42% of small business owners admit they had limited or no financial literacy when they started their businesses. Yet somehow, we expect our businesses to thrive without regularly checking their financial pulse.

Think of your last physical health check. We’re no telepaths, but you probably got your blood pressure checked, had some bloodwork done, and maybe answered a few uncomfortable questions about your diet. Your business's financial journey deserves the same level of attention, just with a financial health check instead of a stethoscope.

Read on to find out when to perform these assessments, which metrics actually matter (spoiler: it's not just revenue), and how to spot the warning signs before they become full-blown crises. Plus, we'll show you how modern financial software can turn this from a dreaded quarterly chore into a pleasant strategic advantage.

A business financial health check is a systematic review of your financial performance, cash flow patterns and overall fiscal fitness that goes way beyond glancing at your bank balance and hoping for the best.

Katina Peters from Willow CFO puts it perfectly: “Just as you wouldn't wait years to visit your doctor for a physical, your business deserves regular checkups too.”

Unlike a simple profit and loss review, a proper financial health check examines multiple dimensions of your business. You're looking at profitability trends, cash flow patterns, debt management, operational efficiency and growth sustainability. It's the difference between knowing you made money last month and understanding whether your business model will survive the next economic hiccup.

Regular financial health assessments are game-changers for SMBs because they catch problems while they're still fixable. Consider this sobering reality: 82% of business failures stem from poor cash management, which can be avoided with ongoing monitoring (trends, seasonal patterns and gradual shifts that could signal bigger issues).

Most successful SMBs conduct lightweight quarterly reviews and comprehensive annual assessments.

Your quarterly check should focus on cash flow trends, budget variances and key performance indicators.

Annual comprehensive assessments dig deeper into your financial planning and strategic positioning. This is when you evaluate your entire business model, assess market position and plan for the year ahead.

Psst! Check out this budgeting cheat sheet before you start making your annual plans.

Just like in personal finance, significant life events require you to dig into the details of credit card debt, insurance coverage, retirement accounts status, bank statements, checking if you have a good credit score etc., some business situations demand immediate financial health assessments, regardless of your regular schedule:

Some red flags scream for immediate financial attention:

Don’t know where to start? You’re in luck.

We made an agency-specific assessment tool that evaluates your business across the metrics that matter most in your industry. There are only 10 one-click questions you’ll fly through, and all of them are crucial to understanding if your agency is on the right track.

You’ll fill it out in minutes and immediately get personalized, actionable recommendations on how to improve your agency’s financial health.

Check it out here.

Our agency metrics health assessment calculator considers these critical benchmarks:

These benchmarks can come in handy as a baseline financial health check, but if you ask us, we’d recommend using our calculator for a detailed view. It gives you a percentage score health result with specific, actionable steps on how to move forward, tailored specifically for your situation. Low utilization rates? There's untapped potential in your resource management and project pipeline. Weak gross margins? Time to examine specific cost centers that are quietly eroding your profitability.

SaaS businesses require specialized assessments of their financial situation because subscription models create unique cash flow patterns and growth dynamics.

The key SaaS metrics every company needs to track include both financial and operational indicators:

We have this comprehensive cheat sheet for SaaS founders that breaks down healthy benchmarks for each metric by company stage.

Every business, regardless of industry, needs a systematic approach to checking its overall financial health. Here's a four-step framework that works for any SMB.

You'll need your latest financial statements from the past 12-24 months, including profit and loss statements, balance sheets and cash flow statements.

Collect your cash flow projections and forecasting models, even if they're basic spreadsheets. Include budget versus actual comparisons for at least the last four quarters.

Get operational metrics specific to your business model. For e-commerce, this might include inventory turnover and seasonal pattern data. For service businesses, focus on utilization rates and project profitability analysis. Manufacturing businesses need production efficiency and cost per unit data.

Now comes the analysis phase. Compare your performance against industry standards using benchmarking data. This external perspective helps identify whether your challenges are internal issues or market-wide pressures.

Analyze how long it takes to convert inventory investments into collected cash. This metric varies by industry and directly impacts your working capital requirements and growth capacity.

Evaluate seasonal patterns in your business. Many SMBs experience predictable fluctuations, but first-time founders often underestimate their impact on cash flow planning. Understanding these patterns helps you avoid unnecessary panic during slow periods and prevents overconfidence during peak seasons.

Project future cash needs based on your growth plans. This forward-thinking approach to your financial future helps identify potential funding gaps before they become critical. Consider both organic growth scenarios and potential investment opportunities.

Growth without sustainable unit economics is just expensive customer acquisition.

Analyze the scalability of your current business model. Can you double revenue without doubling your fixed costs? Do your gross margins improve or worsen as you grow?

Consider the investment requirements for continued growth. Will you need additional equipment, staff or working capital? Factor these requirements into your financial forecasting models to avoid growth-induced cash crunches.

Now, time to prioritize identified issues based on their potential impact and time sensitivity. Cash flow problems trump everything else; operational efficiency improvements can be scheduled over longer timeframes.

Set specific, measurable improvement targets with deadlines (I’m sure you’ve heard of SMART goals). Instead of “improve cash flow,” commit to “reduce average collection period from 45 to 35 days by Q3” or “increase gross margin from 32% to 36% through vendor negotiations and pricing adjustments.”

Establish a regular monitoring schedule using automated financial reporting tools. Even the most in-depth financial health check is useless if you don't follow through with consistent monitoring and course corrections.

Spotting financial trouble early can mean the difference between minor adjustments and major restructuring.

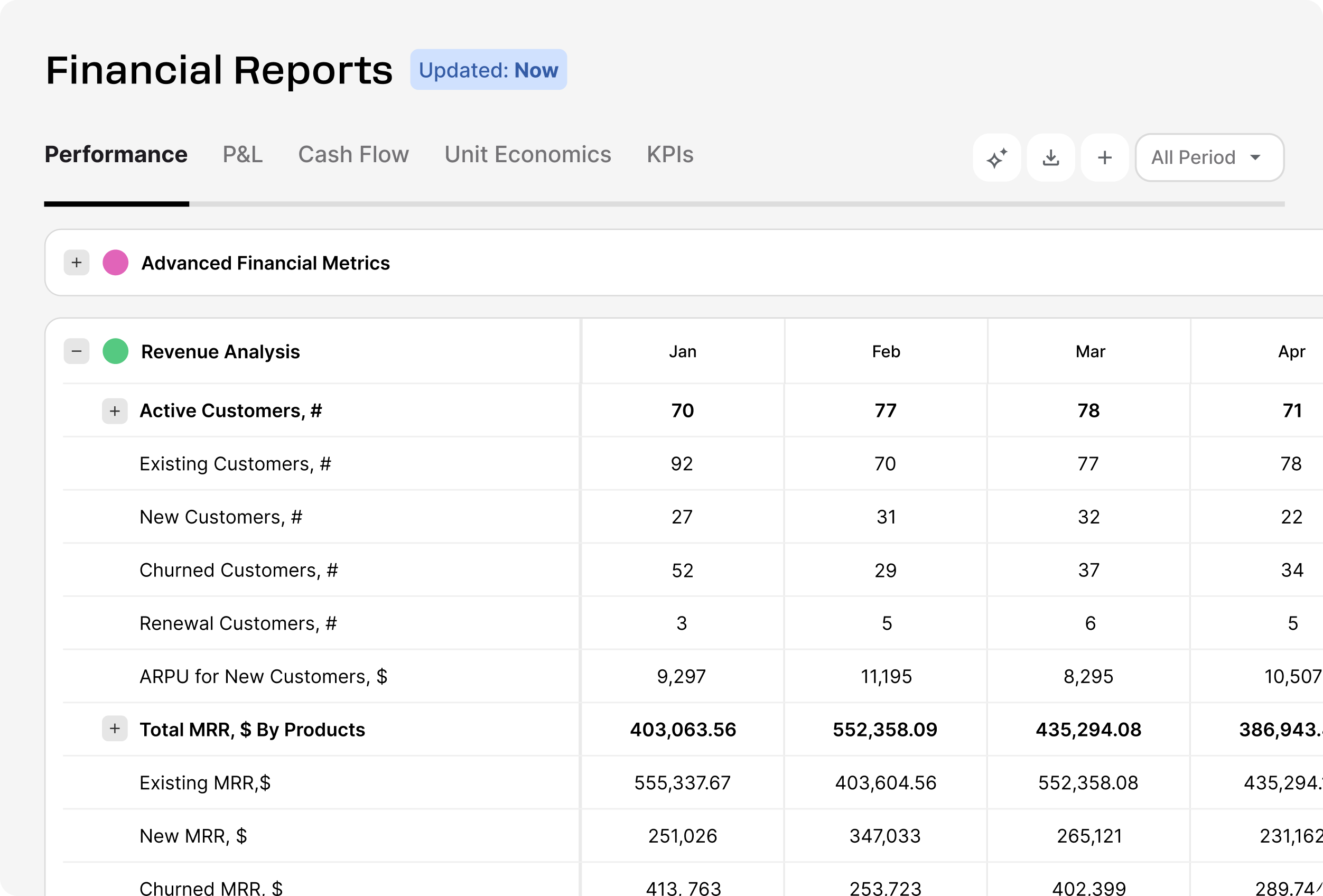

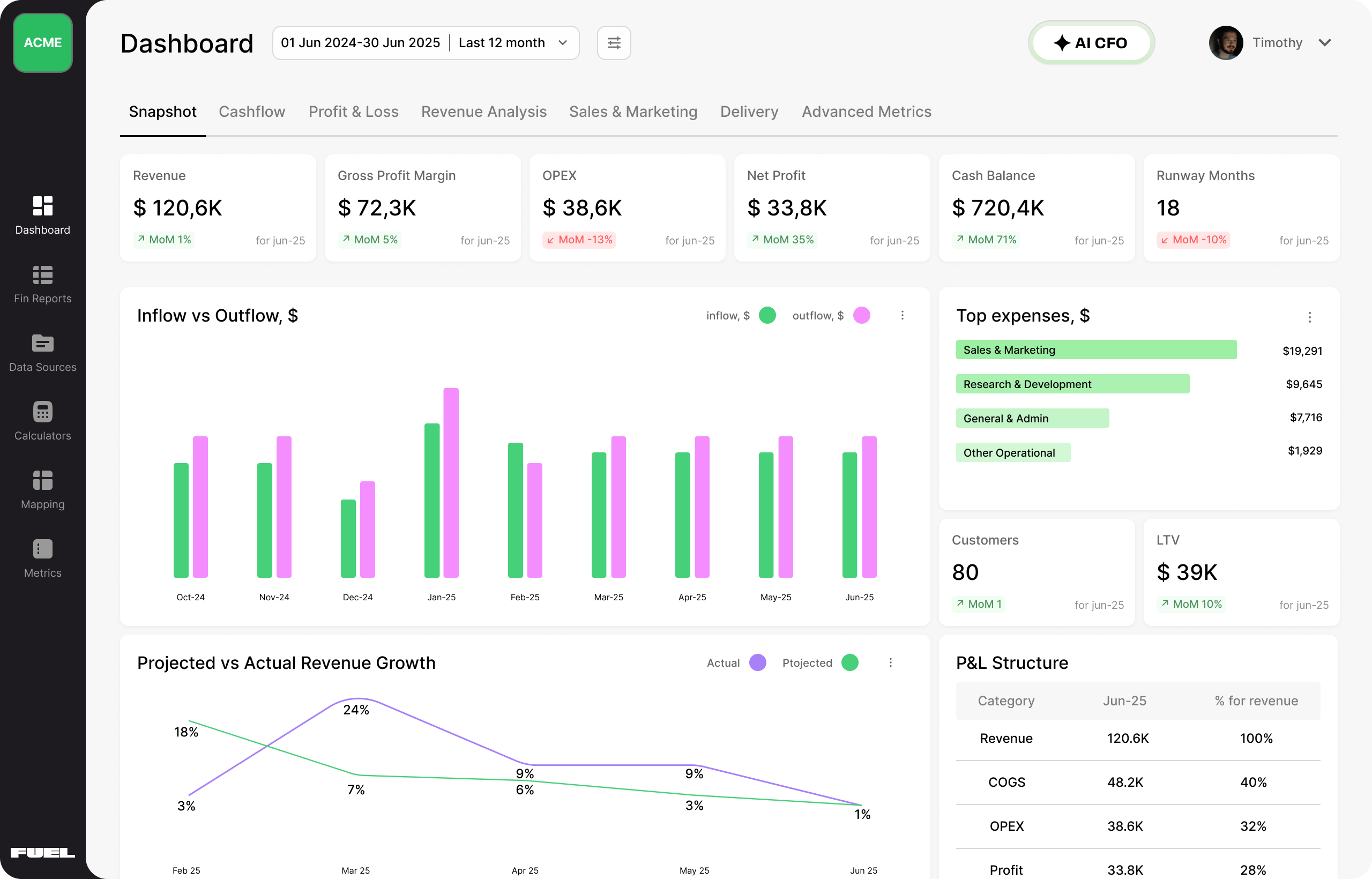

We help you turn financial health insights into practical improvements that strengthen your business foundation with comprehensive financial planning & analysis. With Fuelfinance, all your financial data lives in one place — seamlessly connected across your CRMs, accounting software, QuickBooks, banks, payroll systems, and more. That means you always see the full picture, instantly, with our AI-powered financial analysis.

Here’s what Fuelfinance does for you:

Fuelfinance combines automation, AI, and human expertise to transform financial monitoring from a periodic task into a continuous advantage — helping your business grow stronger, smarter, and more resilient.

Here's what we've covered: your business needs regular financial health checks just like you need regular medical checkups. The warning signs are usually visible months before they become critical, but only if you're really looking.

Agency, SaaS company, or any other SMB, the principle remains the same — consistent monitoring beats crisis management every time.

The good news? You don't need to become a financial pro or hire expensive consultants to implement these practices. Modern financial platforms like Fuelfinance automate the complex parts while giving you the insights you need to make confident decisions.

Don't wait for problems to surface. Your future self will thank you for taking action now. Book a free demo and see how we can turn your financial health check from a quarterly stress-fest into a competitive advantage.

Start with your cash flow statement — it shows the actual money movement in your business. Then review your profit and loss statement for profitability trends, followed by your balance sheet for overall financial position. Many business owners focus only on P&L, but cash flow is what keeps you operational day-to-day.

For short-term liquidity, focus on your current ratio (current assets ÷ current liabilities) and quick ratio (liquid assets ÷ current liabilities). For long-term solvency, examine your debt-to-equity ratio and interest coverage ratio. A healthy current ratio is typically 1.5-3.0, while debt-to-equity depends on your industry but should generally stay below 2.0.

Monitor your cash conversion cycle and days sales outstanding (DSO) monthly. If DSO is increasing, you're taking longer to collect payments. Watch for early warning signs like extending payment terms to customers, frequently hitting credit limits or making decisions based on expected rather than actual cash receipts.

Look for platforms that integrate with your existing accounting software and automate data collection. Tools like Fuelfinance provide automated reporting, AI-powered forecasting and real-time dashboards that eliminate manual spreadsheet management.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.