We worked with a $50M+ ARR client operating across five legal entities in five regions — USA, UAE, Eastern Europe, Canada and Australia.

The chaos:

That just wouldn’t do. So, we rebuilt their entire financial infrastructure from the ground up. Here’s how we handled their financial consolidation:

With Fuelfinance, it’s much easier than your typical workflow.

Grab a chamomile tea to get those nerves back in check, and let us show you how to transform your chaos into order.

To keep things simple, it’s just combining financial data from multiple entities, subsidiaries or divisions into one unified set of financial statements. Think of it as creating a “master view” of your entire business empire, where all the moving pieces come together to tell one coherent story.

But here's the thing — financial consolidation isn't just for Fortune 500 companies anymore. As experts note, “Financial consolidation and close isn't just a back-office task. It's a reflection of how well the business operates — and how ready finance is to lead.”

I’m afraid it’s a bit more complex than one plus one. When Company A (parent company) owns Company B and Company C (subsidiaries), you can't just add their revenues together. You need to eliminate intercompany transactions, align currencies, and ensure you're not double-counting anything. Otherwise, your consolidated financials will be about as reliable as a weather forecast.

The short answer? Sooner than you think. Here are the telltale signs it's time to get serious about your consolidation game.

Once you're operating through more than one legal entity, manual spreadsheet consolidation becomes a recipe for disaster. And recent industry research shows that automating financial close can cut it down from eight to three days.

Your Series A investors want clean, consolidated financials, not five different Excel files they need to decode. Professional financial reporting software becomes non-negotiable when you're trying to maintain investor confidence.

Joint ventures, minority investments or strategic partnerships all require specific consolidation treatment. You need to show only your proportional share of these entities' financial performance.

Planning to sell? Buyers want to see clean, auditable consolidated financials. The M&A due diligence process moves much faster when your books are already consolidated properly.

Alright, now here's how financial consolidation actually works, step by step. And here's what it looks like in Fuelfinance, where this entire process becomes automated and infinitely less painful.

What you need:

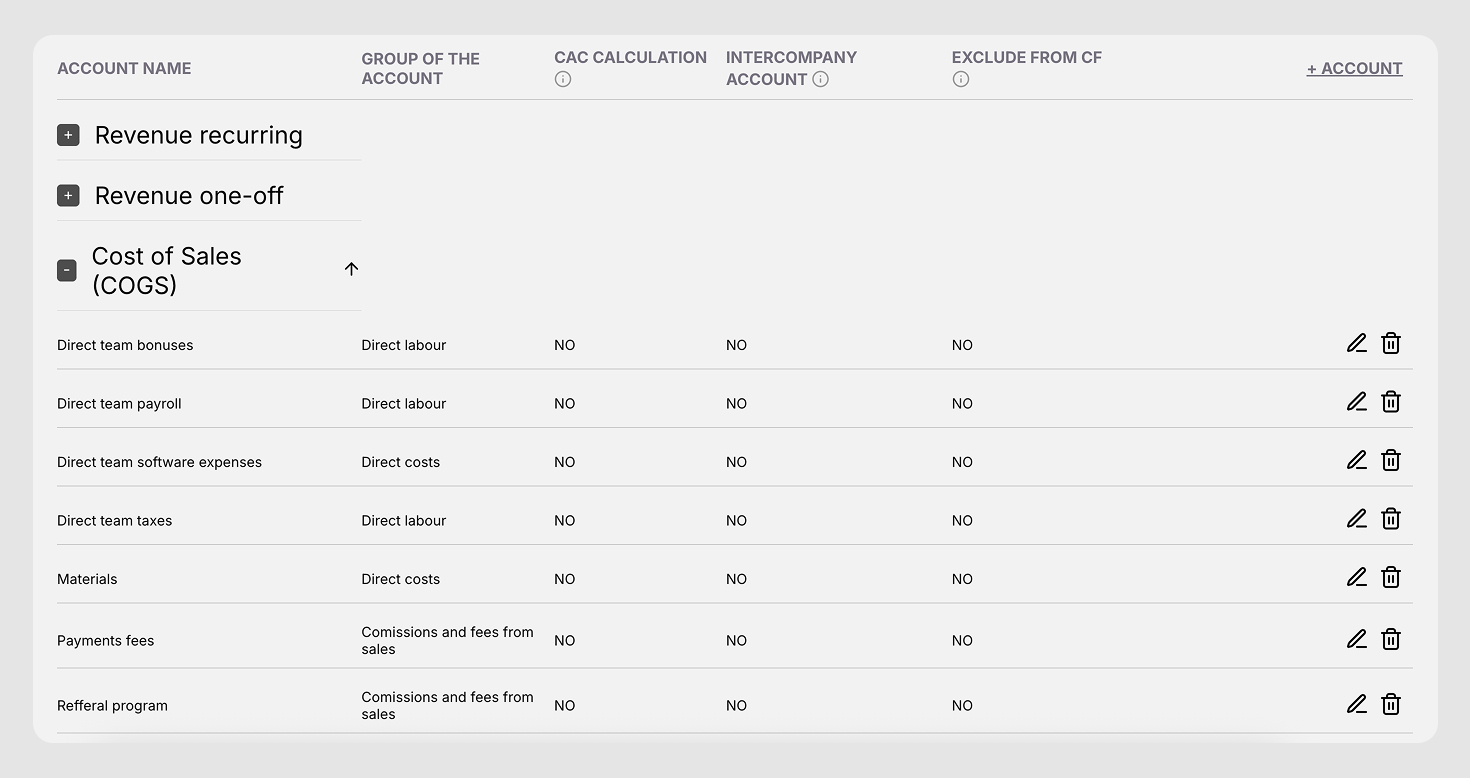

Every entity probably uses a different chart of accounts. Entity A calls it “Marketing Expenses” while Entity B calls it “Advertising Costs.” In Fuelfinance, you create a master chart of accounts and map these variations together once — the system remembers and applies it automatically in every future consolidation. It also connects all your accounting systems and CRMs.

Pro tip: Start with your highest-revenue entities first. Get comfortable with the process before adding smaller, more complex subsidiaries.

If you're operating internationally, you need to convert foreign subsidiaries' financials to your reporting currency using appropriate exchange rates.

Key considerations:

Modern financial management tools handle currency conversion automatically, pulling real-time exchange rates and applying them consistently.

This is where things get interesting (not to say complicated). When Entity A pays Entity B for services, both companies record a transaction. Without elimination, your consolidated revenue gets artificially inflated.

Common intercompany transactions to eliminate:

In Fuelfinance, you simply tag vendors or accounts as “internal” and they're automatically excluded from consolidated reports.

Time for the detail work. This step involves:

According to APQC research, organizations with standardized processes can shave about two days off their monthly close timeline.

The final step creates consolidated financial statements report (as accepted and required by the Financial Accounting Standards Board):

Quality CFO dashboard tools let you drill down from consolidated numbers to individual entity performance with just a few clicks.

Beyond regulatory compliance, financial consolidation delivers strategic value that directly impacts your business success.

Consolidated reporting gives you instant visibility into which entities are performing and which need attention. Automated financial reports ensure you're always working with current, accurate data.

Should you expand Entity A's operations or shut down Entity B's underperforming division? Consolidated analytics will show you the best next steps.

According to EY's CFO research, CFOs who provide clear, timely financial insights strengthen their role as strategic partners to leadership and boards.

Depending on your structure, consolidated reporting might be legally required. But even when it's not mandated, it demonstrates financial sophistication that benefits you in fundraising, acquisitions and partnership discussions.

The problem: Copying and pasting data between systems, manually eliminating intercompany transactions and reconciling in Excel spreadsheets.

The solution: Modern financial planning software tools automate data collection and apply business rules consistently. Fuelfinance connects directly to your accounting systems, pulling data automatically and applying your consolidation rules every month.

The problem: Different entities use different account codes, currencies and reporting standards. Clean-up becomes a monthly archaeological expedition.

The solution: Establish a standardized chart of accounts and data validation rules. Platforms like Fuelfinance enforce consistency by flagging discrepancies and mapping accounts to your master structure automatically.

The problem: Tracking and eliminating hundreds of internal transactions manually is error-prone and time-consuming.

The solution: Tag intercompany relationships once in your system. Best FP&A software platforms handle the elimination logic automatically, maintaining a perfect balance between entities.

The problem: QuickBooks for Entity A, Xero for Entity B, and NetSuite for Entity C. Getting data out of each system becomes its own project.

The solution: Look for consolidation platforms with pre-built connectors to major accounting systems. Fuelfinance offers accounting software integration with 350+ tools, eliminating manual data export entirely.

The method you choose depends on your level of control and ownership in each entity.

When to use it: You own more than 50% of the subsidiary and have operational control.

How it works: Include 100% of the subsidiary's assets, liabilities, revenues and expenses in your consolidated statements. If you don't own 100%, create a “minority interest” line item to account for outside ownership.

Best for: Traditional parent-subsidiary structures where you make the major operational decisions.

When to use it: You own 20-50% of an entity and have significant influence but not control.

How it works: Record your investment at cost, then adjust for your proportional share of the investee's profits and losses. No line-by-line consolidation — just one investment account on your balance sheet.

Best for: Strategic investments, joint ventures and significant minority stakes.

When to use it: Joint ventures where you share control with other parties.

How it works: Include only your percentage share of each line item. If you have a 40% interest, include 40% of revenues, expenses, assets and liabilities.

Best for: True 50/50 partnerships or consortium arrangements.

Finance teams used to spend weeks each month manually exporting data from multiple systems, building complex Excel models with thousands of formulas and praying nothing broke during the consolidation process.

Now (phew!) integrated AI financial analysis tools connect directly to your source systems, apply business rules automatically, and produce consolidated reports in a fraction of that time.

Key features you should consider:

Remember our consolidation nightmare story from the intro?

You won’t believe what an automated, tidied consolidation done with our Fuelfinance team got them:

This is step 0 for global companies. Without it, nothing else works.

Ready to transform your consolidation process, too? Book a demo to see how our financial reporting tool can cut your close time in half while giving you the clarity you need to scale.

We don’t like to gatekeep.

Here's your roadmap to consolidation excellence, whether you're using manual processes or automated platforms.

Next, create consistency:

Questions to ask yourself when evaluating consolidation platforms:

Use the tool you chose to automate what you can:

Modern AI forecasting tools can even predict where consolidation issues are likely to occur, helping you address problems before they derail your close.

Success metrics to keep an eye out for:

Week before month-end:

Month-end week:

Post-close:

Here's the bottom line: financial consolidation doesn't have to be the monthly nightmare. With the right approach and tools, it becomes a smooth process that gives you unprecedented clarity.

The companies that master this make faster decisions, attract better investors and scale more efficiently because their financial foundation is rock-solid. Meanwhile, companies stuck in manual processes watch opportunities slip away while they're buried in spreadsheets.

The choice is yours.

If you’re tired of the same old, hit us up.

A practical example: TechCorp owns 100% of TechCorp UK and 60% of TechCorp Canada. During consolidation, TechCorp includes 100% of the UK's financials and 100% of Canada's financials, but shows the 40% minority interest in Canada as a separate line item. If the UK sold $100K of software to Canada, this internal sale gets eliminated, so the consolidated revenue only reflects external customer sales. Parent company's financial health is clear.

It’s all about creating one view of organizational performance that eliminates internal transactions and presents the economic substance of the business group. The result should be accurate decision-making, satisfied regulatory requirements and reliable information for stakeholders.

The International Accounting Standards Board has some specific guidelines about this that include: data collection from all entities, currency translation to reporting currency, intercompany transaction elimination, consolidation adjustments, reconciliation and final report generation and review.

The biggest time-savers are automated data collection through native system integrations, rules-based intercompany eliminations, real-time currency conversion and workflow management with approval tracking. Platforms like Fuelfinance that combine all these features can massively reduce consolidation time.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.