According to a recent poll by our founder, Alyona Mysko, more than half of entrepreneurs admitted to lacking an understanding of their company’s value—a critical gap that can undermine fundraising, M&A, tax compliance, and long-term planning.

For many founders, the path to a reliable business valuation can feel murky—full of spreadsheets, vague multiples and confusing methods. Should you use discounted cash flow? Market comps? Revenue multiples? What about intangible assets?

Not to mention, a flawed valuation can derail investor conversations, cost you equity or lead to overpaid taxes. The stakes are high.

That’s why modern CFOs are turning to AI-powered business valuation services like Fuelfinance—a finance-as-a-service platform that doesn’t stop at valuations, but can replace your in-house finance department. But, we’re getting ahead of ourselves. Let’s help you with those valuations first.

Business valuation services help you determine your company’s worth using financial modeling, industry benchmarks and market comparisons. Done right, a valuation offers strategic clarity that supports fundraising, exits, compensation planning and long-term financial decision-making. A thorough valuation process also involves identifying and analyzing the key value drivers that influence a company’s worth, especially in valuation matters involving buying, selling or analyzing complex securities.

Thanks to AI forecasting tools and real-time data integrations, today’s software offers accuracy and speed that traditional providers just can’t match.

If you want to DIY it, start with our free 👉 Valuation Calculator

We based it on the a16z article that prioritizes growth rate and profit margin rather than other valuation methods, e.g., asset valuation. Using it is as easy as one, two, three:

Otherwise, keep reading to understand business valuation services better and make sure it’s done right.

Read also: What’s the Right Financial Model Template for Your Startup Stage?

Business valuation isn’t just for exits and tax purposes. Here are key moments when valuation services are essential:

Read also: Pre- Vs Post Money Valuation + a Free Calculator

Accurate valuations are crucial for making informed investment decisions, helping you assess business worth and support your strategic decisions towards your investment goals. But business valuation isn’t just about crunching numbers—it’s about understanding the full story behind those numbers. From legal considerations to intangible assets, capital structure and complex financial instruments, the real value of a company lies in its complexity.

Some of the most valuable parts of a business don’t show up on a balance sheet. Think brand reputation, intellectual property, proprietary tech and customer relationships. These intangible assets can drive the lion’s share of a company’s fair value—especially in SaaS, tech and creative industries.

But putting a number on intangibles? That takes serious expertise. It requires a nuanced approach that blends financial modeling with strategic insight into how these assets will generate cash flow and strengthen competitive positioning over time.

See also: SaaS Financial Model: Do’s and Dont’s of Creating One

Valuing a business gets more complicated when your cap table includes things like stock options, warrants or convertible notes. These instruments can dilute ownership or shift value depending on how they’re structured—and that affects the entire company valuation.

This is where certified valuation analysts and CPAs team up. Together, they ensure the valuation reflects both accounting standards and tax planning considerations. Whether it’s for a financial audit or a board presentation, the result is a defensible report that stands up to scrutiny.

In mergers and acquisitions, you’re not just putting a price on a company—you’re allocating value across every asset acquired, from trademarks to technology to customer contracts.

This process, called purchase price allocation, is crucial for tax purposes and financial reporting. It requires deep industry knowledge and a clear view of what drives value.

When a business isn’t publicly traded—or owns real estate—there’s often little transparent market data to lean on. Valuing these types of businesses means relying heavily on comps, financial modeling and real-world experience. This is especially true for closely held businesses, where internal dynamics and ownership structure significantly affect valuation. You need to factor in everything from local market dynamics to niche growth opportunities.

See also: How to Create a Startup Financial Model in 6 Steps

Debt vs. equity. Convertible notes vs. common shares. Your company’s capital structure dramatically affects its value.

Valuation experts dig into how your financing choices influence risk, growth potential and the company’s cost of capital. A business with the same revenue could have a very different valuation depending on how it’s funded.

Some valuations need to hold up in court. Whether it’s a shareholder dispute, a divorce settlement or a tax investigation, litigation support valuations require a higher standard of precision and documentation.

In these cases, valuation professionals must provide bulletproof reasoning backed by hard data, market comps and a deep understanding of the law.

The rules around valuation are always evolving. Tax codes change. Accounting standards shift. New market trends emerge. That’s why leading valuation professionals treat continuous learning as non-negotiable.

Industry leaders such as the American Institute of Certified Public Accountants establish authoritative standards and certifications for valuation professionals, ensuring that adherence to these standards results in high-quality, reliable advisory services for their clients.

It should be clear by now—there’s no single formula for valuing a business. Various methods make sense for different business models, stages and goals.

When applying these methods, select an appropriate valuation date, as the chosen point in time for collecting financial and business data directly impacts the accuracy and relevance of the valuation.

Here are some of the most commonly used approaches, plus their typical applications and reasons for use.

The DCF method projects your company’s future cash flows and then discounts them back to their present value using a required rate of return. In other words, it’s about estimating how much your future profitability is worth today.

Best for: SaaS companies and high-growth startups that have predictable recurring revenue and strong long-term growth potential. DCF is particularly useful when comps are hard to find, but you have a solid grasp on your financial model and projections.

This approach benchmarks your business against similar companies by comparing key financial metrics, such as revenue multiples or EBITDA. Identifying and analyzing comparable companies determines accurate market multiples that reflect current market conditions and industry standards. It relies on market data to assess how businesses with similar size, industry and growth profiles are valued.

Best for: Agencies, tech startups or DTC brands operating in well-established sectors with extensive public or private market data. Comps are helpful for founders looking to align their valuation with current investor expectations.

Rather than comparing against live companies, this method looks at historical M&A deals involving businesses similar to yours. Analyzing each transaction provides insight into market pricing and deal structures. The idea is to estimate your value based on what acquirers have paid for comparable targets.

Best for: Companies preparing for an exit or exploring acquisition offers. It’s a helpful benchmark for negotiation and understanding how similar deals were priced in your market.

This method focuses on the total value of your assets—both tangible (equipment or real estate) and intangible (IP or trademarks)—minus any liabilities. It’s essentially your net asset value.

Best for: Asset-heavy industries such as manufacturing, logistics or real estate, where the physical or financial assets of the business drive most of the value. It’s also common in liquidation scenarios.

This simple method applies a multiple to your annual revenue (e.g., 3x ARR) based on what similar businesses are getting in the market. While quick and easy, it can lack nuance if used in isolation, especially regarding equity valuations.

Best for: Agencies, bootstrapped startups or early-stage companies that may not yet be profitable but want a ballpark valuation for planning or fundraising.

While the fundamentals of valuation haven’t changed, the way they’re delivered has. Traditional providers rely heavily on manual analysis, which is slow, costly and frustrating to update.

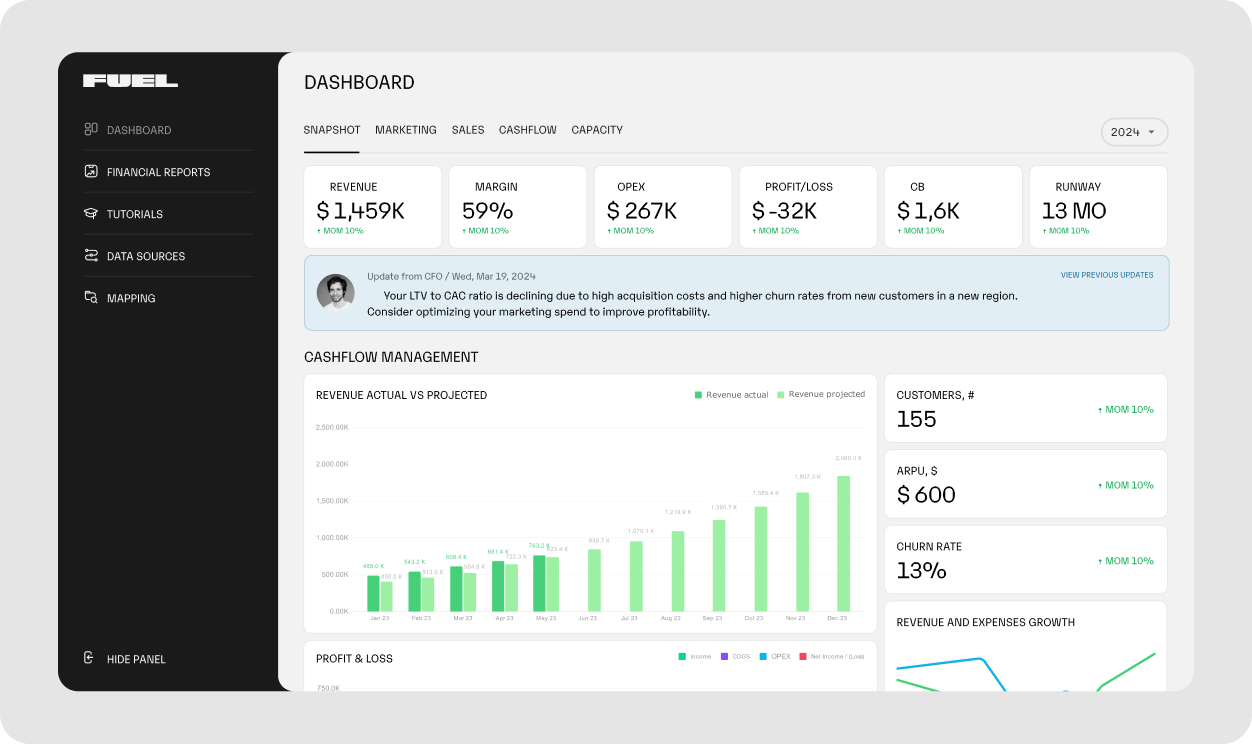

Modern FP&A software platforms like Fuelfinance use automation and AI to make valuation faster, more flexible and accessible—without compromising accuracy. Here’s how the two approaches compare.

Business valuations don’t need to take six weeks and $20,000. Fuelfinance combines deep financial expertise with AI forecasting for valuations that are fast, flexible and made for real-world decision-making. As a company with the resources and experience to deliver audit-ready, compliant valuation reports, Fuelfinance ensures your business can face any financial scrutiny.

Unlike traditional providers, Fuelfinance is more than a one-time service—it’s a whole financial operating system. With experience across 300+ businesses and oversight of over $500M in managed finances, we know what investors, acquirers and strategic partners look for. Whether you’re prepping for a funding round, rolling out an ESOP or just want to understand what your business is really worth, Fuelfinance delivers valuation models that are investor-ready and always up to date.

Our financial modeling software integrates directly with your accounting tools, CRM and spreadsheets to pull real-time data, so your models evolve as your financials do. No more back-and-forth with spreadsheets or waiting weeks for a static PDF. With Fuelfinance, you get fast answers, complete transparency and support from an outsourced CFO.

👉 Try Fuelfinance in action—book a demo.

Understanding your business worth isn’t just useful during a fundraise or an exit—it’s a strategic advantage in your day-to-day decisions. Whether you’re weighing compensation plans, setting growth targets, preparing investor updates or planning future transactions, accurate valuation insights help you act with confidence.

With AI financial analysis tools like Fuelfinance, those insights are no longer limited to big corporations and late-stage startups. You get fast, transparent valuations built on real data, tailored to your business model, always at hand to support your next big move.

Ready to get your valuation? Book a call with Fuelfinance today.

Identify and quantify items like brand value, intellectual property, customer relationships and proprietary technology. Use methods such as the relief-from-royalty approach or excess earnings method to estimate their economic value. Accurate documentation and third-party benchmarks help validate these assets.

Use at least two methods, such as the income approach (e.g., discounted cash flow), market approach (e.g., comparable company analysis) and asset-based approach. Compare results, understand the assumptions behind each and assign weights based on the company’s industry, stage and asset structure. This triangulation improves overall reliability.

AI enhances accuracy by analyzing large datasets faster and identifying patterns in financials, market trends and risk factors. It reduces human bias, automates forecasts and continuously updates valuations with real-time data leading to more consistent and data-driven outcomes, especially for startups or fast-changing businesses.

Market conditions influence the relevance and accuracy of different valuation methods. In stable markets, income-based methods like discounted cash flow may provide reliable forecasts. In volatile or uncertain markets, market-based methods or asset-based approaches may be more appropriate. Understanding the broader economic environment ensures your valuation reflects real-world risks, investor sentiment and industry trends.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.