Picture this: You're juggling investor calls, product development and team management, all while keeping an eye on your financial health. Your accountant sends you a pile of spreadsheets that look like hieroglyphics, and you realize you have no clue if you're making money or burning through cash faster than a Formula 1 race car burns rubber.

Relatable? You're definitely not alone. We've seen countless stories like this in our experience of working with 600+ SMBs.

This article will walk you through everything you need to know about effective financial management systems that help to organize that chaos. We'll break down what they actually do, compare the top ten tools on the market that finance leaders love, and help you figure out which one deserves a spot in your tech stack.

Think of a financial management system as your business's financial control center. It's software that handles all the $ stuff — cash management, asset management, report generation, invoices, planning, forecasting, analyzing and keeping your books organized.

These systems can include features like:

Here's why this matters for growing businesses: studies show that using analytics is clearly linked to better performance in the finance function. But the same study highlights that analytics and automation need to be properly aligned if you want them to be effective in pushing your business forward; otherwise, they do the opposite.

The bottom line? If you're still managing financial transactions with separate tools and manual processes, you're probably wasting resources and growth opportunities. Let's find financial management tools that will help you fix that.

Here's a quick overview of the top modern financial management systems we reviewed, before we dig into the details.

Let's explore these solutions in detail to help you make the right step forward in your finance automation.

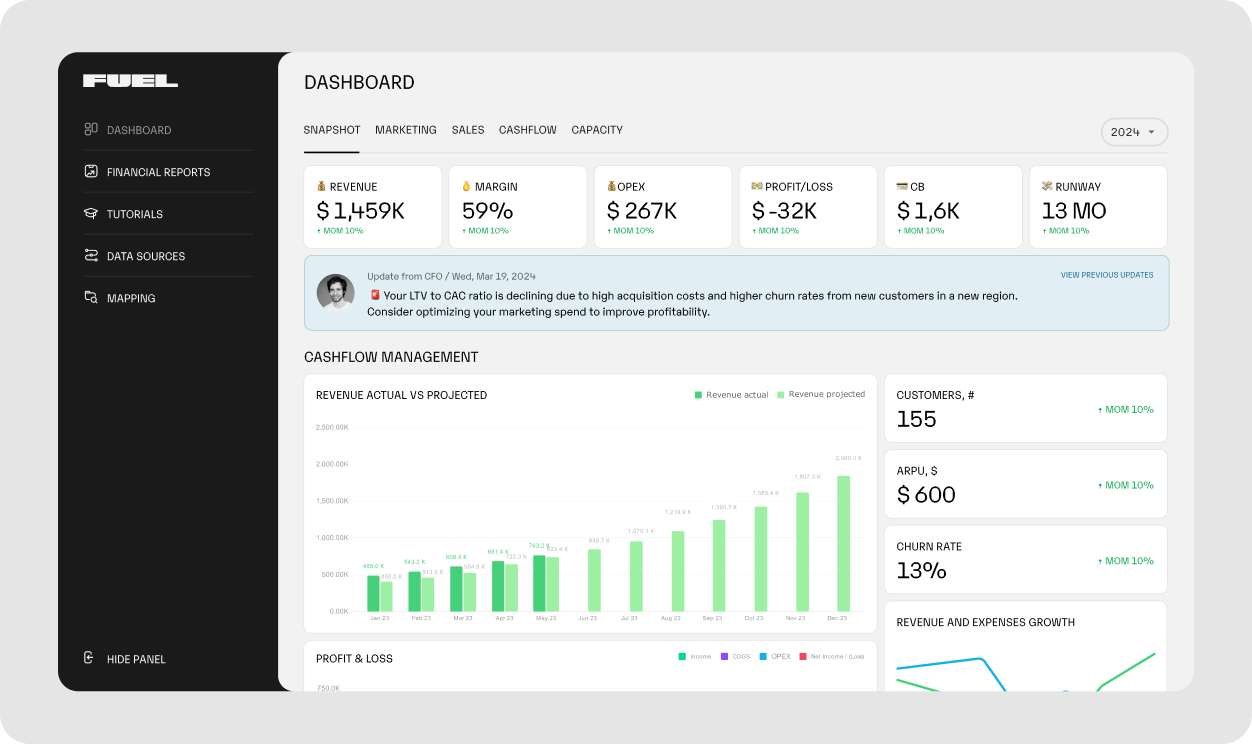

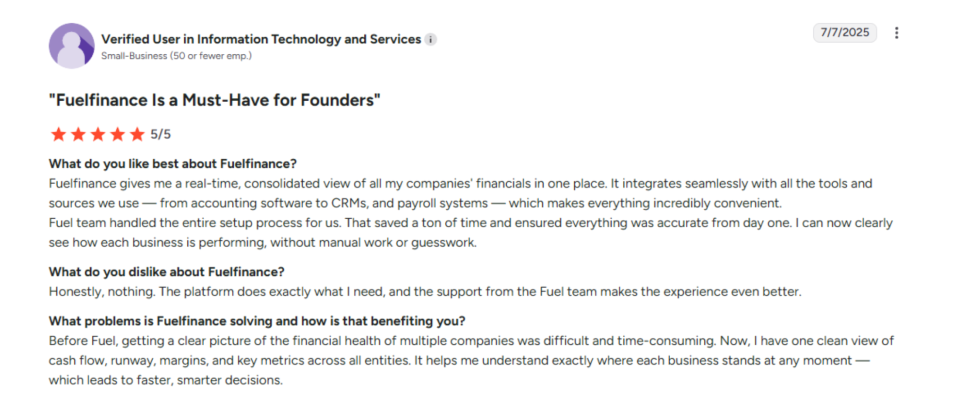

Fuelfinance is your cloud-based financial department that combines cutting-edge AI technology with a team of financial professionals. Instead of just giving you another software tool to figure out, they actually do the work for you.

We take a different approach to standard financial management solutions by offering both software and services. Our platform was made based on our experience of working with 600+ SMBs and includes everything and anything you need, from automated spreadsheets, graphs and reports to AI-boosted planning and forecasting. You get clear CFO-level dashboards of your financial business data, and a dedicated financial expert who provides strategic guidance every step of the way.

Best for: Growing startups, agencies and SMBs that want professional financial management without hiring a full-time Chief Financial Officer or can't afford a whole in-house finance team.

Integration capabilities: Connects with major platforms, including QuickBooks, Xero, HubSpot, Salesforce, Stripe, and hundreds of other tools. The platform creates a unified financial system across all your business systems to help you improve your financial performance and profitability.

One of our clients, ColdIQ, reached out to us when they couldn't keep up with their growth and spent 8+ hours weekly on cracking finances. In just eight months of collaboration, we have helped them shorten close time from 25 to 10 days. The extra time and clarity let them focus more on maximizing profits from scalable revenue streams. The result? 236% growth — from $67K MRR to $250K MRR.

Book a free demo to see how clear and easy finances can be.

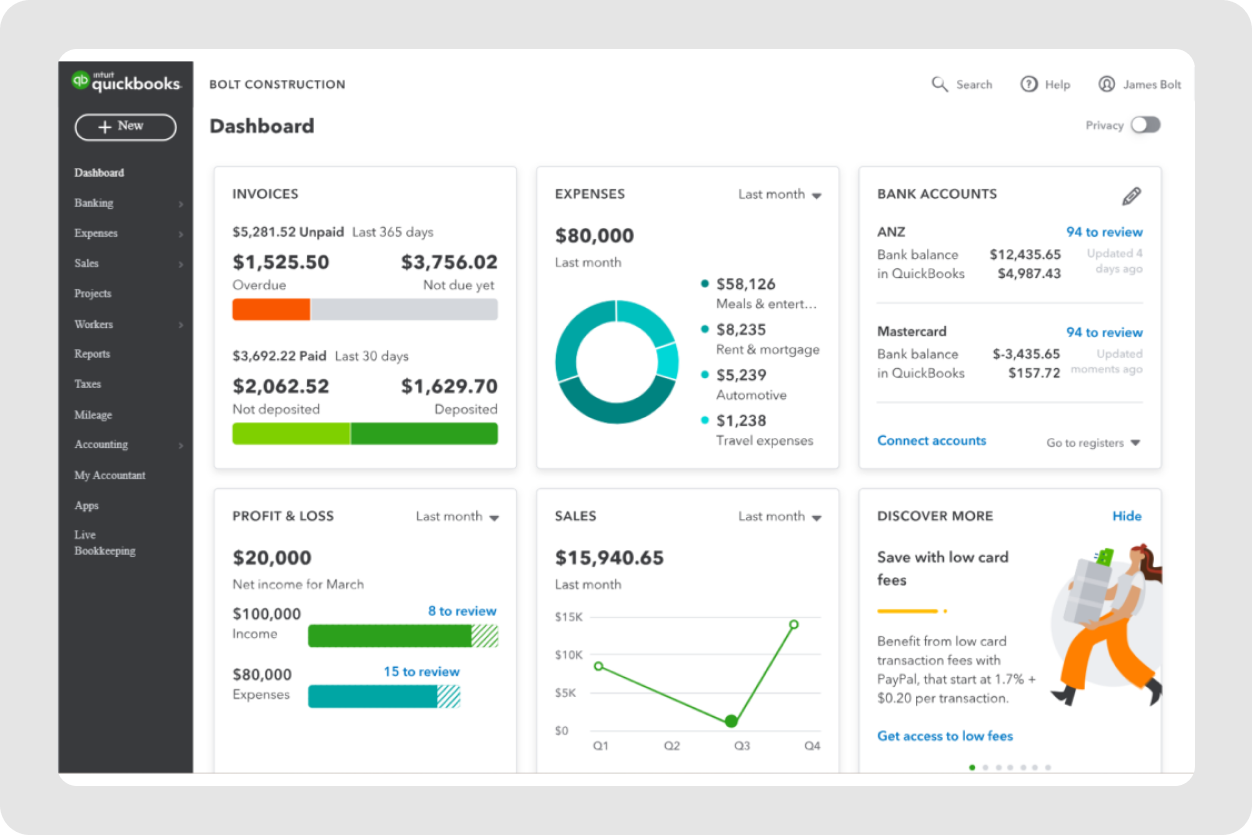

QuickBooks is a popular name in small business financial management, offering a straightforward approach to accounting and bookkeeping. Intuit's QuickBooks has basic accounting features with a focus on ease of use. It's designed for small business owners who need to handle their own books without extensive accounting knowledge.

Best for: Small businesses with straightforward accounting needs and limited budgets.

See also: Financial Reporting Software for QuickBooks

Integration capabilities: This tool offers hundreds of QuickBooks integrations through their app marketplace, though many require additional subscriptions.

Users appreciate the simplicity of avoiding accounting errors, but often outgrow QuickBooks as their business scales. Common complaints include limited customization and expensive add-ons. It's not really enough as a stand-alone tool for complex financial management and planning.

See also: Best QuickBooks Alternative for Small Businesses

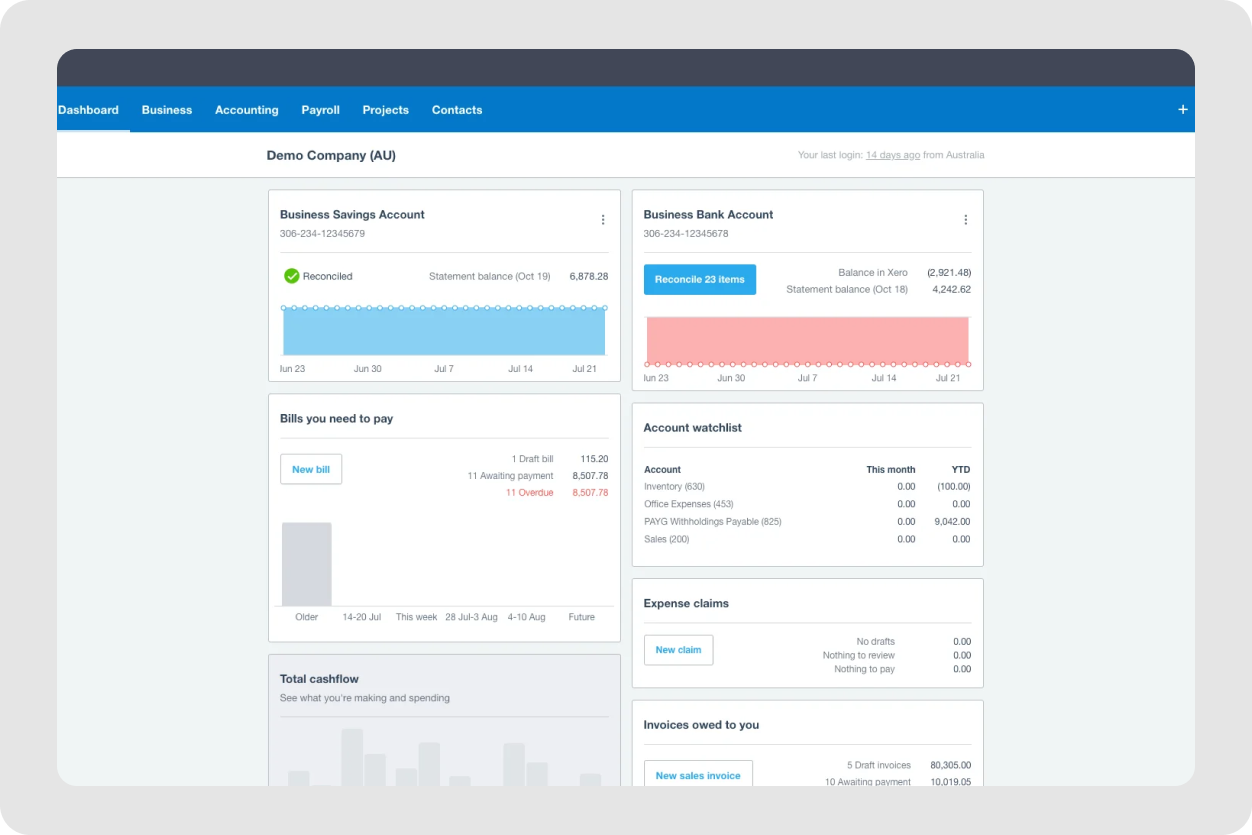

Xero is an accounting software for growing businesses. This cloud-based platform emphasizes user experience and team collaboration. Xero's strength lies in its ecosystem of connected apps and user-friendly interface.

Best for: Companies that need strong collaboration features and extensive third-party integrations.

See also: Find the Best Xero Alternative for You

Integration capabilities: Multiple add-ons and integrations make it highly customizable for different business needs.

Users love the interface and integration options but find the reporting features limited compared to more advanced platforms. Some also hit transaction limits on lower-tier plans.

For a detailed comparison of which accounting system is better for you, check out our Xero vs QuickBooks analysis.

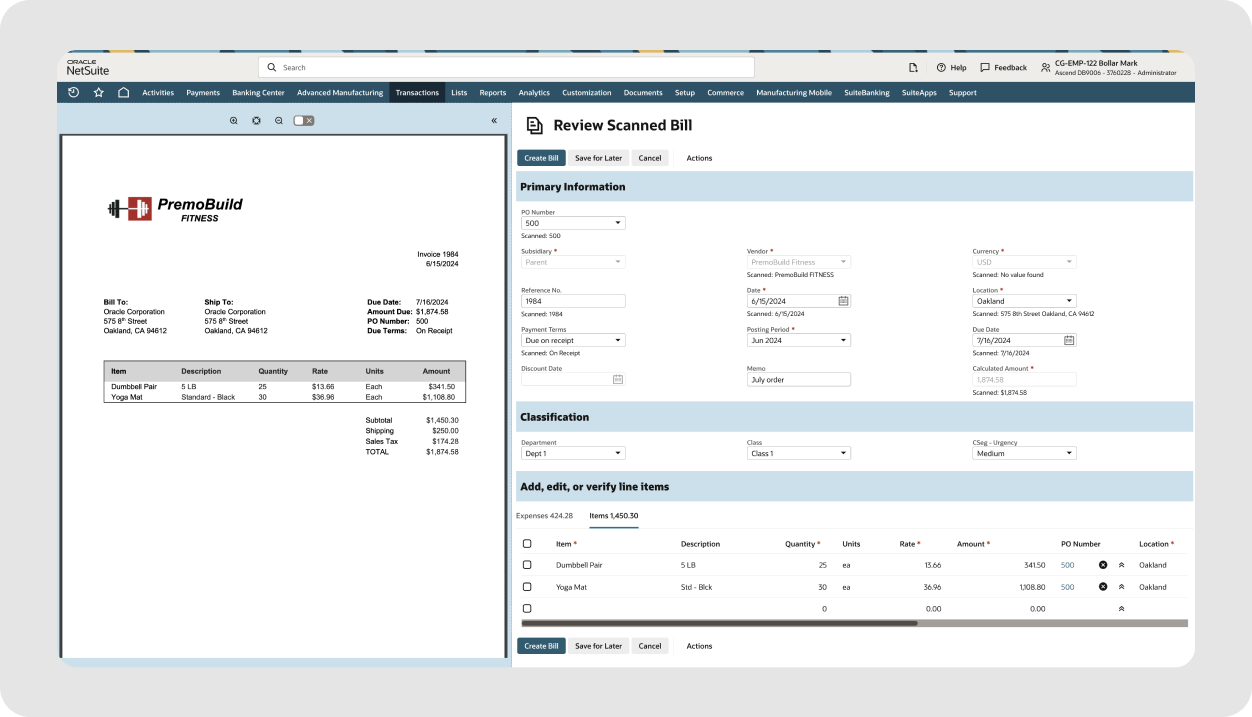

NetSuite is Oracle's enterprise-grade ERP solution that includes comprehensive financial management capabilities. This is a full business management suite that goes beyond basic accounting. NetSuite handles everything from inventory management to customer relationships alongside financial operations.

Best for: Large businesses and enterprises that need comprehensive ERP functionality and info on everything from their general ledger to company-wide operational data.

Integration capabilities: Native integrations with major business systems, though customization often requires technical expertise.

Enterprise users appreciate the comprehensive features that help with long-term enterprise sustainability, but commonly cite complex implementation and high total cost of ownership as major drawbacks.

If NetSuite feels too complicated to use, explore our guide to NetSuite competitors for alternatives.

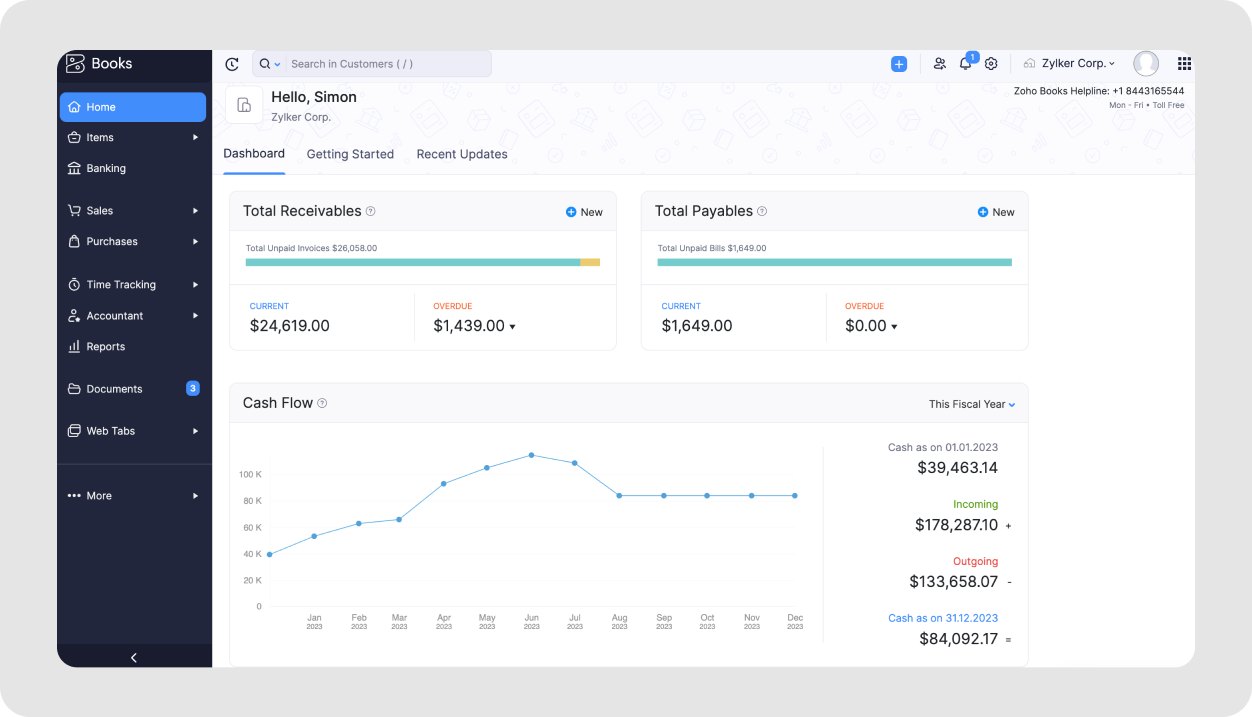

Zoho Books is an affordable accounting software and part of the broader Zoho business suite. This tool provides essential accounting features at competitive prices, helping you manage your capital expenses, generate invoices, as well as recording transactions.

Best for: Budget-conscious small businesses that need an accounting and finance management system connected to banking systems.

Integration capabilities: Seamless integration with other Zoho products and connectors with popular third-party tools, though the selection is more limited than some competitors.

Users appreciate the value for money and tight integration with other Zoho products. However, many find the features too basic as their company grows.

Sage Intacct is for mid-market companies that need more sophisticated accounting capabilities than basic small business software can provide. This cloud-based platform focuses on core accounting and financial reporting for growing companies with complex needs. It also has solutions for specific industries.

Best for: Mid-market organizations with advanced accounting requirements and multiple entities.

Integration capabilities: Integrates with major business systems and offers APIs for custom connections.

Finance teams appreciate the advanced features and reporting capabilities, but many find the learning curve steep and implementation challenging.

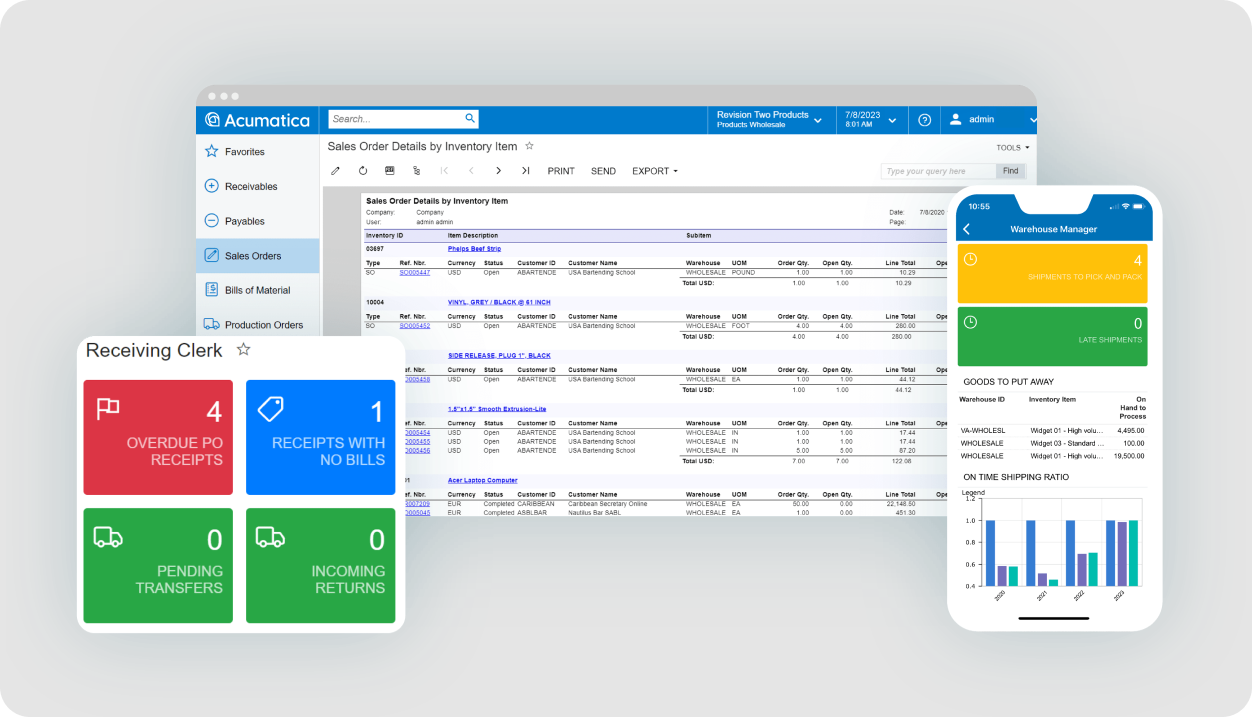

Acumatica is a cloud-based ERP software with financial management capabilities, particularly for specific industries. This platform combines accounting with broader business management features, especially for manufacturing and distribution industries.

Best for: Manufacturing, distribution and project-based SMBs that need industry-specific features.

Integration capabilities: Offers numerous pre-built integrations and APIs for custom connections, though setup often requires technical expertise.

Users in manufacturing and distribution enjoy the industry-specific features, but implementation complexity is a common concern.

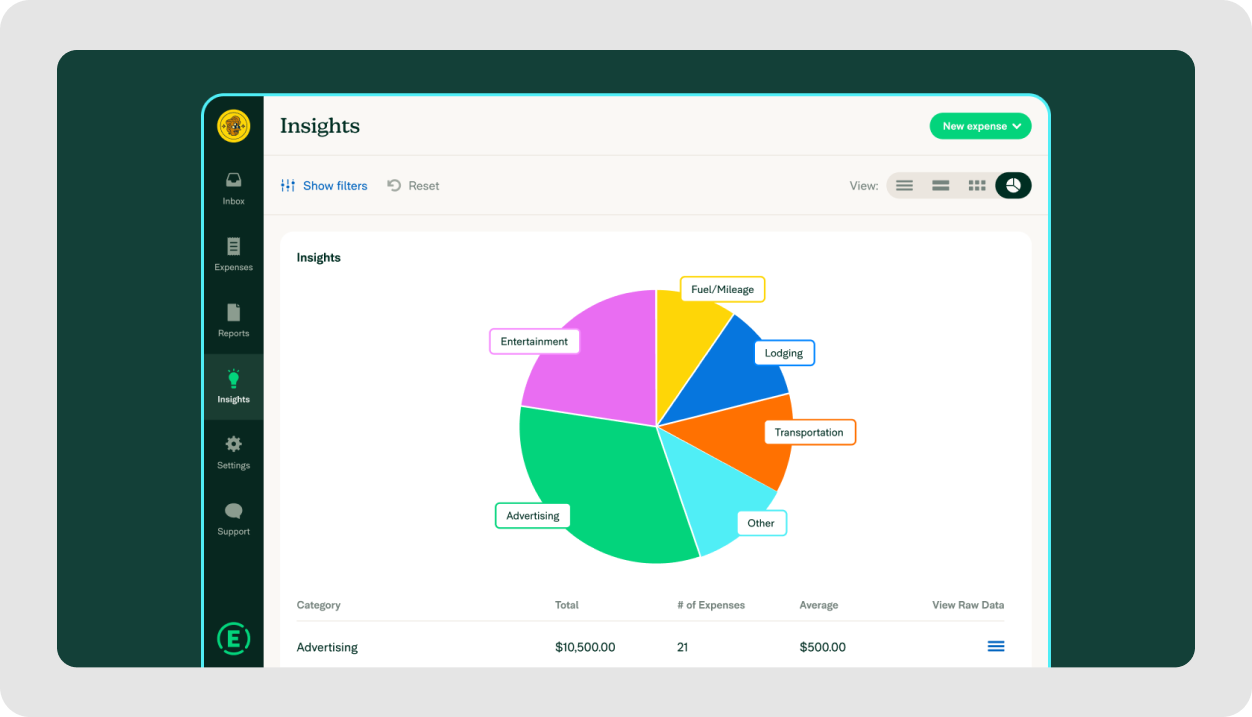

Expensify specializes in expense management and travel-related financial tracking. While primarily an expense management tool, Expensify offers some basic accounting features and has good receipt scanning and expense automation.

Best for: Businesses with significant travel and expense management needs.

Integration capabilities: Connects with major accounting platforms and offers APIs for custom integrations.

Users like the expense management features but find the accounting capabilities too limited for comprehensive financial management, disaster recovery strategies or business planning.

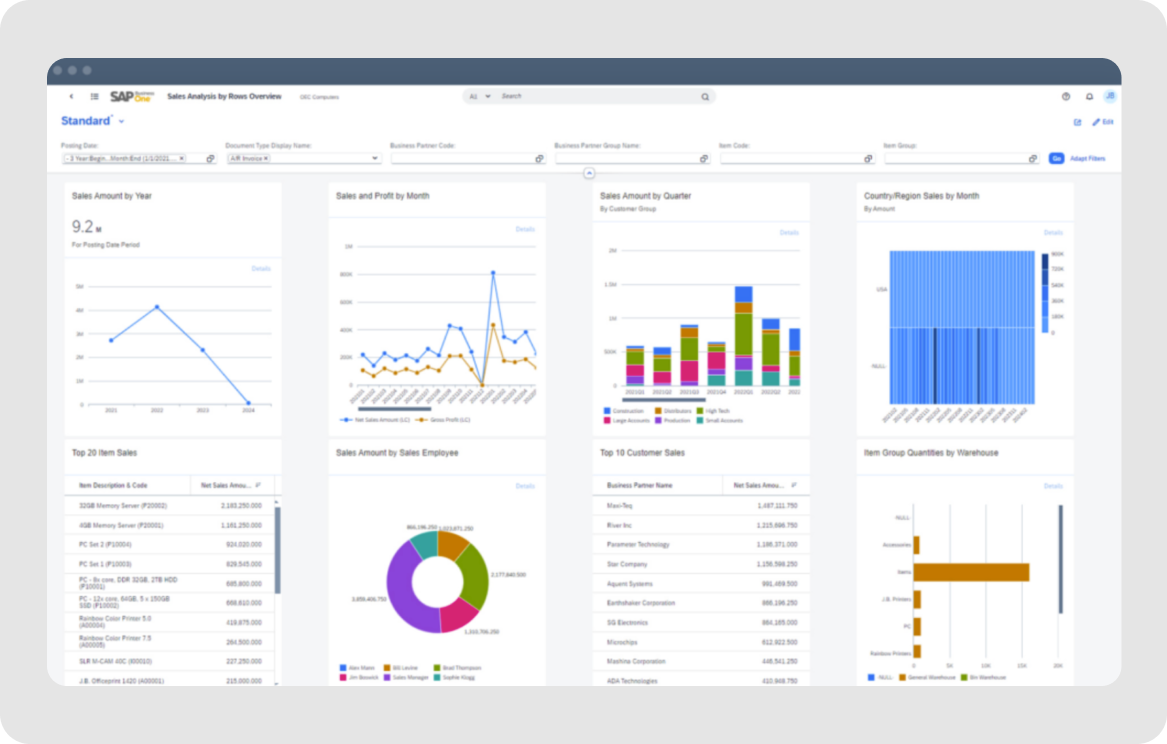

SAP is a comprehensive business software suite with enterprise-grade financial management tools. It's a common choice for large corporations that need comprehensive, scalable financial management with global compliance capabilities.

Best for: Large enterprises with complex, global financial management, regulatory requirements and risk management needs.

Integration capabilities: Extensive integration capabilities with other SAP products and third-party systems, though implementation requires significant technical resources.

Enterprise users appreciate the comprehensive capabilities but consistently cite high costs and implementation complexity as major challenges.

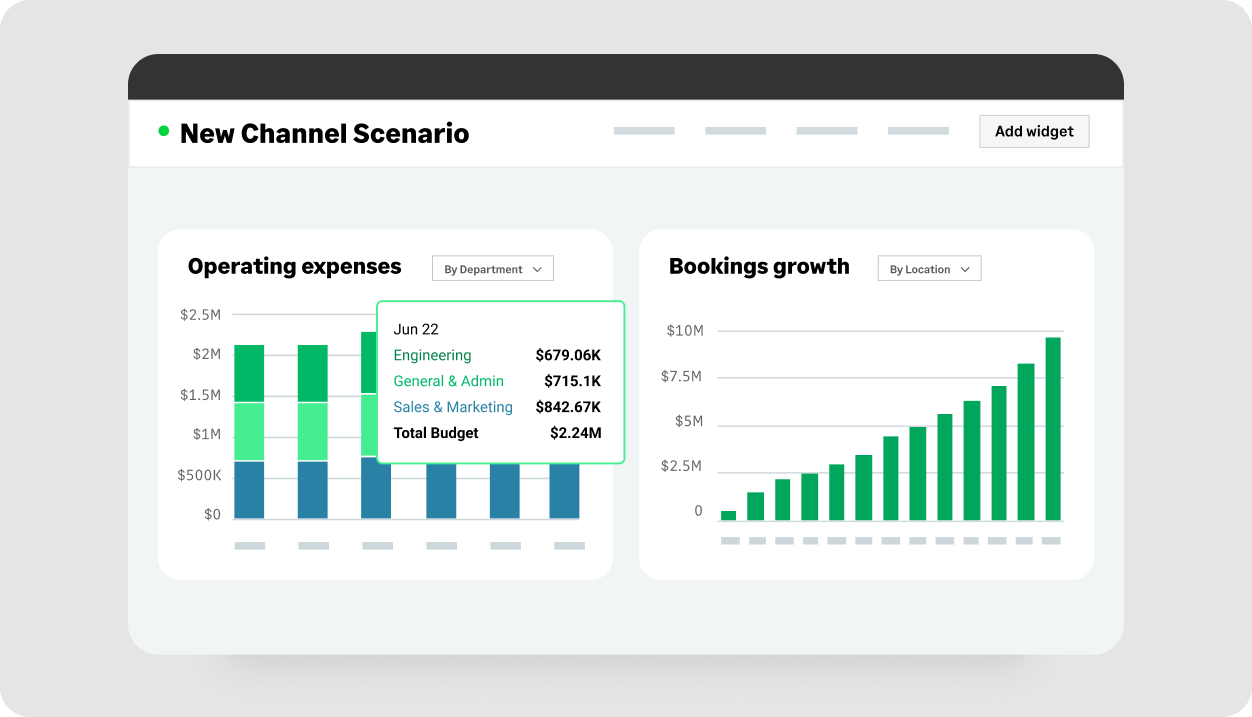

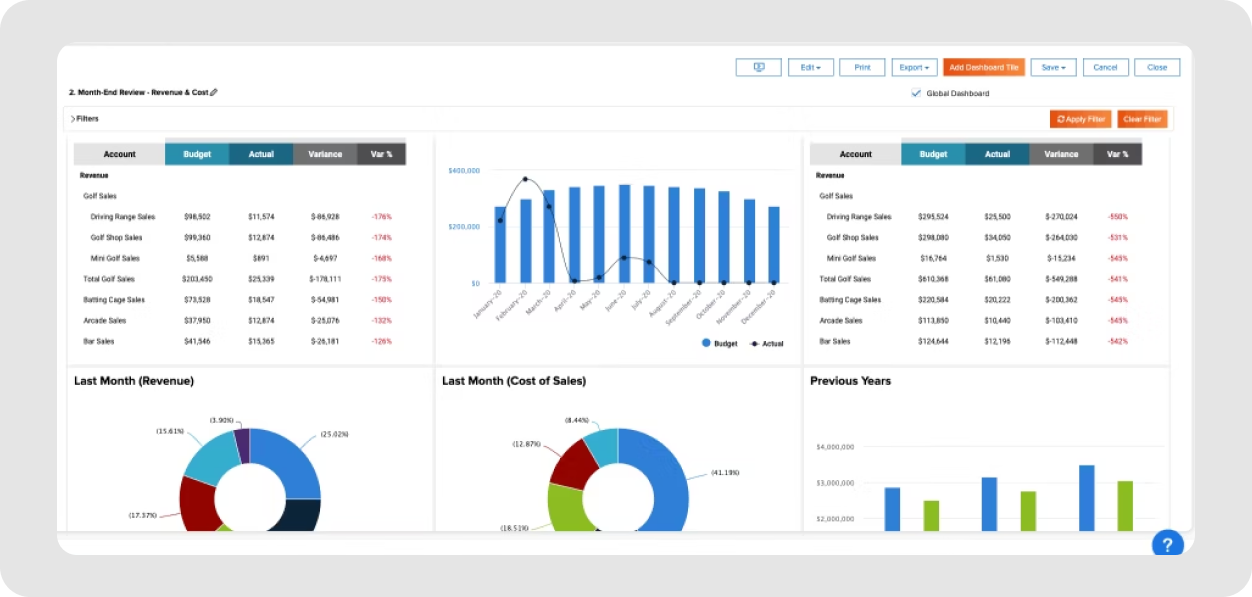

PlanGuru helps with budgeting, forecasting and financial planning for small to mid-sized companies. This specialized tool concentrates on financial forecasting for startups and established businesses, offering budgeting and scenario modeling features.

Best for: Businesses that need budgeting and forecasting without full accounting features.

Integration capabilities: Limited integrations compared to some of the other financial management systems from this list, though it connects with major accounting software for data import.

Users appreciate the forecasting capabilities but some find the interface outdated and integration options limited compared to modern alternatives.

For more advanced forecasting options, explore our guide to the best financial forecasting software.

Here's what we've learned: financial management software automates your books and organizes your data. But here's the thing — software alone doesn't replace strategic financial leadership.

Fuelfinance combines the best of both worlds. You get sophisticated AI-powered software that actually learns from your data, plus a dedicated financial professional who understands your business. While other tools give you dashboards to figure out yourself, Fuelfinance gives you fractional CFO services with the software tailored to your needs.

These tools are changing how companies handle money. AI usage in finance grew over 20% in just one year, and companies that grow most are moving from reactive bookkeeping to proactive financial planning. The winners will be those who know how to squeeze the most juice out of this trend.

Don't spend months evaluating options — most successful founders we work with wished they'd made the switch sooner. Book a Fuelfinance demo and see for yourself what financial peace of mind feels like.

Fuelfinance stands out as the top choice for growing companies because it combines advanced AI-powered software with clear, use-case-tailored dashboards and dedicated CFO expertise. Unlike traditional tools that just give you just data, Fuelfinance provides both the technology and the strategic guidance to make smart financial decisions. Plus, it integrates with your accounting system, keeping your numbers up to date.

Financial management systems are software tools that help you track and organize financial data. CFO services provide strategic financial leadership and decision-making support. The best approach combines both, which is exactly what modern solutions like Fuelfinance offer by pairing powerful software with expert CFO guidance.

While Excel can handle basic financial tracking, it becomes a nightmare as your company grows. You'll spend countless hours on manual data entry, struggle with version control and miss important insights about your yearly cash flow that automated systems catch automatically. Managing business finances with spreadsheets is like trying to run a restaurant with just a toaster oven — technically possible, but you'll outgrow it fast.

Pricing varies dramatically based on features, company size and the complexity of your financial statements. Basic tools like QuickBooks start around $30/month, while enterprise solutions like SAP can cost hundreds of thousands annually. Mid-range options like Fuelfinance cost less than hiring a part-time bookkeeper or finance team while providing CFO-level expertise.

Just imagine how that would transform your team’s productivity and focus? Talk to our financial experts to know more.