I fed ChatGPT one of our real finance reports last week. The results? Let's just say it reminded me why founders need more than a $40 subscription to run their finances.

First, it said there was too much data, and it couldn’t process the file. (If it's struggling with Fuelfinance-sized data, imagine a thousand-employee business…)

After a few tries, I got a waterfall chart showing net profit higher than total revenue. The margins were incomplete. The context was missing entirely. And this was ChatGPT 5.0 — supposedly the smart one.

Should you be adopting AI in your finances? Yes. Should it be specifically ChatGPT? I would advise against it.

I could’ve made that dashboard decent after a few iterations.

But that’s because I knew what was wrong the moment I saw it.

Most founders don’t. And you shouldn’t have to.

Let's talk about how to use ChatGPT for finance work, where it falls short and what AI alternatives can actually help you.

Using ChatGPT for finance means you're trusting large language models to handle your finance operations. You feed it financial data or questions, and it generates responses based on patterns it learned during training.

The model processes natural language, so you can ask it to "explain this P&L" or "forecast next quarter's revenue" without coding. It's trained on massive amounts of public data from the internet, including some financial reports, news articles, and research papers.

But here's what most founders miss: ChatGPT doesn't actually understand your numbers. It's calculating probabilities, not analyzing your business. It doesn't have your company context. There's no live, clean data. And most importantly, you have to know enough finance to know what to ask for.

The quality of results depends heavily on your ChatGPT prompts and prompt engineering skills.

Despite its limitations, ChatGPT can handle certain financial operations if you know what to ask for and how to verify the output.

Upload your P&L or balance sheet and ask ChatGPT to summarize the key findings. It can identify trends, flag unusual items, and create plain language explanations for non-financial team members. The tool can provide insights into surface-level patterns and offer basic financial advice.

Example prompts:

The output generated will summarize patterns, though you'll need to verify accuracy since ChatGPT can hallucinate.

You can ask it to generate formulas for calculations, and it should provide working solutions.

Try these prompts:

ChatGPT can generate starting points based on industry standards and company size.

Example prompts:

The budgets will likely be generic, but they give you a framework to customize based on your actual finance operations and goals.

ChatGPT can explain basic tax concepts and regulations. Be extremely careful here, though. Tax and compliance advice from artificial intelligence should never replace professional guidance from a financial advisor or accountant.

Example prompts:

Critical limitation: ChatGPT's training data has a cutoff date, so recent regulatory changes won't appear in its responses. This creates potential legal issues and compliance risks. Always verify with qualified professionals.

ChatGPT can draft financial communications, present complex information in plain language, and create different versions for various audiences.

Example prompts:

This helps finance teams communicate valuable insights without spending hours on messaging. Just review and edit the ChatGPT output to match your voice before sending.

Use ChatGPT to create training materials and explain complex financial concepts to team members learning finance.

Example prompts:

For founders and teams building financial literacy, ChatGPT search serves as an accessible educational resource. It can present various aspects of finance in approachable language. But I wouldn't use it for deep research (note the hallucination problem).

After testing ChatGPT with real financial data, its limitations became obvious quickly. Some are annoying. Others are actually dangerous.

This is the big one. ChatGPT invents plausible-sounding information that's completely false.

When I tested ChatGPT with our financial data, the waterfall chart showed net profit higher than total revenue. That's the AI making up numbers — a potential risk if you trust it blindly.

For financial statements where every number matters, this error rate is unacceptable.

The scary part is that the output generated sounds confident. ChatGPT doesn't say "I'm not sure" — it presents wrong answers with complete certainty.

Security and confidentiality concerns

Every ChatGPT conversation gets stored on OpenAI's servers and used to train future models unless you specifically opt out. Your financial data, revenue numbers and sensitive business information could leak or become searchable by others.

In 2024, Cisco research found that one in four companies banned generative AI tools entirely due to data privacy concerns. Samsung discovered this risk when an engineer accidentally leaked sensitive source code through ChatGPT.

Financial institutions face severe legal issues if client data or proprietary information gets exposed. There are no proper security controls, no compliance certifications and no way to guarantee data privacy.

Knowledge cutoff and outdated information

ChatGPT's training data has a cutoff date. Currently, it doesn't know about recent financial news, market trends, changes in regulations, or stock market developments after its training period.

Try asking it about recent tax law changes, current investment opportunities or latest financial reporting requirements. This limitation makes ChatGPT unreliable. You can't use it for financial advice that depends on recent developments and new technology.

Lack of contextual business understanding

I could write better ChatGPT prompts because I know what "good" looks like. Founders aren't finance-natives. They want valuable insights, not a new job as a prompt engineer.

More importantly, this AI doesn't know why your numbers look the way they do. It can't tell a one-off event from a systemic issue. It doesn't understand:

Without this context, it provides generic responses that miss the actual story in your numbers.

Complex calculations and quantitative analysis limits

ChatGPT struggles with complex financial analysis, especially when dealing with large datasets. When I uploaded our finance report, it couldn't even process the file initially. If it's struggling with mid-sized business data, imagine trying to analyze a company with thousands of transactions.

The model also makes errors in mathematical reasoning. Research shows that when dealing with complex analysis, ChatGPT's reliability drops to about 10% accuracy(!). For financial forecasting, risk analysis and sophisticated financial planning, you need powerful tools built specifically for these tasks.

After seeing ChatGPT's limitations firsthand, I'm not worried about generic AI replacing purpose-built finance platforms.

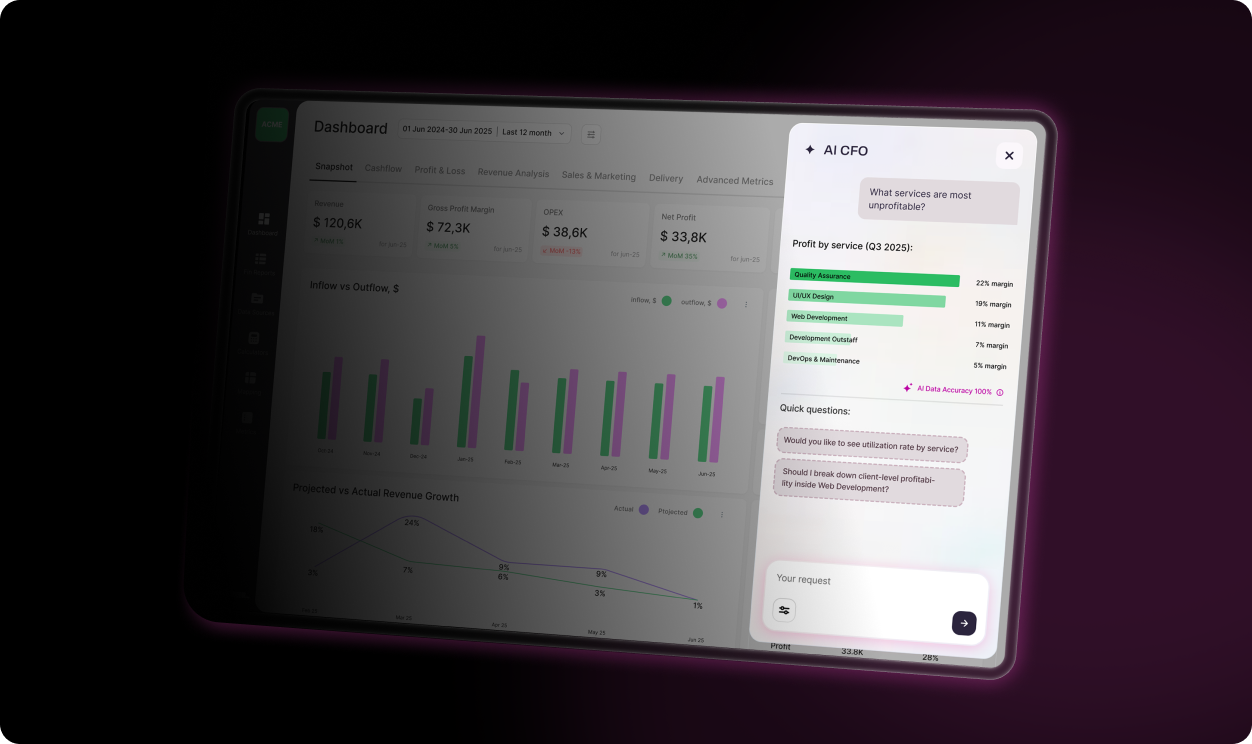

Fuelfinance changes the game with AI made specifically for financial operations, combined with the human expertise your business needs.

Here's what our AI for finance does:

Purpose-built beats generic every time. Here's the difference.

We integrate with 350+ systems: a QuickBooks integration, Stripe, HubSpot, banks, payroll, Google Drive. Your data flows automatically. No manual exports. No copying and pasting.

But connection is just step one. We also clean your data — categorizing transactions correctly, reconciling discrepancies, and eliminating duplicates. Clean data means accurate analysis.

Unlike ChatGPT conversations stored on OpenAI's servers, Fuelfinance is SOC 2 compliant with encrypted data and proper access controls. Your financial information stays secure with full audit trails for compliance.

This matters for due diligence, fundraising, and protecting sensitive business data. You control who sees your numbers and can prove exactly how every metric was calculated.

We handle the setup in 2 weeks. Then everything runs automatically.

Compare that to ChatGPT, which requires manual work every single time you need updated reports. Our finance team saves 15+ hours per month on data gathering and report creation.

AI alone isn't enough. Fuelfinance combines AI with dedicated financial managers who provide strategic guidance, help with financial planning for business owners and answer questions the AI can't.

When you're preparing for fundraising or making critical financial decisions, you talk to someone who actually understands your business. Not a chatbot.

The AI handles the heavy lifting on data processing and analysis. Human financial professionals handle strategy, context and decisions that need experience. This hybrid model beats both pure-AI solutions (which miss nuance) and traditional outsourced financial services (which are slow and expensive).

Most ChatGPT errors come from misunderstanding the question.

Fuelfinance AI uses a classification system that adds context before processing your question. It knows:

This context layer means you get accurate answers on the first try instead of going back and forth refining your prompts.

While you're running your business, Fuelfinance's AI system continuously scans your financial data for problems like:

When it finds something, it reports it with context and action items:

⚠️ Alert: Margin slipped to 42% (from 48%). Target is 50%+, so we need a quick course-correction.

💡 Opportunity: Switching to annual billing could improve cash by $18K

⚠️ Alert: You’re Over-Dependent on 3 Customers

Here's something ChatGPT doesn't do: tell you when it's uncertain.

Fuelfinance AI includes a confidence signal with its analysis:

This transparency helps you understand both the result and the reasoning. When data gaps exist, you know exactly what's missing.

Here's how finance AI brings digital transformation.

Ask questions in plain language:

Fuelfinance has all your actual data, analyzes patterns and explains what happened with specific insights based on your numbers.

The AI knows your chart of accounts, recognizes expense categories, and can trace changes back to specific transactions.

Fuelfinance's AI forecasting tools create projections based on your historical patterns, not generic assumptions.

Ask things like:

The system models these scenarios using your actual revenue patterns, cost structure, cash flow, seasonality, sales cycle and more. It creates different scenarios (baseline, optimistic) in monthly, quarterly and yearly versions. You see the impact on runway, profitability and hiring plans. This is how you make decisions backed by data instead of guesses.

Examples:

Fuelfinance builds these dashboards and keeps them updated automatically. No manual exports, no copying numbers, no version control issues.

When your team needs to see specific metrics, you create the view once, and it stays current. That's the difference between financial reporting software and chatbots.

Here's the real power move: Fuelfinance warns you instead of waiting for you to ask:

These alerts appear automatically in your dashboard. You don't have to remember to check. You don't have to know which questions to ask. The system knows what matters for your business and tells you when something needs attention.

Sure, ChatGPT for finance can handle basic tasks if you're willing to verify everything and deal with its limitations. But most founders need more than a chatbot that occasionally invents numbers.

If you want to use AI for financial operations properly:

Ready to see what specialized finance AI can do for your business? Get a demo and we'll show you exactly how Fuelfinance turns your messy financial data into clear insights — no hallucinations.

Yes, but with major limitations. ChatGPT can summarize financial statements, explain concepts and do basic calculations. However, it can't connect to your actual financial systems, often produces inaccurate results, lacks context about your business and has no security features. It works for casual questions, but shouldn't replace proper financial management tools.

The best AI for finance depends on your needs. For comprehensive financial management, look for platforms that connect to your accounting systems, provide real-time data, include anomaly detection and combine AI with human expertise. Tools like Fuelfinance offer AI-powered forecasting, custom dashboards and a dedicated financial manager.

ChatGPT is a general-purpose language model that requires manual data uploads and provides generic responses without business context or proven accuracy. Finance-specific AI tools like Fuelfinance connect directly to your financial systems, learn your business model, provide proactive alerts and combine AI with human financial expertise. The output comes with confidence scoring.

Avoid using ChatGPT for: investor reporting (no audit trail), tax calculations (too risky for errors), cash flow forecasting (needs real-time connected data), compliance work (lacks proper documentation), board presentations (can't verify accuracy), due diligence preparation (no security controls), and strategic financial planning (missing business context). For these critical tasks, use specialized platforms like Fuelfinance that offer FP&A software capabilities with proper security and accuracy.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.