Has Excel been your go-to financial tool for a while, but it no longer satisfies your growing financial needs? In that case, you're probably looking for a tool that can help you automate your financial processes, provide you with strategic insights and even forecast potential scenarios in the future.

Enter Vena and Datarails – financial management solutions that are essentially Excel add-ons, keeping its familiar interface but providing more advanced features such as collaboration, automation and smart reports.

In this article, we'll explore Vena vs Datarails, breaking down their features, integrations and user reviews to help you make the right choice. You'll also discover another tool that might be a better option, especially for startup founders and small business financial management.

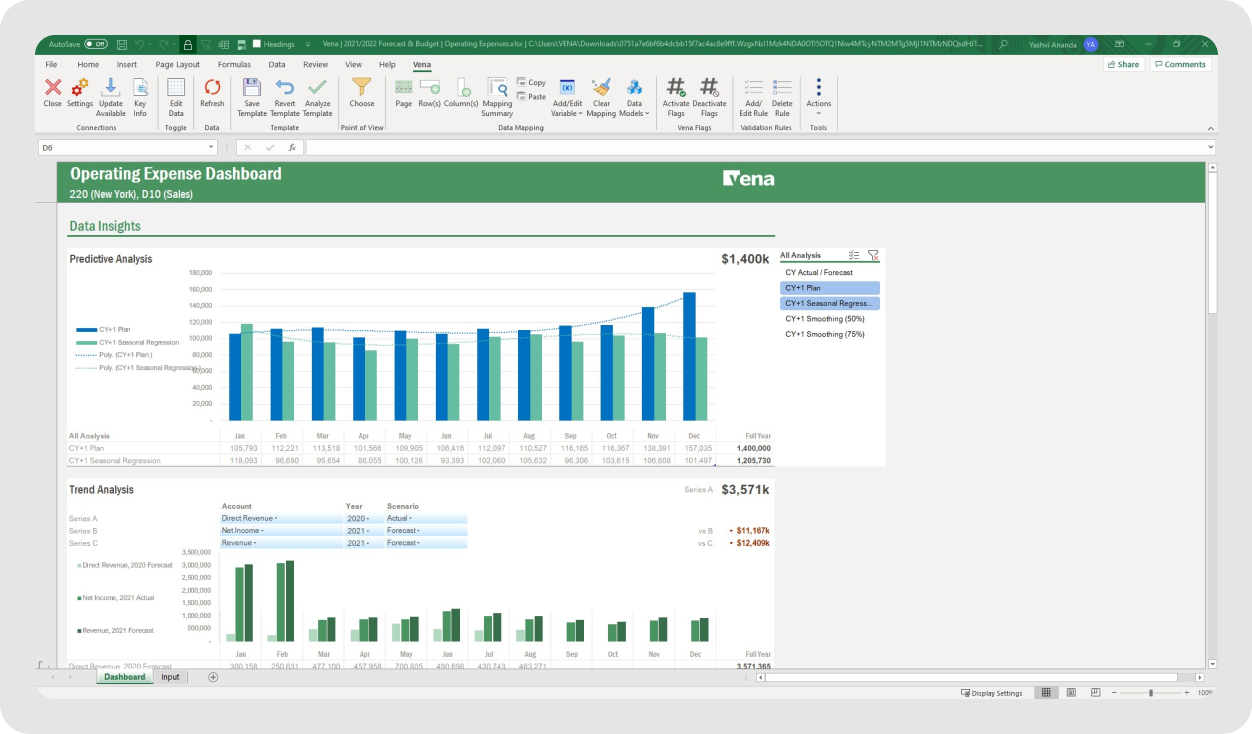

Vena is a native Excel and Microsoft 365 integration for financial and operational planning and consolidating data.

It’s designed for medium to large companies and allows teams to manage their financial data and processes more effectively without exiting Excel’s familiar interface. Some of its more advanced features include financial forecasting and budgeting.

However, the tool is mostly used by financial professionals, and other users might find its interface too complex to navigate. If that's the case for you, feel free to explore these Vena competitors that offer a more intuitive design.

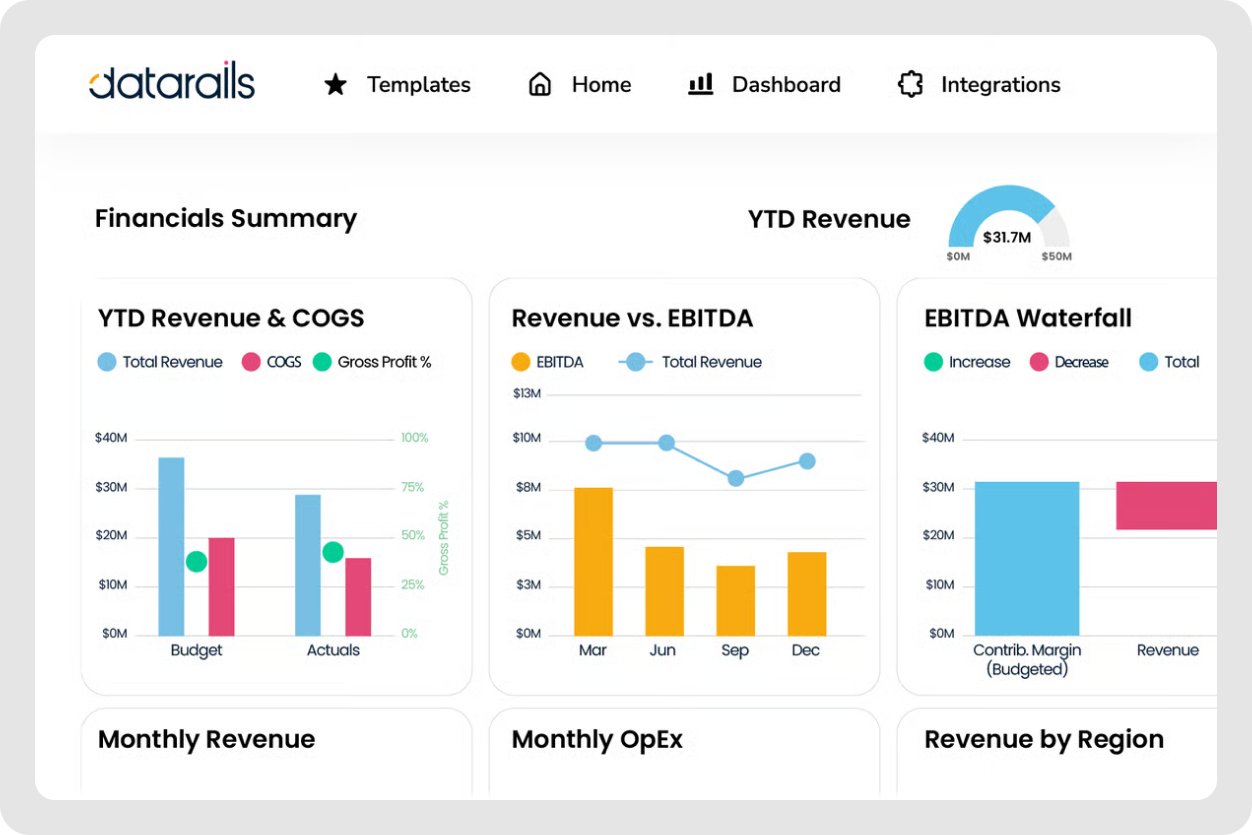

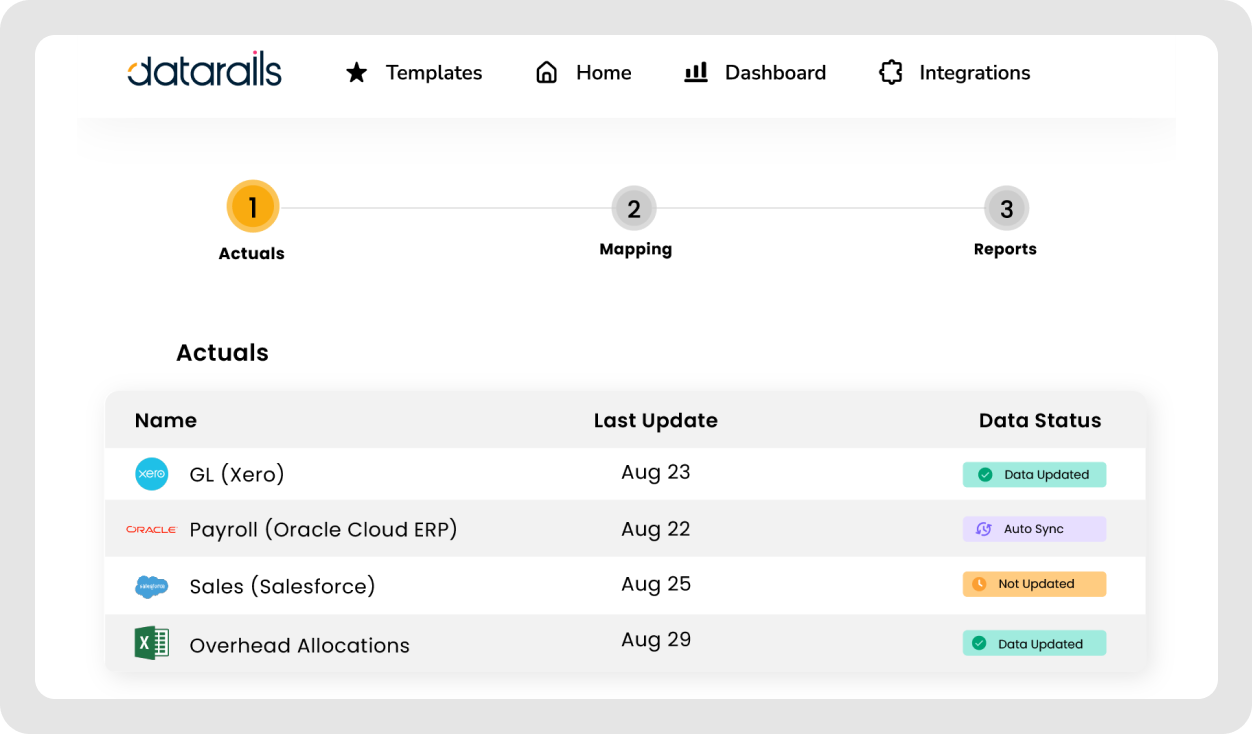

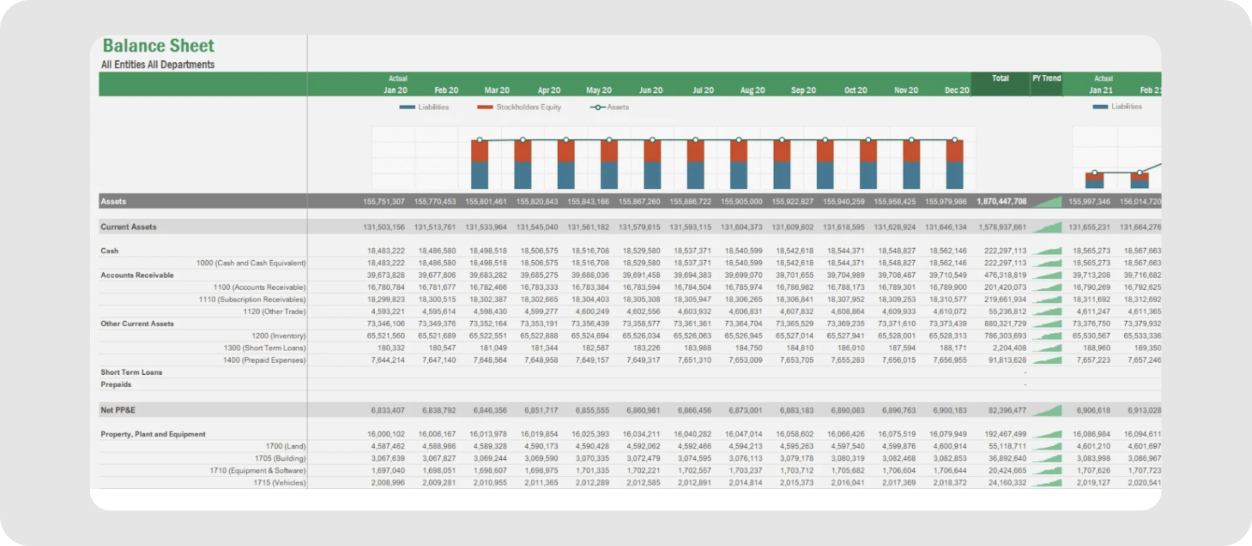

Datarails is a financial modeling software that also works as an add-on to Microsoft Excel. It is especially known for its dashboards, which let you visualize large amounts of operational data in one place.

This software is mainly used by large businesses for tasks like budgeting, forecasting, financial analysis and reporting due to its strong data-handling features.

If you want to explore this tool and its alternatives in more depth, check out our Datarails competitors guide.

See also: Datarails vs Cube

Now, we’ll compare these two platforms' key features, integrations, pricing and customer support to help you choose the best financial analysis software for your needs.

Here are the key features we considered when comparing these financial planning software tools.

Vena helps you understand how different scenarios could impact your business by using advanced modeling and What-If Analysis to test assumptions and visualize outcomes. It automates data collection and integration, freeing up your time for planning and analysis.

This scenario planning software enables collaboration across departments like Sales, Marketing, Finance and HR with AI insights and real-time data updates. You can explore multiple scenarios, from best-case to worst-case and take action based on solid data.

Datarails helps you plan and prepare for different outcomes, too. Thanks to its Excel integration, you can work with your existing financial models, create new ones or update assumptions if needed.

Out of the two, Vena offers more advanced AI insights and broader team collaboration options, while Datarails focuses on making it easy to adjust and manage financial models within the Excel environment.

Vena centralizes your data for accurate budgeting and forecasting. It provides Excel templates, workflow tools and supports various budgeting methods like top-down, bottom-up and zero-based. It's also suitable for long-term budgeting across different departments.

This business budgeting software integrates with ERPs, CRMs and HR systems to keep your templates up-to-date with the latest data. It enhances Excel with features like data integration, advanced modeling and security controls, helping you plan more efficiently.

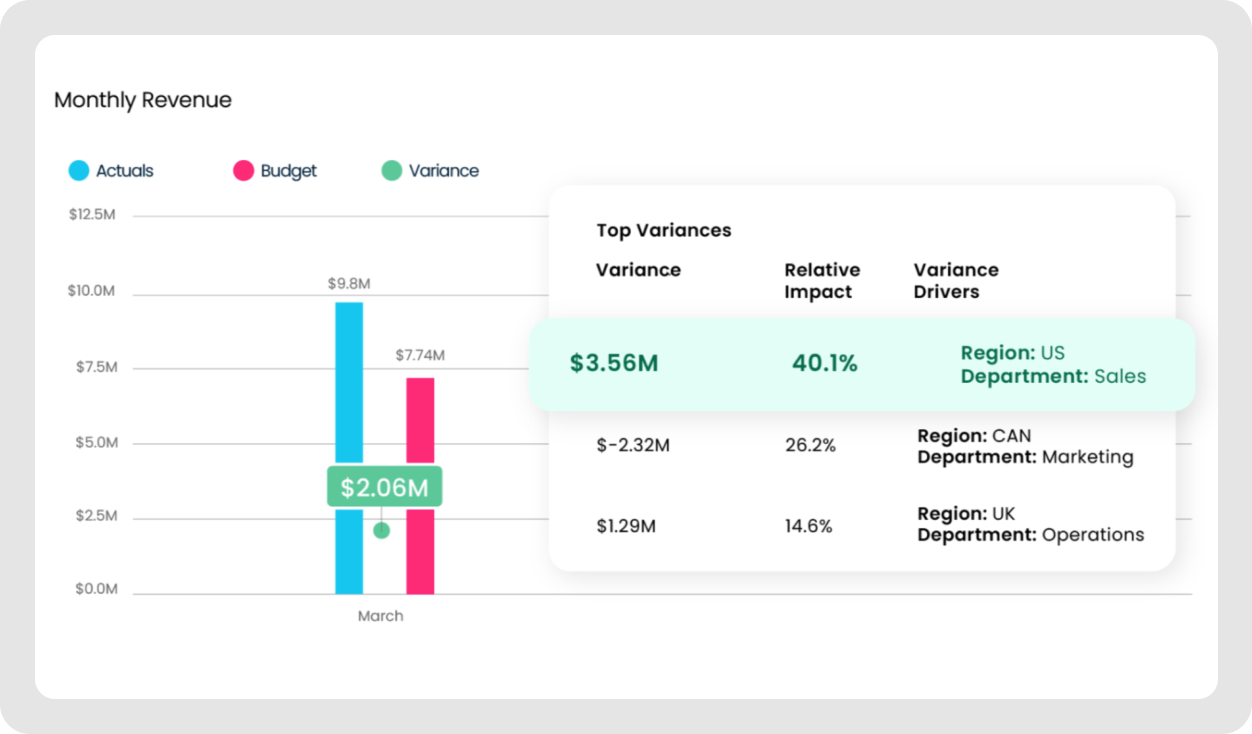

Datarails allows teams to collaborate on budgeting and forecasting. It keeps all communication, feedback and file versions in one place so everyone stays aligned. You can forecast metrics like revenue, costs and headcount and choose how often to update them – weekly, monthly, quarterly or yearly.

Compared to Vena, Datarails focuses more on collaboration and centralizing information, while Vena offers more advanced budgeting features, drill-down capabilities and integrations with other systems.

Vena automates financial reporting with its pre-built templates for comparing departmental financials, reviewing income statements and performing variance analysis.

It also improves collaboration with workflows, allowing you to track processes and share reports. Vena ensures data integrity with secure templates and permissions.

Datarails could be a good option for large companies because it brings data from different sources into one report and automates monthly reporting, saving time on manual data collection. This financial dashboard software can also create AI-generated presentations that turn your reports into visual insights, highlighting trends and key information.

Compared to Vena, Datarails focuses more on automating data consolidation and transforming reports into visuals, while Vena provides more advanced financial modeling and integrates with multiple systems for deeper financial analysis and reporting.

Vena easily integrates with multiple systems, making it quick and secure to combine multiple sources and get real-time insights. It connects smoothly with Microsoft 365 apps like Excel, Power BI and PowerPoint, as well as ERP, CRM, analysis tools and HR systems.

You can also import spreadsheets and connect to various file storage systems with Vena’s pre-built connectors and customizable API.

Datarails also connects with various software options, including accounting tools, ERP systems, CRM platforms, HR systems and payment solutions. It offers over 200 integrations, such as BambooHR, Oracle NetSuite, HubSpot, Xero and Shopify.

Financial management solutions usually don't list pricing on their websites because each plan is tailored to your specific needs. Pricing is based on factors like the size of your team as well as the features and the integrations you need. This approach is quite common in the industry and ensures you only pay for what fits your business. Both Vena and Datarails follow this trend.

However, keep in mind that these tools primarily target large enterprises, so the pricing may be quite steep for most startups and small businesses. Also, it may turn out that you don't even need the majority of their features as they're created for accountants and finance experts.

On the positive side, there are many Vena and Datarails competitors designed specifically for small businesses and financial forecasting for startups, such as Fuelfinance – more details on that below.

Vena Solutions has two customer support plans:

Datarails also has two customer support options, but they’re much less complex: you can submit a support request on their website or email them. They typically respond within 24 hours, but phone support and the option to schedule a meeting aren’t available.

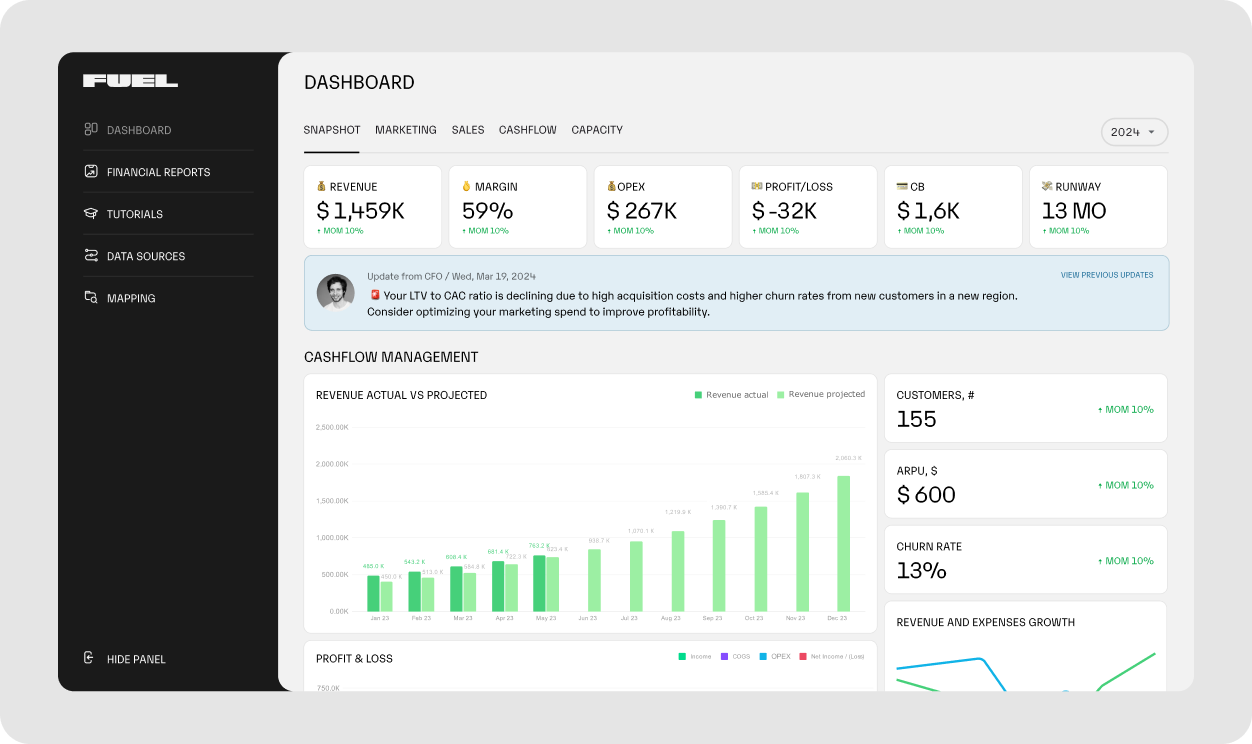

If you're still unsure which of the two Excell add-ons is most suitable for your startup, let us present you Fuelfinance – one of the best financial forecasting software for startups and small businesses.

This is a user-friendly system designed specifically for startups and small businesses to manage their finances. It stands out for its easy-to-use interface, data accuracy and automation capabilities.

Plus, it offers unlimited support from the Fuelfinance expert team, who can act as your part-time, outsourced CFO, saving you both time and money.

Here are some of our advanced features that'll help your finance teams:

Plus, you can still do all this in familiar Google Sheets – with the simplicity of spreadsheets and the reliability of cloud. But that’s not the only way we work. You can also connect your existing Sheets to our dashboard or leave spreadsheets entirely if you prefer. Book a demo call with us to see how it works.

Additionally, Fuelfinance has earned 27 nominations on G2, including “High Performer” in Budgeting, Forecasting, Financial Analysis and Cash Flow Management, as well as being a “Momentum Leader” in Cash Flow Management. Our platform has also been top-ranked in Capterra’s Dashboard category, thanks to our new, improved dashboard.

Customers are seeing great results with Fuelfinance: over $50M in Series A funding raised using its reports and financial models, a 2x increase in monthly recurring revenue from unit economics insights and a 61% boost in cash inflows through better payment tracking.

What makes Fuelfinance special is its ability to provide enterprise-level financial management for startups and SMBs, with automated reporting, personalized CFO support and powerful financial insights all in one platform. Our pricing is customized based on your company's size and specific needs because we don’t believe in a one-size-fits-all approach.

Choosing the right financial solution can be challenging, especially if you're just starting out. However, with the right tools, managing your finances can be simple, intuitive and effective. That’s exactly what Fuelfinance offers.

Our platform is designed with small businesses in mind, making it easy to track your finances, plan for the future and make informed decisions – even if you don’t have a background in finance.

Fuelfinance simplifies complex tasks like scenario planning and financial modeling, ensuring you’re always equipped to make smart, cost-effective choices and become more profitable.

No matter where you are in your business journey, Fuelfinance grows with you.

Ready to take control of your financial future? Book a demo call today and see how we can help you succeed.

Yes, Vena is a reputable company that started as a small FP&A startup in 2011, but it acquired a lot of clients and recently gained Centaur status, given to startups that surpass $100 million in ARR.

The price depends on many factors, such as the features and integrations you need and the number of users. All plans are custom-made, but it's on the pricier side, according to some online reviews.

Datarails is used for many financial operations, for example, planning, budgeting, forecasting and scenario modeling. It's used by companies that use Excel for financial management but want to do more complex things and get more in-depth insights.

Vena is a tool that can help you with financial planning and analysis, financial close management and workforce planning. It works as an Excel add-on and gives you strategic insights about your finances.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.