Ever stare at five different Excel files, wondering if your subsidiary numbers actually add up? Join the club.

Most finance teams spend weeks every quarter playing detective with their consolidated financial statements, hunting down mysterious discrepancies between entities and praying their intercompany eliminations don't blow up the balance sheet. Recent research from Consero Global shows that 48% of CFOs without automated partners need 21+ days to close their books, compared to just 35% of those using modern financial consolidation software.

Manual consolidation processes eat up most of your close time, forcing finance teams to choose between speed and accuracy. You can overcome this issue with financial consolidation software.

In this article, we'll examine financial consolidation tools that can transform your month-end close from a nightmare into a grand ol’ time.

Financial consolidation software automates the process of combining financial data from multiple entities into unified consolidated financial statements. Instead of manually aggregating numbers from different subsidiaries, these tools pull data directly from your accounting systems and handle the complex calculations automatically.

Manual consolidation processes break down fast as your business grows. What works for two entities becomes impossible with ten. You're dealing with:

The right consolidation software transforms your financial close process by:

If you're tired of month-end close feeling like financial archaeology, automated consolidation tools can bring your finance transformation into the 21st century.

We didn't just grab the biggest names and call it a day. Our evaluation focused on real-world criteria that matter to finance teams actually doing the work:

Every tool in this list earned its spot by solving real financial consolidation challenges, not just checking feature boxes.

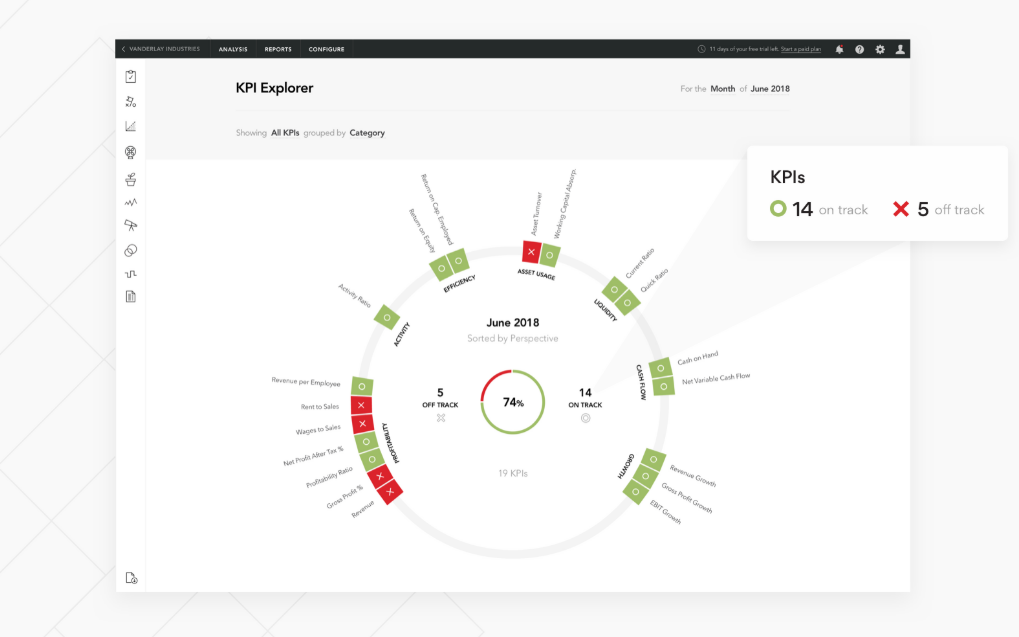

Here's how the top financial consolidation software options stack up across key features, ratings and ideal use cases:

Now let's dive deeper into what makes each platform unique and when they work best.

Fuelfinance is the financial consolidation software that actually makes sense for growing businesses. While most platforms assume you have a dedicated IT team and months to spare for implementation, Fuelfinance gets you up and running in weeks, not quarters.

Best for: Startups and SMBs (10-500 employees) that want comprehensive FP&A software without the enterprise complexity.

Pros: True all-in-one solution combining consolidation, planning, forecasting and expert guidance. Unlike pure consolidation tools that leave you staring at reports, wondering what they mean, Fuelfinance includes CFO-level interpretation and strategic advice.

The platform shines for companies that need more than basic number-crunching. Take ColdIQ, a GTM agency that used Fuelfinance to organize scattered financial data across multiple entities and build custom dashboards. Result? 236% revenue growth in eight months with complete visibility into business performance.

What sets Fuelfinance apart is the combination of powerful technology and human expertise. You're not just buying software — you're getting a financial management solution that includes ongoing CFO guidance to help interpret your consolidated reports and make strategic decisions.

Ready to stop wrestling with consolidation spreadsheets? Fuelfinance combines automated financial consolidation with the strategic insights your business actually needs. Book a demo today and see how AI-powered consolidation can transform your financial close process.

If you're dealing with hundreds of entities, complex ownership structures and regulatory requirements that change by jurisdiction, OneStream is the most suitable solution for your financial consolidation process.

Best for: Large enterprises with complex, multi-entity structures

Pros: Handles most complex scenarios, comprehensive feature set

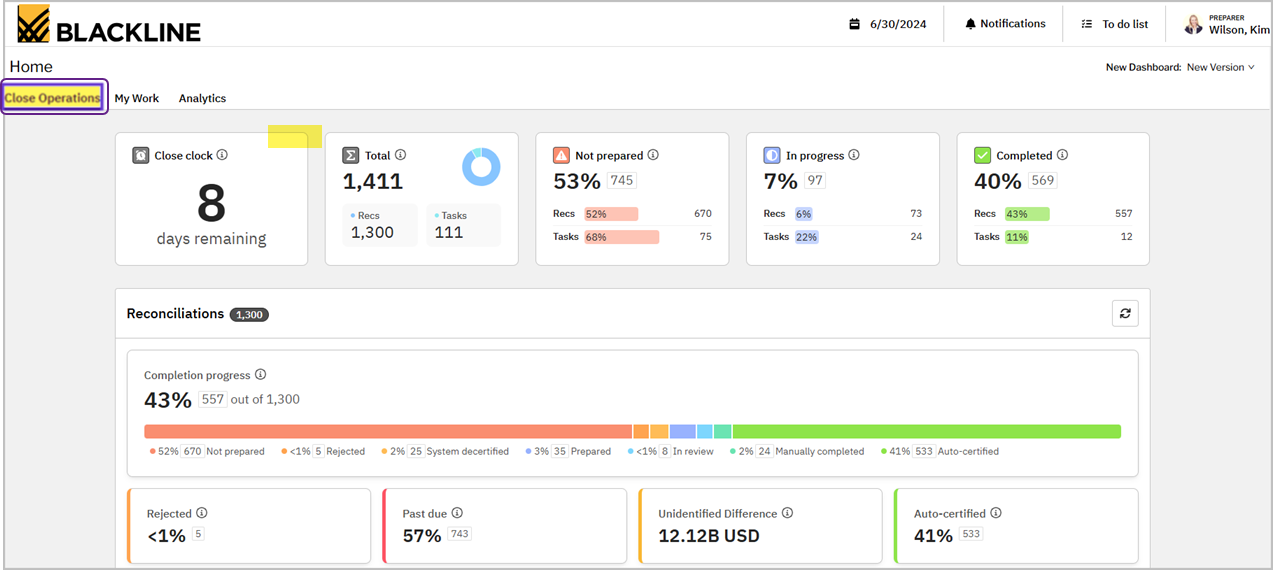

BlackLine is a financial consolidation software solution that automates parts of the financial close process. It helps companies reduce manual, repetitive tasks during the month-end close.

Best for: Mid-to-large enterprises focused on close automation

Pros: Market leader in financial close, strong compliance features

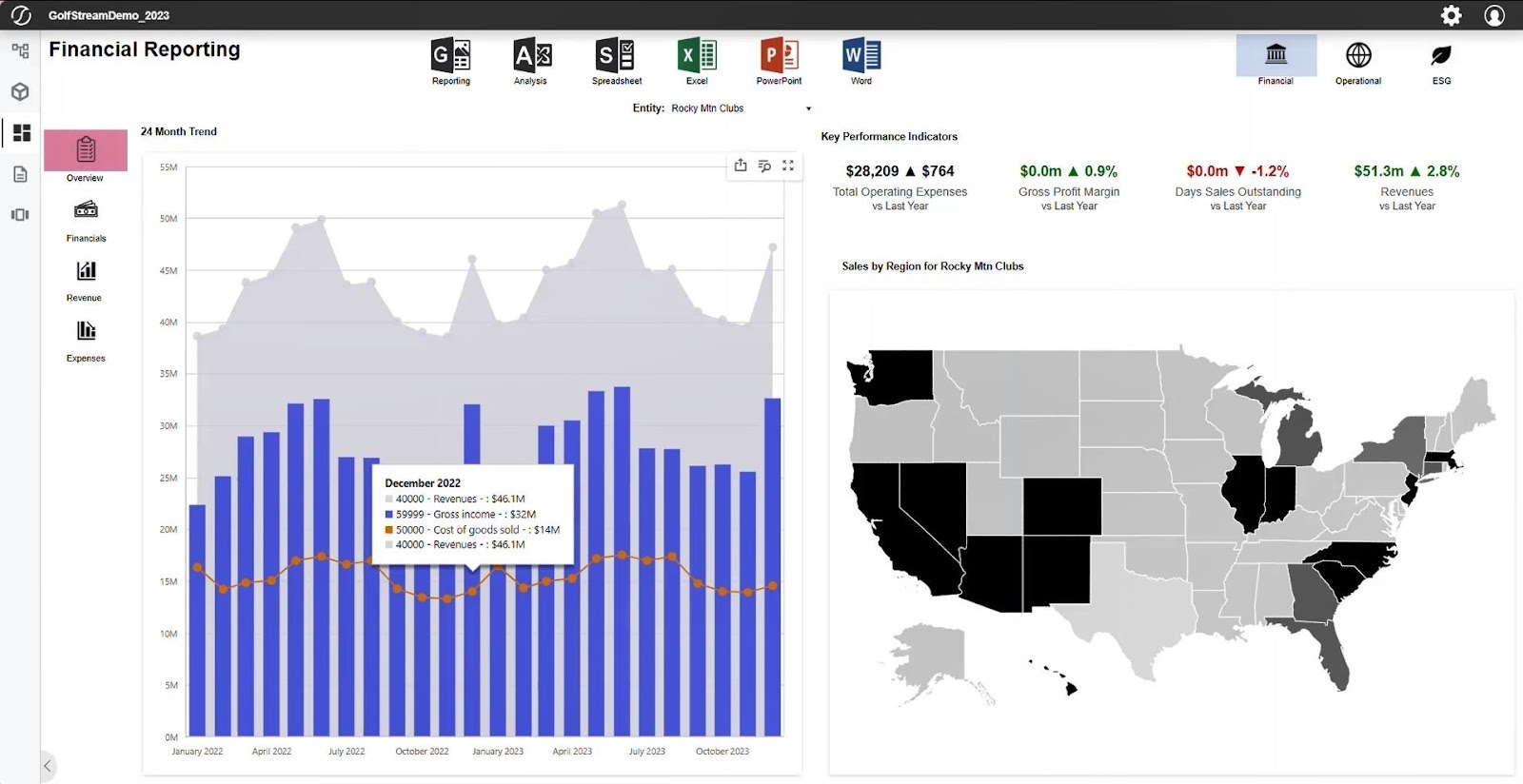

Planful takes a different approach by combining financial consolidation with comprehensive planning and budgeting in a single platform. Instead of treating consolidation as a separate month-end headache, Planful integrates it into your ongoing financial planning workflow.

See also: 6 Top Planful Competitors & Alternatives

Best for: Growing companies wanting integrated FP&A and consolidation

Pros: Strong integration capabilities, user-friendly interface

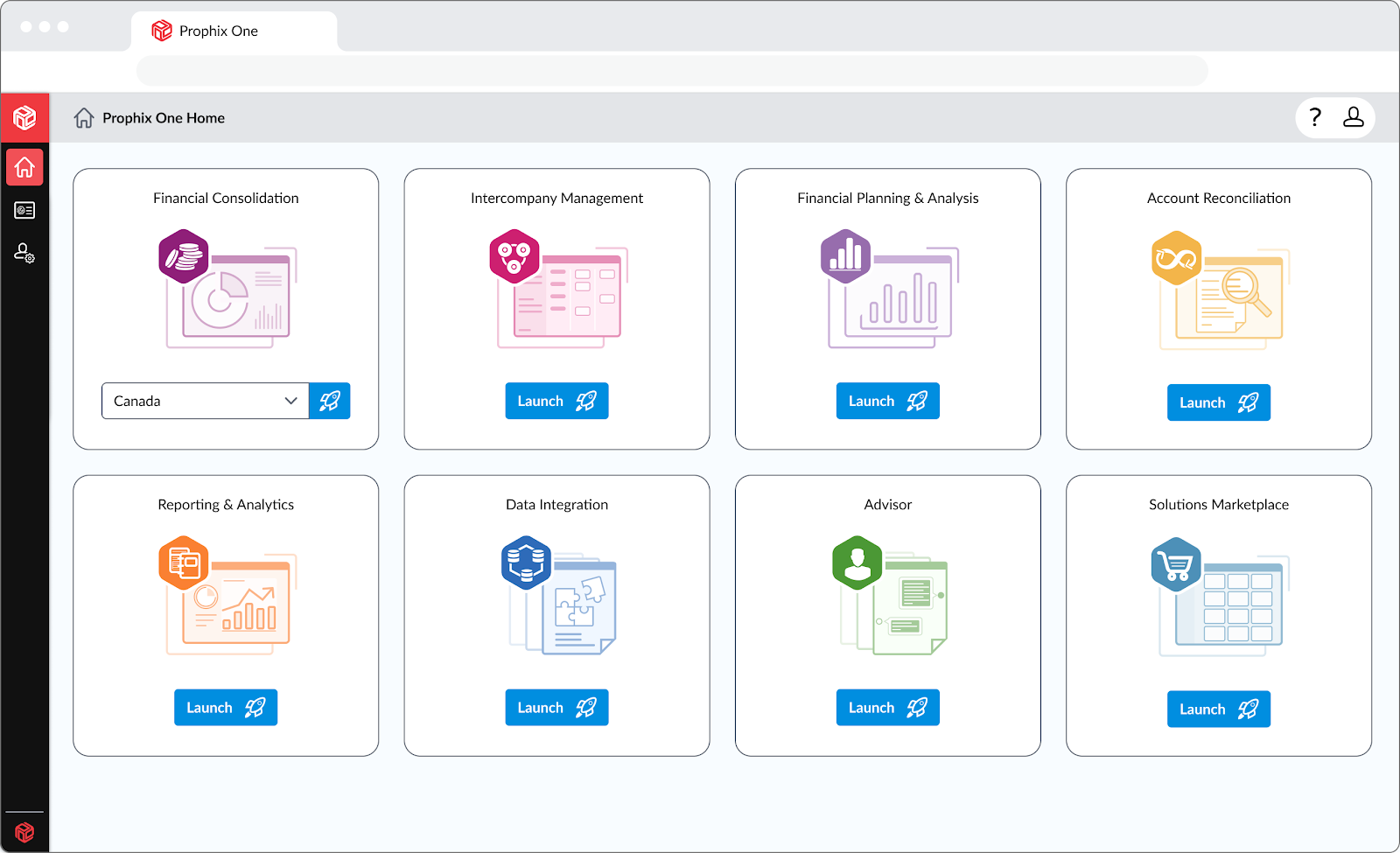

Prophix is an enterprise performance management tool. It focuses on mid-market companies that need enterprise-grade consolidation functionality without enterprise-level complexity. The platform combines AI-powered automation with an Excel-like interface that feels familiar to most finance teams.

Best for: Mid-market companies (100-1000 employees)

Pros: User-friendly, comprehensive training, good support

Vena's approach recognizes a simple truth: most finance teams live and breathe Excel, and forcing them to abandon familiar workflows creates more problems than it solves. Their platform provides cloud-based financial consolidation capabilities while maintaining the Excel interface your team already knows.

See also: 6 Top Vena Competitors & Alternatives for Financial Planning

Best for: Teams heavily reliant on Excel workflows that need a finance add-on

Pros: Familiar spreadsheet interface, strong version control

Sage Intacct combines accounting and consolidation in a cloud-based platform designed for growing businesses. Instead of bolting consolidation onto existing accounting software, Intacct built both capabilities from the ground up.

Best for: Growing businesses needing combined accounting and consolidation

Pros: Strong accounting foundation, scalable cloud solution

Fathom is financial consolidation software built specifically for small businesses and franchises dealing with multiple locations or entities. Their focus on simplicity and visual reporting makes financial consolidation accessible to teams without dedicated FP&A resources.

Best for: Small businesses and franchises with multiple locations

Pros: Affordable, easy to use, great for franchises

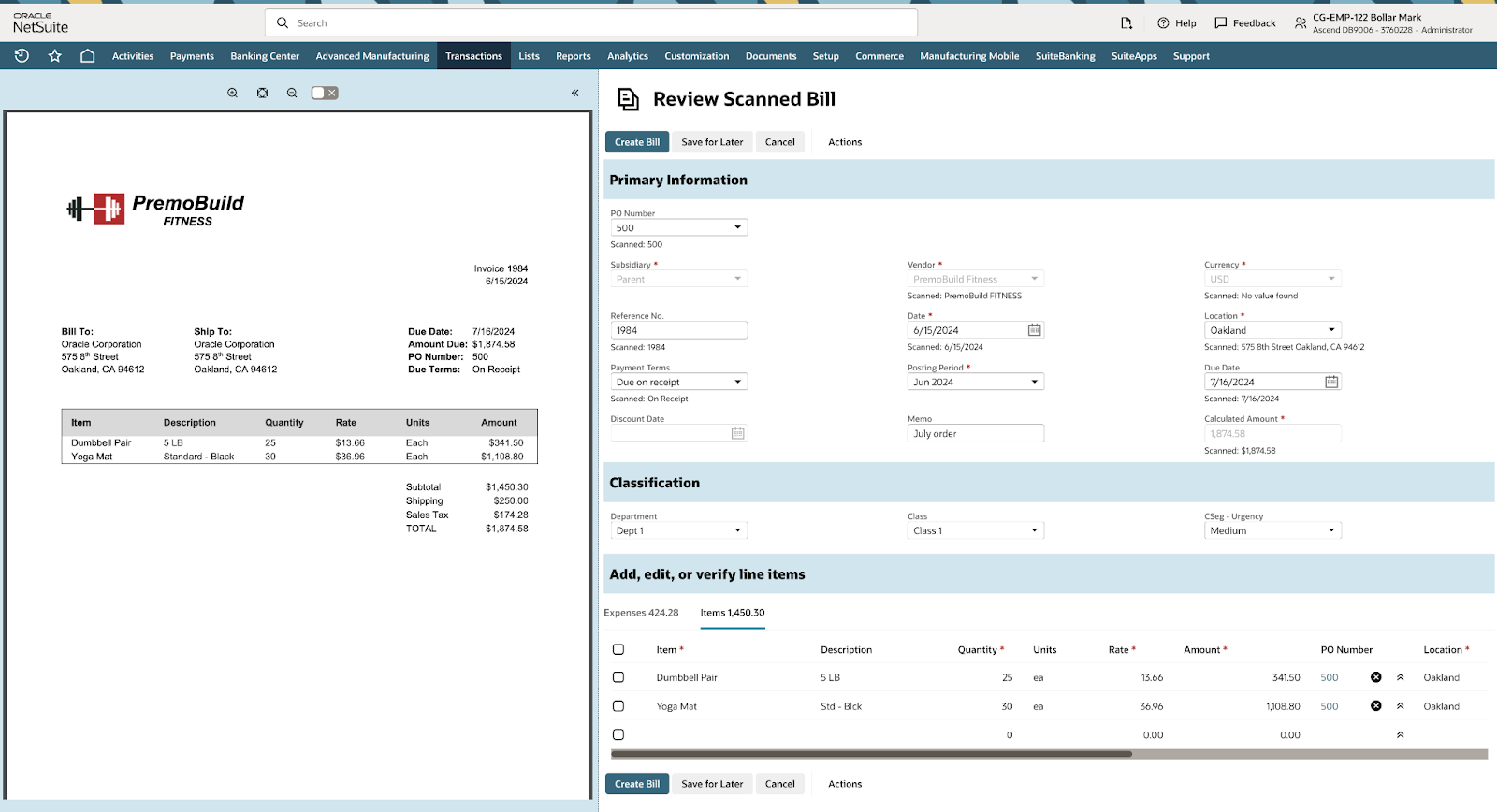

NetSuite's consolidation capabilities are part of its broader ERP platform, making it a natural choice for companies wanting to replace multiple business systems with a single integrated solution. The consolidation module leverages the same data model as accounting, CRM and inventory management.

See also: Top 10 NetSuite Competitors & Alternatives for Clearer Finances

Best for: Companies wanting a full ERP replacement

Pros: All-in-one business solution, scalable platform

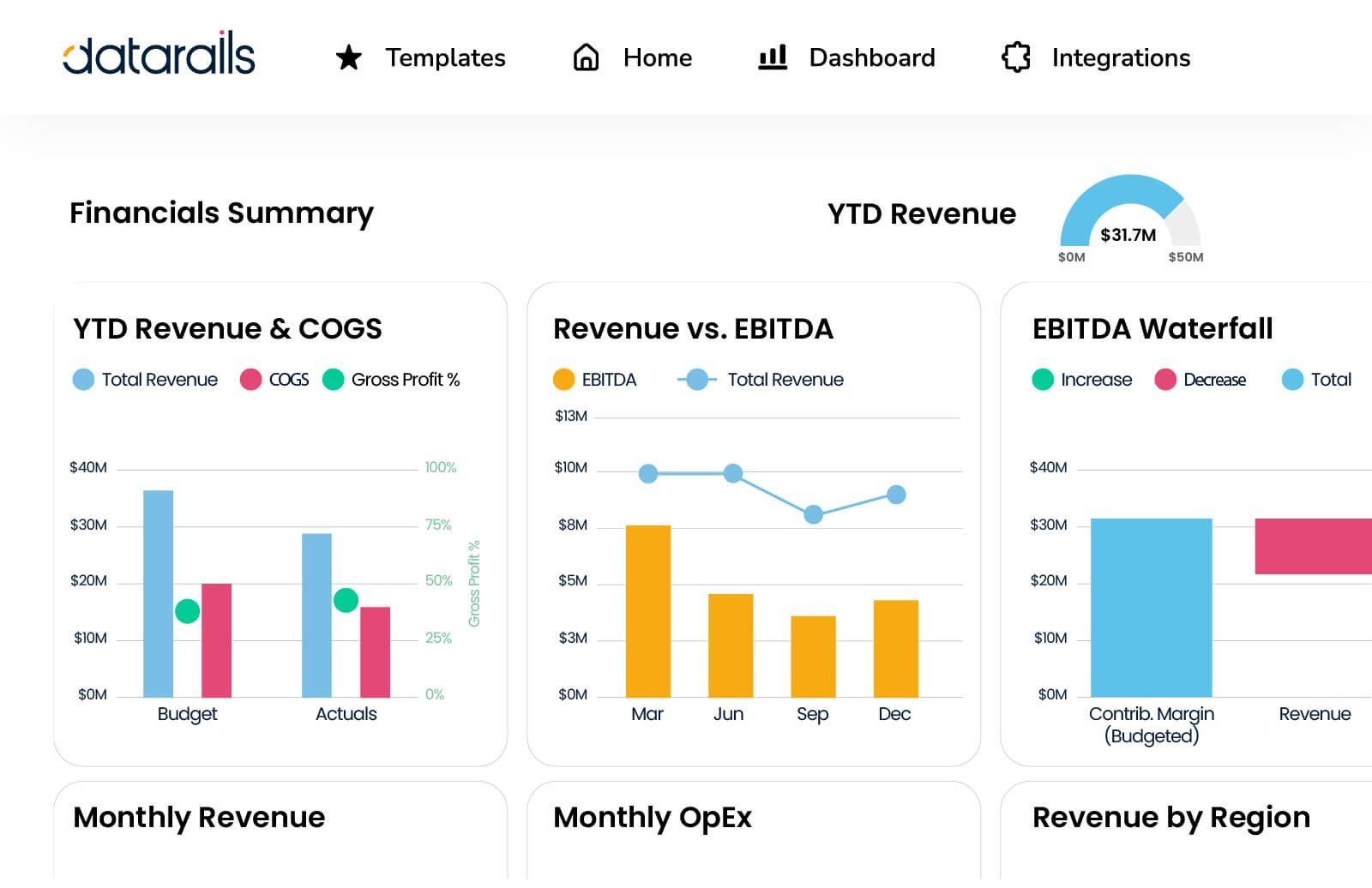

Datarails is another financial consolidation software that bridges the gap between Excel-based financial processes and modern cloud-based automation. Their platform uses AI to enhance familiar spreadsheet workflows while providing centralized data management and automated consolidation.

See also: 10 Best Datarails Competitors & Alternatives

Best for: Mid-sized businesses comfortable with Excel

Pros: Familiar spreadsheet interface, AI-powered insights

Workday Adaptive Planning integrates financial consolidation with comprehensive enterprise financial planning and budgeting. The platform is designed for large organizations that need consolidation as part of broader corporate performance management initiatives.

Best for: Large enterprises with complex planning needs

Pros: Real-time multi-source data integration with advanced scenario modeling and forecasting capabilities

Choosing the right consolidation software depends on your specific business needs, but here are our top recommendations for common scenarios.

For startups and SMBs, Fuelfinance provides the best combination of consolidation functionality, AI forecasting and expert support. Plus, it can work either connected to Excel or as a standalone tool. Either way, you get automated consolidation plus CFO guidance to actually understand what your numbers mean and use them to help you grow like it did for ColdIQ: 236% revenue in eight months.

If you use Excel, Vena or DataRails, you can maintain familiar spreadsheet workflows while adding cloud-based consolidation and collaboration features. On the other hand, larger enterprises should explore OneSteram or BlackLine to monitor financial performance across jurisdictions.

Fuelfinance stands out for its combination of powerful consolidation capabilities, AI-driven insights and included CFO expertise. Most platforms give you the tools but leave you to figure out what the results mean. Fuelfinance provides both the technology and strategic guidance to turn consolidated data into actionable business insights.

Stop spending weeks every quarter wrestling with consolidation spreadsheets. Book a free Fuelfinance demo and see how AI-powered consolidation combined with CFO expertise can transform your financial close from a quarterly nightmare into a strategic advantage.

OneStream and BlackLine excel at complex intercompany eliminations. OneStream's extensible dimensionality handles unlimited intercompany relationships, while BlackLine's automated matching identifies and eliminates transactions with built-in validation rules.

Automated data feeds and real-time consolidation save a lot of time. Tools like Fuelfinance eliminate manual data entry by pulling directly from source systems and creating your cash flow statements and other summaries.

NetSuite, OneStream and Workday Adaptive Planning handle complex multi-currency consolidations with real-time rate updates and automated translation adjustments.

Most companies use specialized financial consolidation software rather than trying to manage complex consolidations in basic accounting platforms. Popular applications include solutions like OneStream and Fuelfinance. The choice depends on entity complexity, transaction volume and reporting requirements.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.