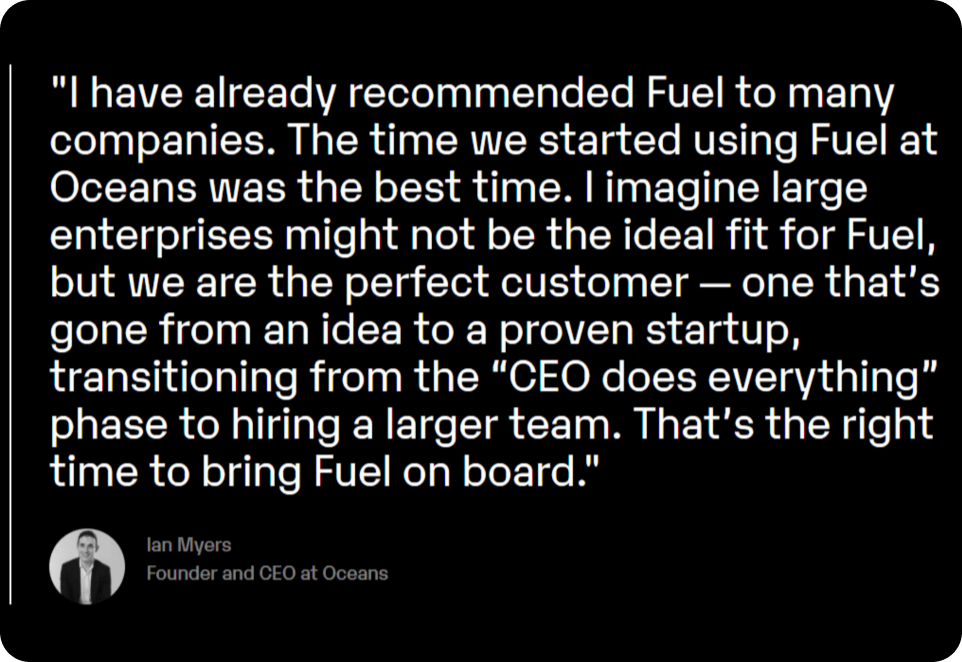

Studies show that customer retention is just as important as acquisition (if not more), with returning customers spending 67% more than new clients. Oceans, a recruiting agency, struggled to track churn and take action before customers left. Scattered data and manual reporting made it difficult to see financial trends or act on potential risks on time.

With AI forecasting and churn analytics, Fuelfinance gave them actual insights into retention and spending. Their forecast deviation dropped from 50% to just 5-10%. They also saved $20K annually by switching to a better financial provider and improved cash flow by optimizing account receivables.

AI forecasting is just one part of the equation. Fuelfinance is built to take the headache out of small business financial management, giving startups and SMBs the tools they need to stay in control. Here’s what else it can do:

Fuelfinance gives businesses full financial visibility, smarter forecasting and automated reporting – all in one platform. Book a demo today and see how it simplifies financial management for growing companies.

Financial planning doesn’t have to be a guessing game. AI forecasting removes uncertainty from budgeting, cash flow forecast and revenue planning – helping you make smarter decisions.

That’s exactly why we built Fuelfinance. Startups and SMBs need a financial system that’s fast, accurate and built to prevent cash flow surprises, missed growth opportunities and last-minute budget scrambles.

Fuelfinance’s AI forecasting simplifies financial planning, giving you accurate insights to avoid overspending, prepare for slow months and plan for wise growth. With real-time data and automated projections, you can hire at the right time, optimize budgets and keep your business financially steady.

Want to see it in action? Book a free demo today.

AI in forecasting analyzes historical data, identifies patterns and generates predictions that update automatically as new data comes in. This makes financial projections more accurate, adaptable and data-driven compared to traditional methods.

Yes, AI models can predict trends, financial outcomes and business performance by analyzing large datasets. There’s no crystal ball for seeing the future, but AI gets pretty damn close. It processes historical data and industry trends to forecast both baseline and optimistic scenarios, making it way more reliable than gut feelings.

Absolutely. AI-powered financial forecasting evaluates past financial trends, market conditions and actual data to create projections for revenue, expenses and cash flow. This helps businesses plan budgets, mitigate risks and optimize financial strategies.

The best AI prediction tool depends on your needs. For financial forecasting, Fuelfinance offers a top-tier AI-driven solution customized for startups and SMBs, providing up-to-date insights and automated forecasting to simplify financial planning.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.