You know that feeling when you're buried in spreadsheets at 11 PM, manually updating forecasts that should've refreshed themselves?

Here's the thing: we're living through the biggest shift in finance since Excel launched. Anthropic's Claude for finance dropped recently — trained specifically for financial workflows and connected to real data from S&P Global and FactSet. But Claude is just one piece of a much bigger AI revolution happening in finance right now.

Gartner research shows 58% of finance functions were already using AI in 2024 — up 21 percentage points from 2023. Finance teams are finally moving beyond manual data entry and reactive reporting to predictive insights and automated workflows.

The question isn't whether to adopt AI for finance anymore. It's which tools actually work.

In this guide, you'll discover the ten best AI for finance tools that are transforming how companies analyze data and automate workflows in 2025.

Remember when "AI in finance" meant basic rules-based automation? Those days are over.

Today's AI finance tools handle everything from AI forecasting and anomaly detection to natural language queries that turn complex financial documents into actionable insights. Machine learning algorithms analyze market data, identify trends in unstructured data and help finance teams move from reactive reporting to strategic decision making.

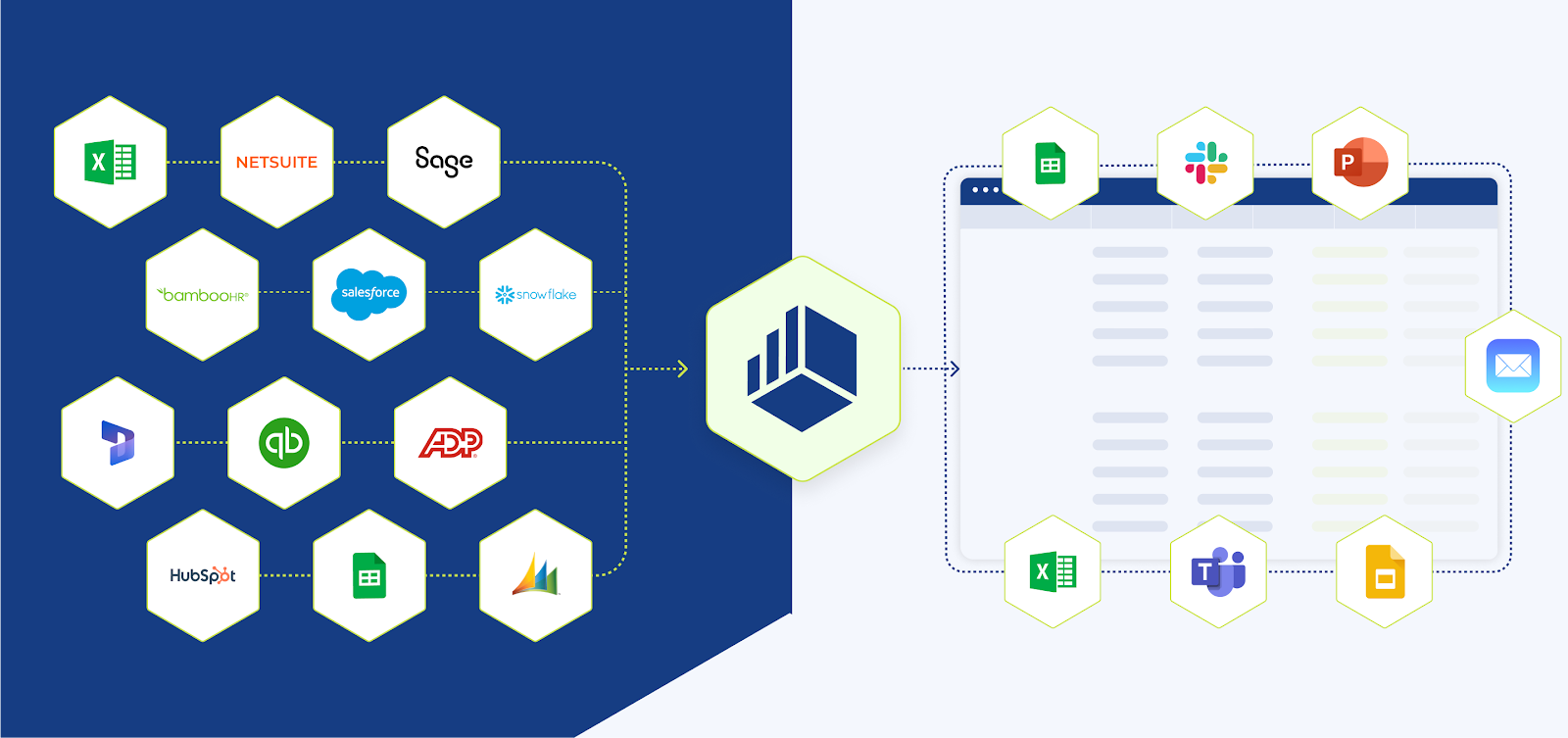

The real breakthrough isn't just better algorithms — it's seamless integration with existing financial systems. Modern AI tools for finance connect with your accounting software, CRM, payroll systems and even bank statements to create a unified view of financial performance.

Let's talk numbers. Finance teams using AI-powered tools are saving time and fundamentally changing how financial analysis gets done.

See also: Best Financial Modeling Software: Top 6 Tools Overview [2025]

We didn't just compile marketing materials and call it research. Our evaluation involved real-world testing with finance teams at companies ranging from early-stage startups to established SMBs.

Here is our testing methodology while we analyzed the best AI for finance tools:

We also developed specific evaluation criteria to help you make informed decisions:

See also: 5 Best QuickBooks Integrations for Better Financial Management

Here's how the top AI finance tools stack up based on our testing:

Most AI tools for finance show you what happened. Fuelfinance is a full-service FP&A platform that helps you figure out what to do next.

Fuelfinance's AI Copilot plugs into your existing systems (QuickBooks, Stripe, HubSpot and more), reads your data, spots risks and gives you clear answers in seconds — not days. It works like your smartest FP&A hire, except it operates 24/7.

What makes Fuelfinance different? Three breakthrough AI features that automate your entire financial workflow:

The AI also generates automated Financial Summaries that translate raw numbers into easy-to-understand narratives. Instead of sifting through spreadsheets, you instantly know your company's health, growth trends and potential risks. Everything is SOC 2-certified with enterprise-grade security to keep your financial data private and safe.

See also: 10 Best Financial Dashboard Software Tools: A Detailed Comparison

Ready to transform your finance workflow? Book a demo today and see how AI-powered insights can accelerate your growth.

ColdIQ, a GTM agency, used Fuelfinance to organize scattered financial data and build custom dashboards. Result: a 236% revenue increase in eight months with complete financial visibility.

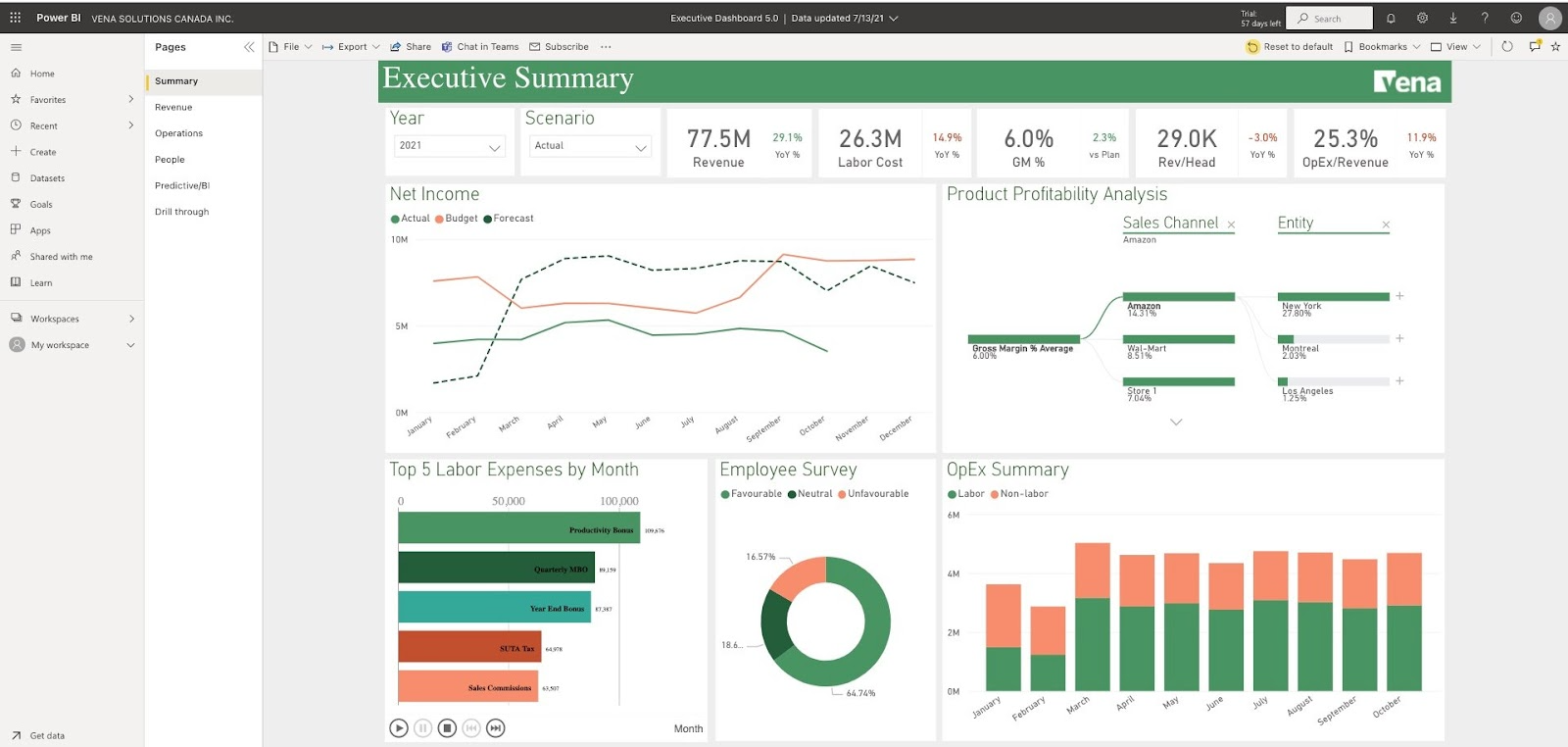

Vena brings natural language processing to financial planning and analysis. Instead of building complex formulas, you can ask questions in plain English and get insights from your financial data.

The platform connects Excel-based workflows with modern AI capabilities. Finance teams can keep on using familiar spreadsheet interfaces while gaining predictive modeling and automated data consolidation.

See also: 6 Top Vena Competitors & Alternatives for Financial Planning

Most comments praise Vena for working with Excel instead of replacing it.

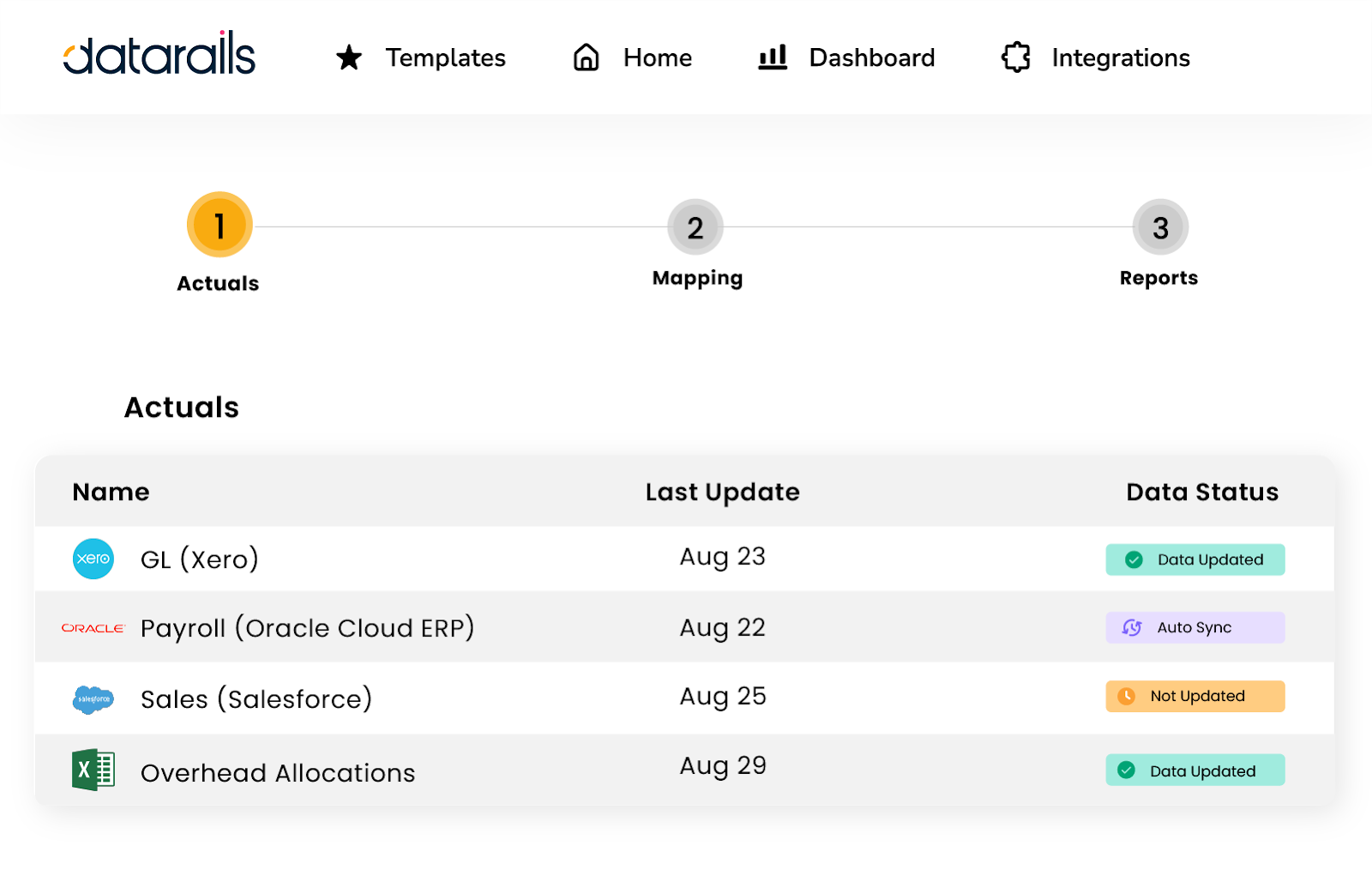

For teams that live in Excel but want to extend it with AI features, Datarails Genius is the bridge between spreadsheets and modern financial analysis.

The platform automatically consolidates data from multiple sources into Excel-based models, then applies AI to identify patterns, flag anomalies and generate insights. It's suitable for companies with complex Excel-based financial planning processes.

See also: 6 Best Datarails Competitors & Alternatives for 2025

Customers appreciate that Datarails Genius helps them save time by automating manual tasks.

Zeni is the next platform on our list of the best AI for finance tools. It combines AI-powered bookkeeping with real-time financial insights, making it suitable for tech startups and high-growth companies.

The platform automatically categorizes expenses, reconciles transactions and maintains clean books while providing CFO technology dashboards for strategic decision-making.

See also: How To Forecast Revenue Step-By-Step

Customers praise its AI features and monthly insights into financial performance.

Cube Software focuses on connected financial planning, using AI to streamline budgeting and forecasting across departments.

The platform connects operational data with financial models, enabling more accurate predictions and faster plan adjustments.

Customers like that they can create templates to accelerate routine financial reporting.

Planful Predict brings machine learning to enterprise-level financial planning, with advanced forecasting capabilities and error detection.

The platform is designed for larger companies with complex financial structures, offering sophisticated modeling and predictive analytics.

See also: 6 Top Planful Competitors & Alternatives

Users praise its forecasting and budgeting features, as well as its ease of use.

Workiva Gen AI focuses on AI-powered document processing and regulatory reporting, making it valuable for public companies and heavily regulated industries.

The platform automatically extracts data from complex financial documents and generates compliance-ready reports.

Most reviews highlight the platform's ease of collaboration and real-time document linking.

Vic.ai specializes in accounts payable automation, using AI to process invoices, detect anomalies and streamline approval workflows.

The platform significantly reduces manual invoice processing time while improving accuracy and fraud detection.

Most reviews praise Vic.ai for saving time on invoice processing and having high accuracy.

Ramp combines expense management with AI-powered spend insights, helping companies optimize their financial operations through intelligent automation.

The platform provides corporate cards, expense tracking and bill payments with AI-driven insights for better financial control.

Many reviews highlight the tool's automation features and real-time visibility, which save finance teams time on expense management.

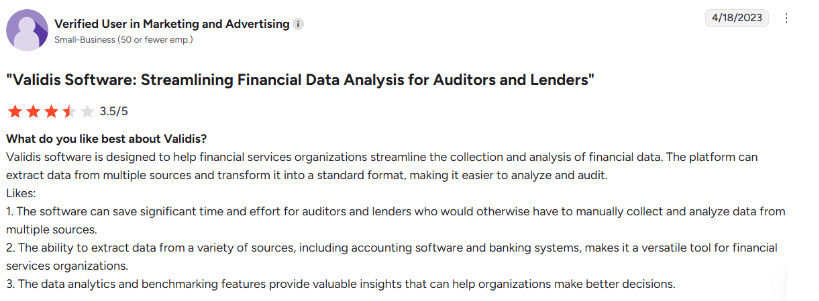

Validis connects to accounting systems to automatically pull and standardize financial data, helping lenders, auditors and investors save time on reviews and make faster, more informed decisions.

Users say Validis makes financial data collection easier by directly connecting to accounting systems.

Choosing the best AI for finance tool depends on your business size, existing systems and specific needs.

Vena Copilot and Datarails Genius are strong fits for mid-market finance teams, while Planful Predict and Workiva Gen AI are built for enterprise complexity. But for SMBs and agencies, Fuelfinance is the top recommendation.

The combination of AI-powered insights, seamless integrations and included CFO expertise provides unmatched value for companies that want to move beyond basic financial reporting services.

And while picking the right tool matters, what truly determines success is how you implement it — because AI in finance only delivers impact when it’s supported by clean, structured data, a team that embraces new workflows and leadership that helps them with it.

Ready to transform your finance operations with AI? Start with a Fuelfinance demo and see how AI-powered financial insights can boost your growth.

Yes, there are several AI models specifically designed for finance, including Anthropic's Claude for finance, which is trained for financial workflows and connected to major financial data providers. However, general-purpose models like ChatGPT aren't recommended for sensitive financial analysis due to accuracy and security concerns.

AI uses automated data validation, anomaly detection and consistent application of rules for this. Unlike manual processes prone to human error, AI systems can identify discrepancies across thousands of transactions, flag unusual patterns and ensure data consistency across multiple systems and reports.

For comprehensive financial planning and analysis, Fuelfinance combines AI-powered insights with human CFO expertise. But we always say that the "best" depends on your specific needs and business size.

AI excels at processing huge amounts of historical data and identifying patterns humans might miss. However, the best results come from combining AI's pattern recognition capabilities with human expertise in market context, business strategy, and qualitative factors. AI should augment human analysis, not replace it entirely.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.