If you're running an online business, we've got good news. The average revenue per user is anticipated to increase dramatically over the next few years, both in e-commerce and online services.

Average revenue per user is just one of the metrics essential for tracking unit economics, the analysis that helps you determine the profitability and fund growth of your business down to each unit, which can help you with financial planning and scaling your business.

In this article, you'll learn two ways to determine unit economics analysis alongside all the important metrics to track and optimize.

Unit economics is basically your business, broken down to the smallest level – measuring how much revenue and cost comes from a single unit, whether that’s a product, a service or a customer.

Let’s say you run a coffee shop. Your unit is a cup of coffee. To figure out if you’re making money, compare how much you sell it for vs. what it costs to make – beans, milk, sugar and the barista’s time.

If you’re covering those costs and still making money per cup, great! But don’t forget about fixed costs like rent, utilities and equipment – because profits disappear fast if those aren’t factored in.

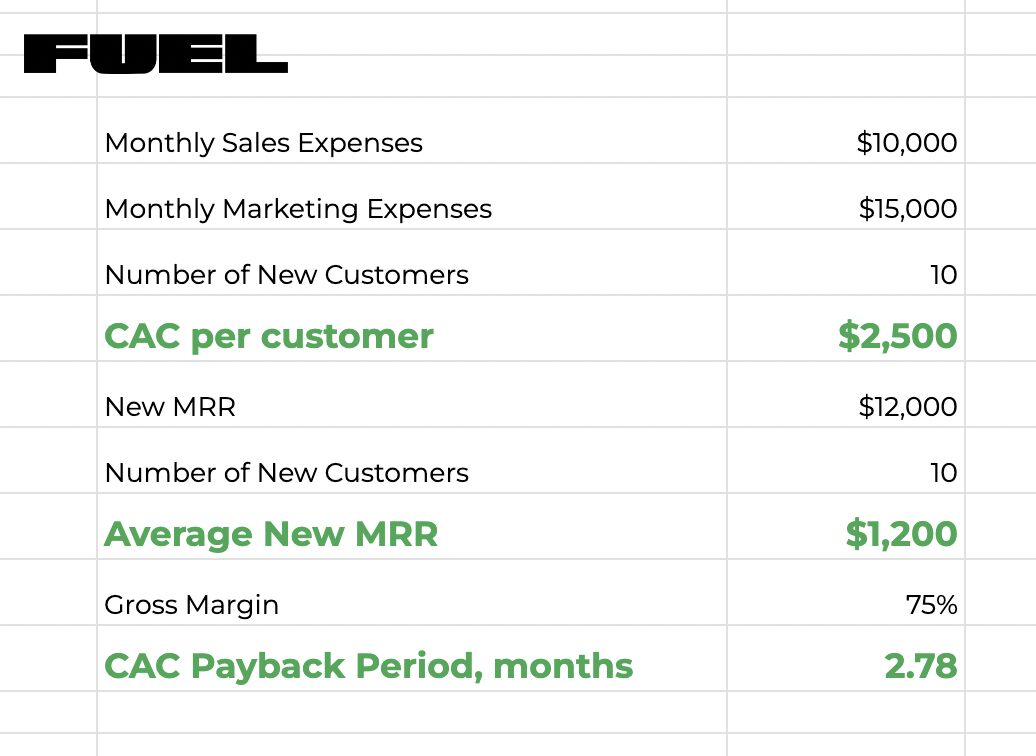

In SaaS, your unit is a customer, not just a single subscription. To figure out if your business model works, you need to track key SaaS metrics like CAC (Customer Acquisition Cost) and LTV (Lifetime Value) – basically, how much it costs to get a customer vs. how much they bring in over time.

That means looking at customer support, product development, sales and marketing costs to see if you’re making more than you’re spending.

Fun fact: Unit economics can show you which customers are actually worth your time. Instead of chasing every lead, you can focus on high-value customers and tweak your pricing to maximize profit.

It’s also a game-changer for new products – helping you figure out your break-even point and making sure you’re not just burning cash for fun. More on that later.

See also: 7 steps to start managing business finances

There are different ways of calculating unit economics, but the main difference is in what they see as a unit.

The first method sees sold products as a unit, while in the second method, the units are your customers.

Let’s start with the method often used in traditional industries that are selling physical items. This formula will help you see how much each unit contributes to covering overall costs and generating profit.

Contribution Margin = Price per unit – Variable costs per unit

To illustrate this with an example, let’s say you’re selling handmade jewelry. If you sell a piece of jewelry for $100 and the variable costs (including material and working hours) are $60, your contribution margin per piece is $40.

If you want to calculate your weekly or monthly contribution margin, simply multiply the result per item by the number of sales you had that week or month.

Can this be considered your profit? Unfortunately, not yet, as you still have to use that money to pay for your fixed costs such as rent and utilities before you can calculate how much profit you actually earned.

If you work in the SaaS industry and sell online products or services, the second method will probably resonate more with you, and it’s the one we use at Fuelfinance.

The second method defines unit economics as the relationship between the following SaaS metrics:

In the glossary we provided above, you can find definitions of both metrics and formulas to help you calculate them.

But at Fuelfinance, we’ve found a way to calculate and predict LTV per customer with more precision. Here’s our formula:

LTV per customer = Average MRR*Gross Margin*LT

As already mentioned, unit economics represents a relationship between your LTV and your CAC and it’s calculated by dividing your LTV by CAC.

Here’s our unit economics equation:

Unit Ecomonics = LTV/CAC

If you already know your customer’s lifetime value, you can use the exact number, but if you’re not sure, you can use the projection of the amount of money you expect to receive from that customer throughout your business relationship.

Of course, you want your LTV to surpass your CAC by the widest margin possible to make sure your business model is viable and profitable. If LTV exceeds the CAC by three times, it’s a sign that the company can increase its marketing budget.

On the other hand, if your CAC is greater than your LTV, then we’re talking about a non-profitable situation, meaning that your acquisition costs are too high.

Large companies with big budgets sometimes use this as part of their customer acquisition strategies to reach the largest number of customers possible, but it’s hard to sustain this strategy in the long run.

At Fuelfinance, we believe that the maximum customer acquisition cost should be 1/3 of the projected CLV, according to the golden rule of LTV. You can use our cost-per-lead calculator to see the maximum budget you can allocate to generating leads.

If this sounds too complex, don’t worry – it’s not you.

Unit economics is one of the most popular outsourced financial services, as many business owners and founders decide to leave it to the professionals, and you can do the same. If you opt for Fuelfinance, you’ll no longer have to spend hours crunching your numbers as we act as your outsourced CFO, freeing up your time for other tasks.

Here are five main reasons why calculating unit economics is important for your small business or startup.

Many people assume that financial forecasting for startups involves speculation and assuming as you have to consider numerous unexpected factors that could impact your business performance. But it doesn’t have to be that vague if it’s based on your historical financial data and unit economics.

While it’s possible to do small business financial planning based on financial statements (which you can generate with our financial modeling software), incorporating unit economics will help you predict more easily when your company will reach its break-even point and plan more accurately.

Our financial modeling software can help you generate these statements and provide you with financial projections, both optimistic and conservative, so you can make more informed decisions.

Plus, unit economics tells you whether your business is profitable at the most basic level. For example, by comparing your Customer Acquisition Cost (CAC) with your Customer Lifetime Value (LTV), you can see if it costs you more to acquire a customer than that customer will bring in over their lifetime. If LTV is higher than CAC, you're likely on a profitable path.

Understanding your unit economics helps identify inefficiencies. It helps you determine which aspects of your operation are more expensive than necessary and where they can improve, whether in marketing, production or customer support. This can lead to better resource allocation and cost management.

Product optimization is one way to reduce costs related to creating a product and increase its value for users or its appeal to new customers.

To do that, you first need to know your price per unit and your customer acquisition costs, and unit economics gives you the answer to both.

That’s why we’ve created the max cost per lead calculator that shows you the optimal budget for lead generation and helps you allocate your marketing budget more efficiently.

Now, here’s how unit economics can help you with prices:

If your cost per unit is equal or even higher than your price per unit, it means you’re underpricing. Some companies underprice their new products to capture a large market share, but this strategy can be financially risky and it’s not sustainable in the long run.

On the flip side, if you’re charging much more than it actually costs you to make a particular item, it means that the item is overpriced, and it could be the reason people aren’t buying it if they don’t see enough value.

Unit economics helps you identify products or services with higher profit margins. They’re the most valuable units in your offer and the quickest way to improve your profitability or scale your business by focusing on them.

New business owners often fall into the trap of focusing on revenue before everything else. Let’s say you have product A and product B. You sell product A for $100 but it costs you $90 to make it, and you sell product B for only $30, but it costs you $15 to make it. The first item may seem to bring more cash, but it brings you only $10 of profit per item, while the second brings you $15 per item.

Unit economics provides investors with insights into how efficiently your business operates at the microeconomic level and helps them assess the profitability and scalability of your startup financial model before they decide to invest in it.

Investors pay close attention to unit economics because it shows the potential for long-term profitability. They want to know if your business model is sustainable. Positive unit economics can help attract venture capital, as investors will see that your business can scale effectively and generate high returns over time.

If your unit economics are solid, it’s easier to justify increasing investment to acquire more customers, as you know each new customer is likely to generate more value than it costs to acquire them. Conversely, if your unit economics aren’t healthy, scaling can become a risky decision.

By analyzing unit economics, investors can identify potential risks early on. For example, if your customer acquisition costs are too high compared to the revenue generated, it may be an alert to them that your business model isn’t set up well.If you want to prepare for the investor pitch, check out this article on how to do a financial analysis, as it’ll point out things they’re looking for.

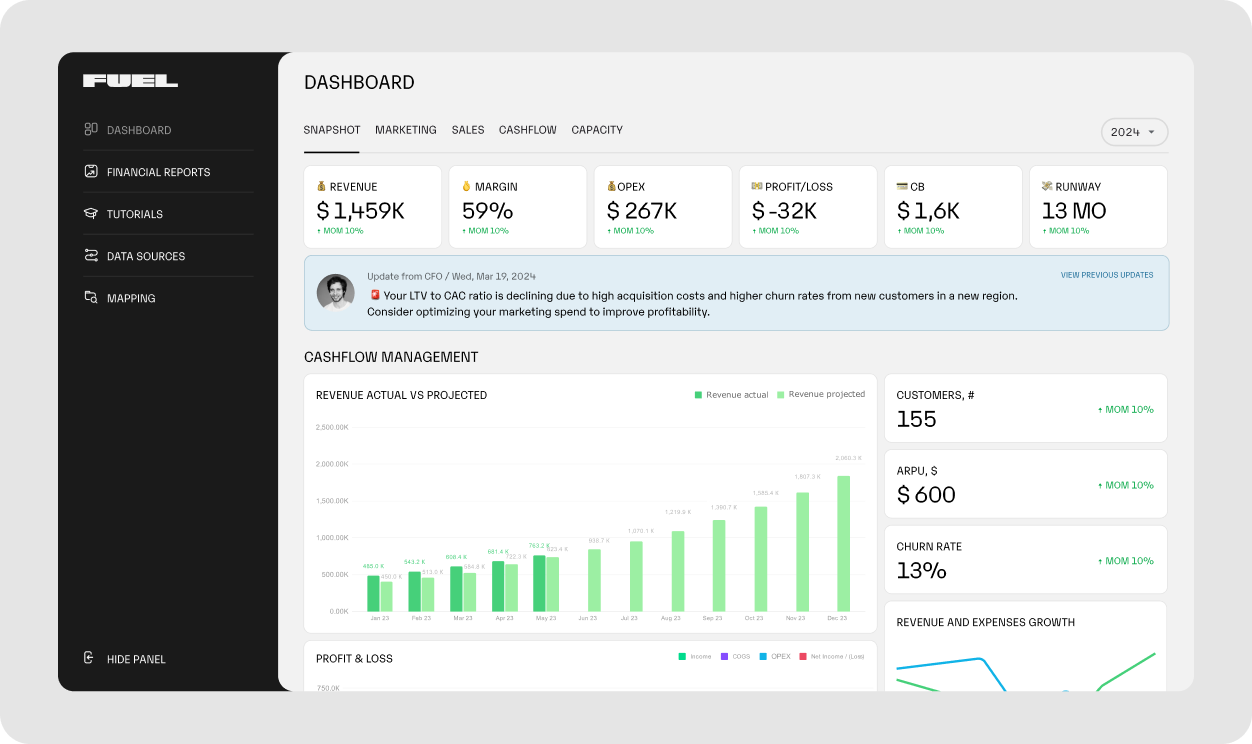

If you want to automate calculating your unit economics, we introduce you to Fuelfinance – our cloud-based SaaS Financial Software for startups and small businesses.

The purpose of our FP&A software is to save you time by eliminating as much manual work as possible, securely storing all your data in one place and helping you make accurate financial projections and plans.

Fuelfinance is one of the best financial analysis software, and unit economics is one of its core features.

Our unit economics section examines the relationship between your customer lifetime value (LTV) and customer acquisition cost (CAC) to help you maximize revenue. We’ve also created a framework that helps you identify hidden costs that grow at scale as your user base grows.

Apart from this, Fuelfinance offers other features, such as:

Our tool connects with over 300 third-party solutions, including integrations with QuickBooks, HubSpot, Gusto, Stripe and Wise.

Determining the profitability of your business is one of the most important things, but it’s not always an easy one. Many startup founders put it off until it’s too late, and they’ve already invested a lot of money in a product or service that can’t scale.

With Fuelfinance, you can crunch your numbers and determine unit economics, even though you’re not a financial expert. Plus, our team of experts is there to guide and advise you along the way.

Book a demo call with us, and let’s make your finances easy!

In unit economics, a unit refers to a product, service or any other item that can be quantified and for which it’s possible to calculate exact costs and revenues.

Good or positive unit economics means you’re generating more revenue per unit compared to the cost required to create that product or provide that service. It means your business model is profitable down to individual units, which is a good sign.

Here’s a simple real-life scenario to help you understand this model. Let’s say that someone has a small business selling homemade cakes online. Each cake that gets sold would be considered a unit. The owner would have to analyze the revenue generated from selling each cake and then compare it with the costs of making that cake (ingredients, packaging, staff hourly rate and delivery costs). If the revenue per item is higher than the costs, it means that the business is making a profit. If the costs are higher than the revenue, the owner has two options: either to try to somehow cut costs or increase the price per product.

There are different strategies to improve unit economics. For example, you could focus on increasing revenue per unit, reducing the costs associated with production and sales, decreasing your CAC, increasing customer LTV and optimizing your product.

No, unit economics takes into account only variable costs, as fixed costs remain the same no matter the number of products or services you’ve sold – they include things like rent and utilities or salaries for full-time employees.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.